Why do pensions fail to capture the imagination?

Before I consider how Master Trusts can play a leading role in engaging with members, let’s look at what’s wrong with pensions. Ask any marketer and they will tell you that, to be successful, you have to tell a strong coherent story and with a distinct want - pensions doesn’t. We tell a story of complexity and bewildering terminology, in a patronising manner, all wrapped up in pages and pages of disclaimers!

I believe our starting premise on pensions, that there is an interest in pensions, is wrong. We have to accept that pensions are BORING! Yes, I know it’s hard to believe but the general public doesn’t spend all of their waking hours wanting to become pensions experts (until, of course, it’s time to retire). Just look at what happens when you go to the pub or attend a wedding (now we’re allowed to). If you say you work in pensions, people quickly make their excuses and move on (or maybe it’s just me!). A friend of mine (who shall remain anonymous) decided to experiment and instead of saying he worked in pensions, said he worked in financial services and was instantly more popular!

Creating a relevant, topical & emotional connection

We need to stop trying to make pensions exciting; they never will be. Instead, we need to use levers that are topical and relevant, so that members feel a connection to pensions. The levers will change over time and there is a need to ensure we recognise when this happens. Engagement is not just about putting tech on the front end and saying job done; it’s much more. Yes, tech has a role to play, but simply by having an app or online presence, there is no emotional, relevant or topical connection.

How can ESG help?

ESG is the lever we should use in 2021 to drive interest. I appreciate that ESG means different things to different people, but for this purpose that really does not matter. What matters is that it’s relevant, individuals have a view about it and

there is a connection to pensions that members can relate to i.e. ‘what is my pension doing in this area and what are its plans to invest in companies that are not just best in the world but also best for the world’.

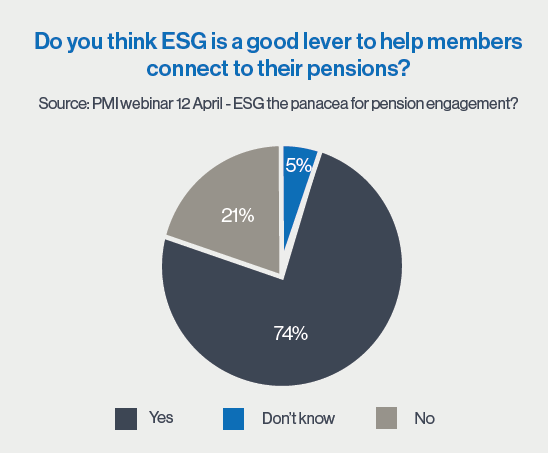

ESG has captured the imagination across all demographics and there are many high-profile campaigns which keep it as front page news. Not only that, members can see the impact on their everyday lives, whether that is something as simple as plastic bags no longer being sold in supermarkets, or the purchase of an e-car; it’s something tangible and a topic of conversation that isn’t seen as boring or dull. As can be seen from the graph below, nearly 75% of the respondents at the webinar agreed that ESG is a good lever to help members connect with their pension.

Can Master Trusts lead the way?

The simple answer is yes! A master trust’s scale means it has the skills, resource, budget and capability to drive engagement forward. Many Master Trusts have also grasped the ESG investment agenda and incorporated it into their strategies, for example, at Atlas, we have around 70% of the assets in the default lifestyle strategy invested in explicitly-focused ESG investments, with the remaining 30% still having ESG considerations fully integrated into the investment decision-making process. So, there is a good story to tell here; let’s use ESG as the front page headline but give some prime time ad space to other important topics such as benefit adequacy or income options. This type of clever placement will give other newsworthy stories the airtime they deserve.

Conclusion

Pensions are, quite simply, boring, so it’s up to us and especially Master Trusts to find the relevant and emotional levers. In 2021 it’s ESG, but we should already start thinking about what it will be in 2022.

Notes/Sources

This article was featured in Pensions Aspects magazine June 2021 edition.

Last update: 3 June 2021

You may also like: