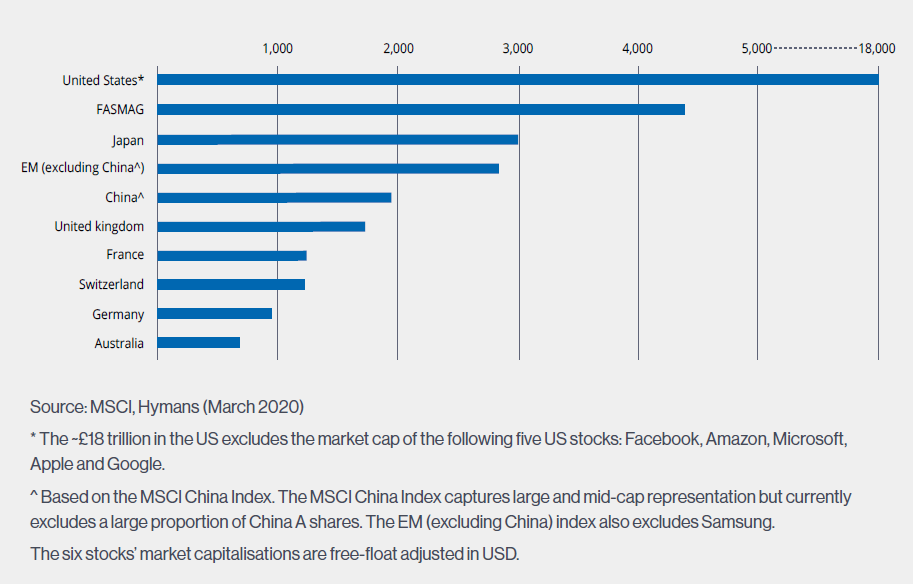

Prior to the COVID-19 crisis, the US equity market cap, excluding the five US stocks highlighted above, was closer to $30 trillion. The chart above shows that at the low of March 2020, this figure fell below $20 trillion (although at the time of writing, there has been a significant bounce back across the entire US market). These five companies have done extremely well because they have allowed people to maintain virtual connectivity, distribute content and maintain a global marketplace in the absence of physical connectivity or physical marketplaces.

Implications for DC schemes

- The majority of Defined Contribution (DC) schemes access equity markets using market cap-weighted index tracker funds. Therefore, assets flow proportionately into companies based on how large they are and not based on any other fundamentals.

- Trustees and governance committees should be aware of the increased single stock concentration risk in investing in a passive global equity index. Traditionally, concentration risk has been one of the main issues with the UK equity market with its significant exposure to the Financials and Energy sectors.

- What can go wrong with the Internet of Things? We have seen entire sectors change overnight due to a health-related virus. Could there be a cyber virus disrupting the companies mentioned above and stopping search engines, social media, software and online retail platforms?

- We believe that sustainability and long-term responsible investment will become significant issues across all companies. In particular, there will be increased scrutiny on labour conditions, an increased focus on operational risk and data privacy, and the implications of the use of technology over people going forward. Naturally, the larger the company, the greater the scrutiny.

- Trustees and governance committees should also be aware of the alternatives to a passive market cap-weighted tracker fund approach. This typically includes the use of active management (making a choice to invest in a stock other than just because they happen to be large), and a factor-based approach (tracking an index that has been designed based on fundamentals other than the size of a company in the index).

Notes/Sources

This article was featured in Pensions Aspects magazine July/August edition.

Last update: 21 July 2020

You may also like: