1. Which lives to cover?

As longevity swaps are unfunded, meaning no large upfront payment is required, it is possible for a swap to cover a very large group of scheme members without having a significant impact on the scheme’s finances. Traditionally this has meant that schemes have implemented longevity swaps that cover all pensioner members, rather than just a subset.

Recent innovation means that longevity swaps can now cover deferred pensioners as well, but as the cost of these is much higher than that of pensioners, we would expect most schemes to restrict coverage to their pensioner population.

2. Which reinsurer to use?

Price will be a leading factor when selecting a longevity reinsurer, but there are others to consider:

- Collateral structure: longevity swaps use collateral to reduce exposure to counterparty risk. It is essential that a scheme understands and is able to accommodate their chosen reinsurer’s preferred collateral structure.

- Eligible collateral assets: reinsurers may accept corporate bonds as collateral, which can be very efficient for a scheme’s investment strategy. However, it is important to ensure the reinsurer has the operational set-up to return collateral assets in a timely fashion so that the scheme can still manage those assets effectively.

- Termination provisions: it is important to ensure that termination provisions are not disadvantageous to the scheme. For example, ‘hair trigger’ default clauses that can lead to the termination of a swap following a minor payment delay should be avoided.

3. Onshore or offshore insurance intermediary?

As reinsurers can only transact with insurers, the scheme must find an insurance company to sit between it and the reinsurer. There are two potential routes, both of which are well-tested:

- Onshore: a traditional UK-domiciled insurer is used as the intermediary between the scheme and the reinsurer.

- Offshore: this typically involves the use of a dedicated Guernsey-domiciled Incorporated Cell Company (ICC) as the insurer.

The onshore route is typically seen as slightly simpler to implement and more familiar for trustees, whereas the offshore route can be cheaper to run and gives the scheme more control and transparency. Exercising greater control could be important if a scheme is considering multiple future transactions, or a future buy-in or buy-out.

4. Is the longevity swap good value?

Comparing the fixed cashflows payable by the scheme under the longevity swap against the expected pension cashflows is perhaps the simplest way of assessing value. For example, the fixed cashflows might be 5% higher than the expected pension cashflows. We can then determine what this increase equates to in terms of a higher life expectancy, or how much more investment risk must be taken to meet this increased cost.

5. Who to use for collateral management?

However, as collateralisation of a longevity swap can be very different to that of an LDI portfolio, it is important to check that the LDI manager is able to support the operational requirements of the potential reinsurers before a reinsurer is ultimately selected, and vice-versa.

A scheme’s existing liability-driven investment (LDI) manager is well placed to act as collateral manager for the swap; they already manage a pool of collateral assets and will have some of the required processes and infrastructure in place.

6. What are the implications for a pension scheme’s target endgame?

In recent years, some longevity swaps have been ‘novated’ to a buy-in or buy-out provider. When a swap is novated, the pension scheme enters into a bulk purchase annuity contract with a new insurer and the existing longevity reinsurer remains in place, but now provides longevity protection to the new insurer. The use of an offshore longevity insurance intermediary potentially makes this novation more straightforward than if an onshore intermediary was used.

Longevity swaps: an effective and efficient option for hedging longevity risk

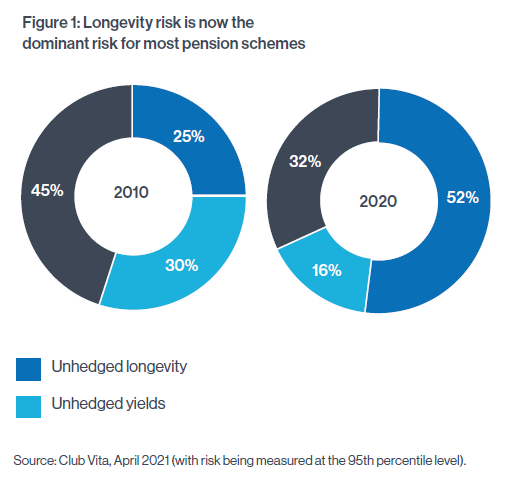

Leaving your pension scheme’s longevity risk unhedged could have significant implications: it could lead to a delay in reaching target funding or increased deficit contributions.

A longevity swap could help a scheme avoid these outcomes. By understanding how longevity swaps work and the key decisions underpinning them, their effectiveness and efficiency can be maximised, helping support your scheme’s journey to its ultimate objective.

Notes/Sources

Risk disclosures

Investment in any strategy involves a risk of loss which may partly be due to exchange rate fluctuations.

This document is a financial promotion and is not investment advice. Unless otherwise attributed the views and opinions expressed are those of Insight Investment at the time of publication and are subject to change. This document may not be used for the purposes of an offer or solicitation to anyone in any jurisdiction in which such offer or solicitation is not authorised or to any person to whom it is unlawful to make such offer or solicitation. Insight does not provide tax or legal advice to its clients and all investors are strongly urged to seek professional advice regarding any potential strategy or investment. Telephone conversations may be recorded in accordance with applicable laws.

For clients and prospects of Insight Investment Management (Global) Limited: Issued by Insight Investment Management (Global) Limited. Registered office 160 Queen Victoria Street, London EC4V 4LA. Registered in England and Wales. Registered number 00827982. Authorised and regulated by the Financial Conduct Authority. FCA Firm reference number 119308.

© 2021 Insight Investment. All rights reserved. IC2746

This article was featured in Pensions Aspects magazine November/December edition.

Last update: 7 December 2021

You may also like: