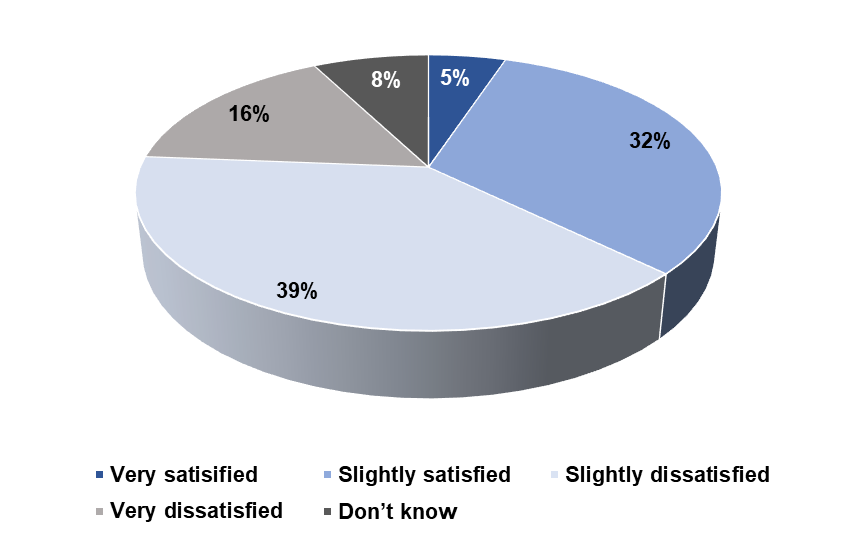

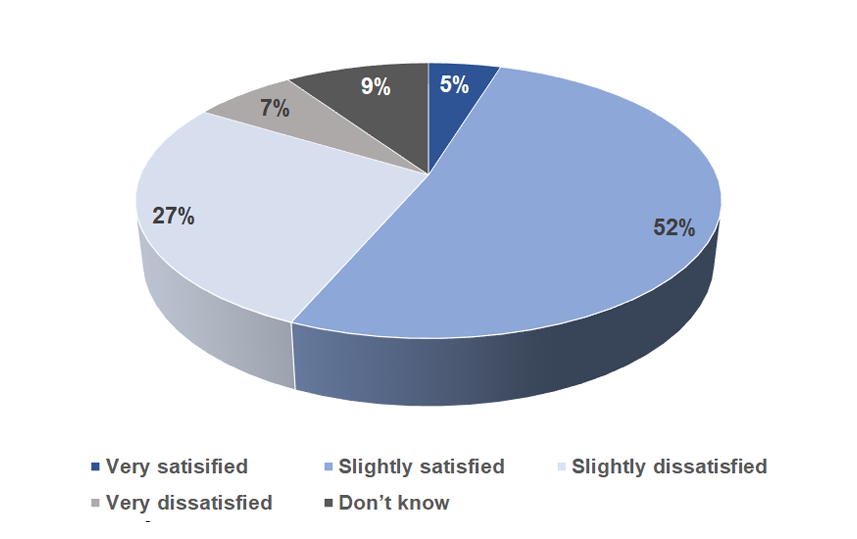

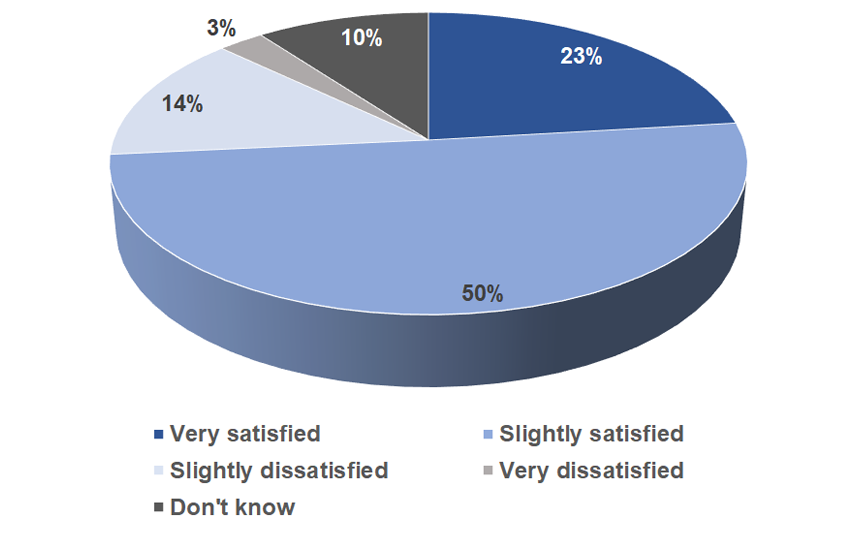

1. How satisfied have you been with the direction of pensions policy over the last 6 months?

January 2020

June 2020

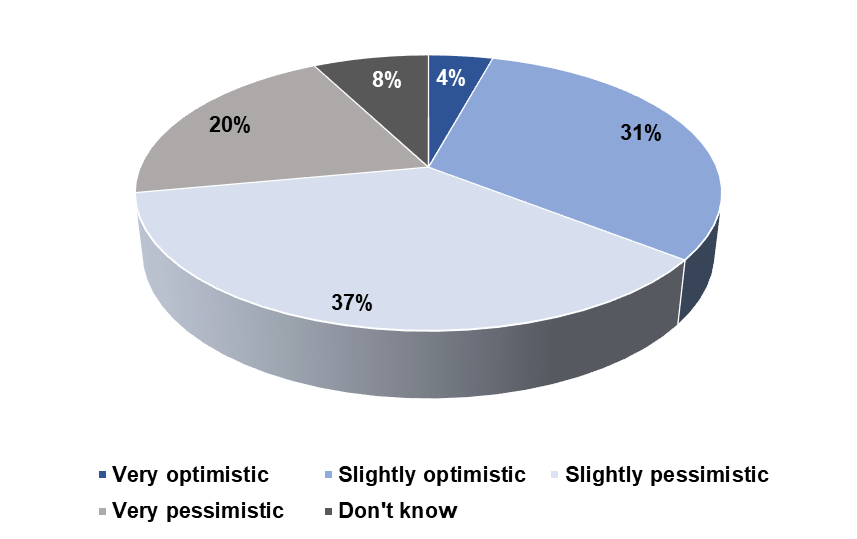

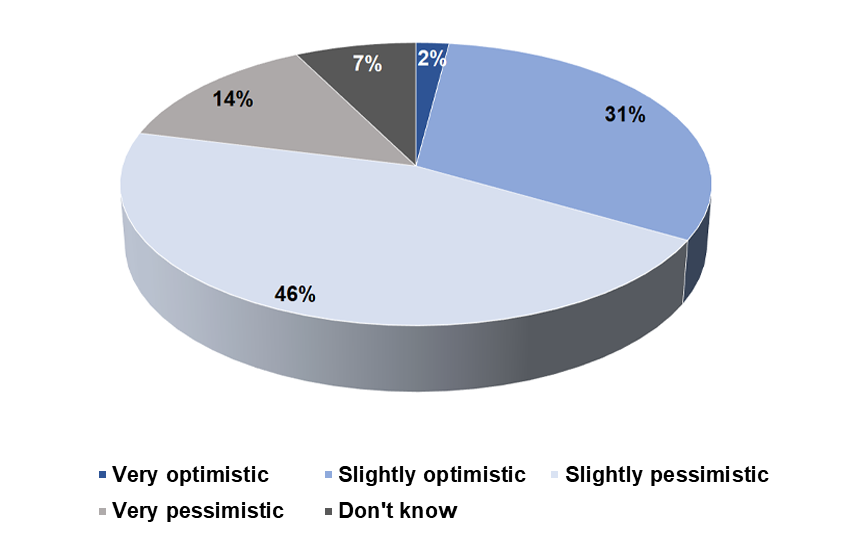

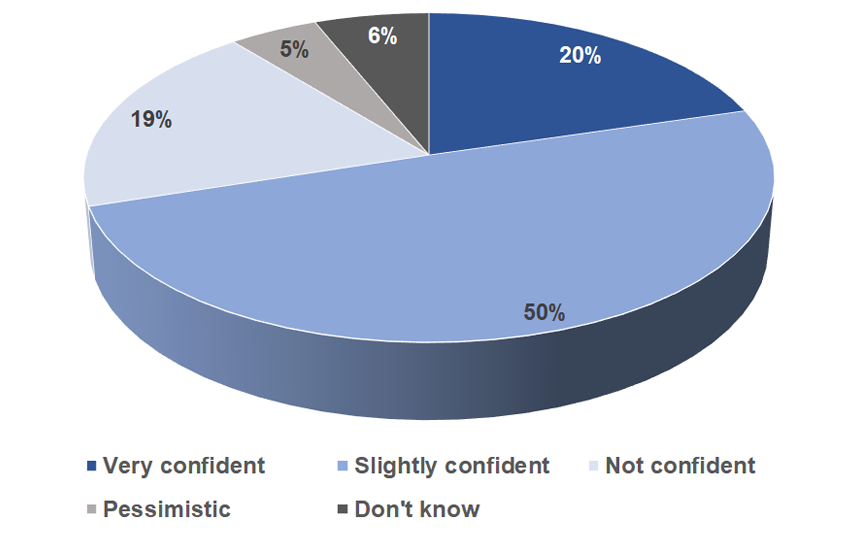

2. How optimistic are you about the direction of pensions policy over the next 6 months?

January 2020

June 2020

3. How satisfied have you been with the activity of the Pensions Regulator over the last 6 months?

4. How confident are you that the Pensions Regulator will focus on the right areas in the next 6 months?

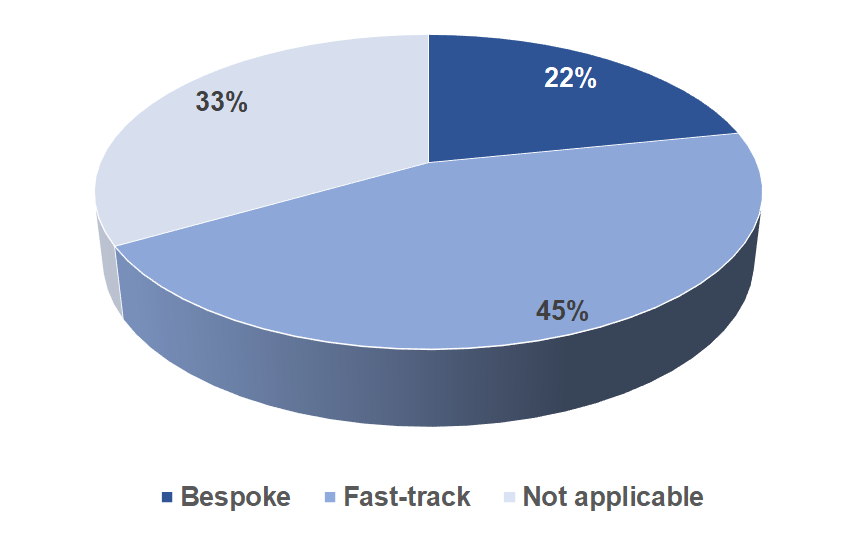

5. With reference to the Pensions Regulator’s proposed twin-track regime for DB valuations, do you currently expect that your scheme (or the majority of schemes, if you are dealing with more than one) will adopt an approach that is:

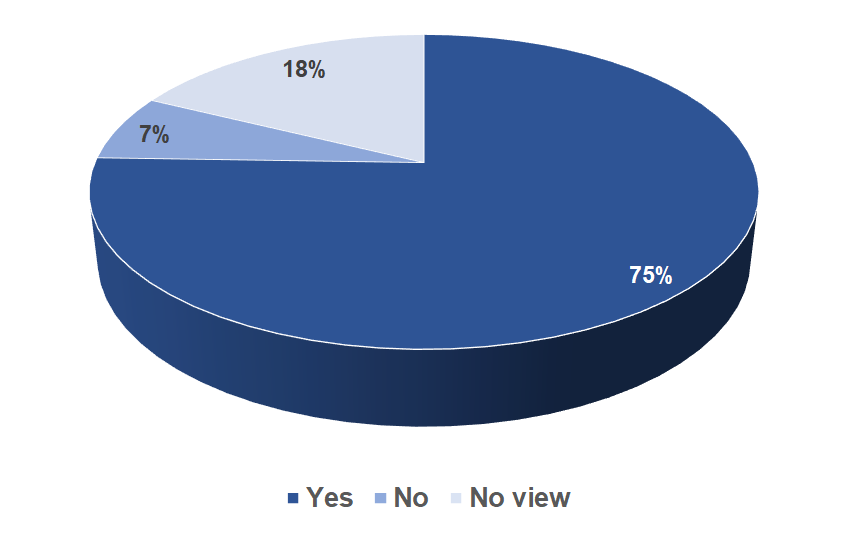

6. Has the Regulator’s advice to schemes during the COVID-19 emergency been helpful?

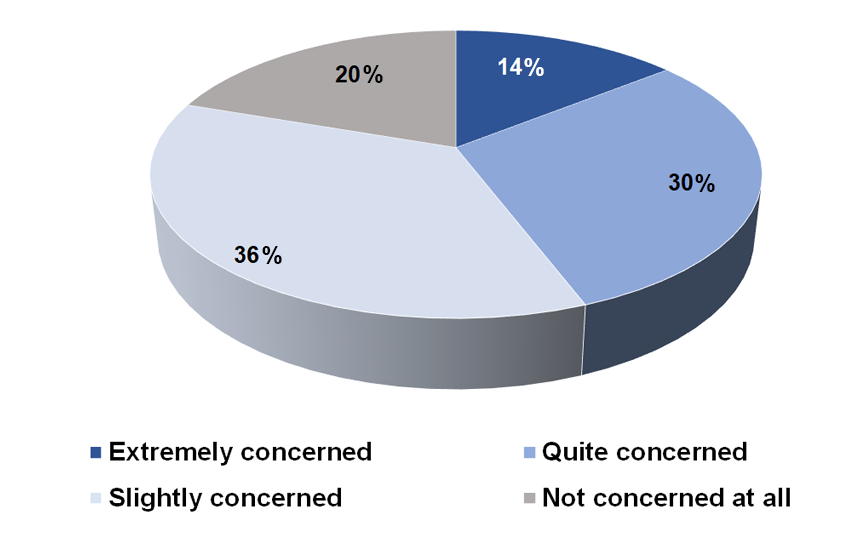

7. Clause 107 of the Pension Schemes Bill is intended to make it a criminal offence to ‘recklessly endanger’ a Defined Benefit pension scheme. However, many within the pensions industry are concerned that the Clause as worded is far too broad in scope and would potentially criminalise a range of ordinary activities concerned with the management of, or services to a pension scheme.How concerned are you that Clause 107 of the Pension Schemes Bill will criminalise normal DB scheme management and consultancy services?

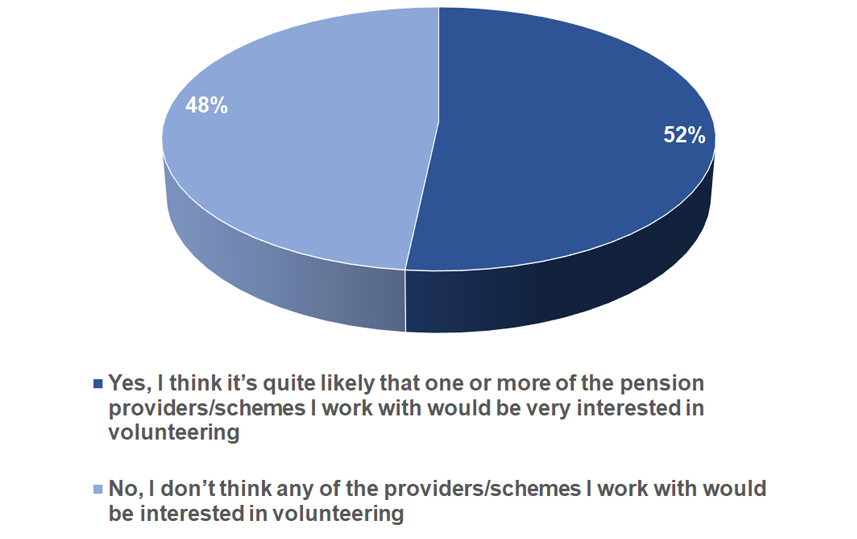

8. To settle the data standards for pensions dashboards (before industry-wide compulsion comes into force), a number of volunteer pension providers and schemes need to put themselves forward. They will work very closely with Government to test/refine the proposed data standards, applying real pensions data to the digital architecture, in turn benefiting the whole industry. Do you think our industry will bring forward the necessary volunteer pension providers & schemes? *

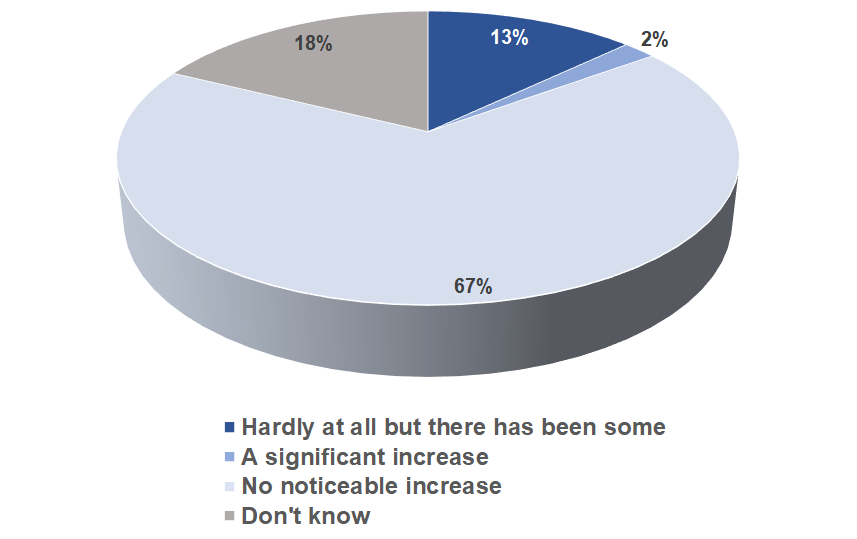

9. We have been advised that during lockdown the risk of pension fraud has increased greatly. What evidence have you seen of an increase in fraudulent activity?

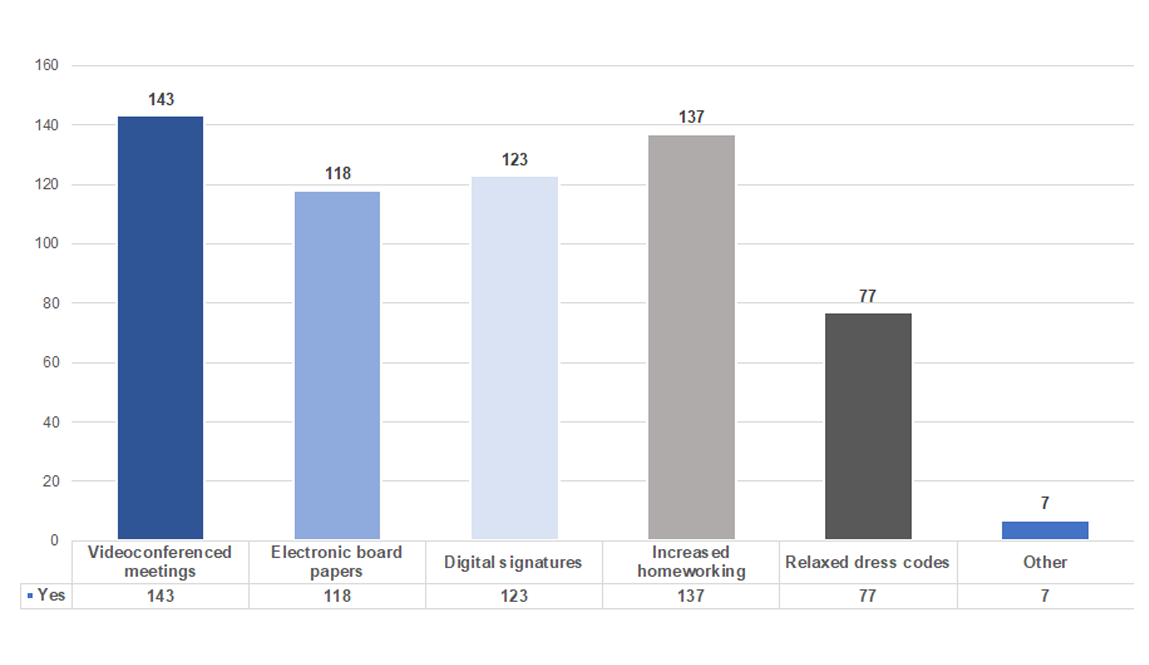

10. Will we see permanent changes to working practices arising from the COVID-19 emergency? What is likely to continue? Select all that apply

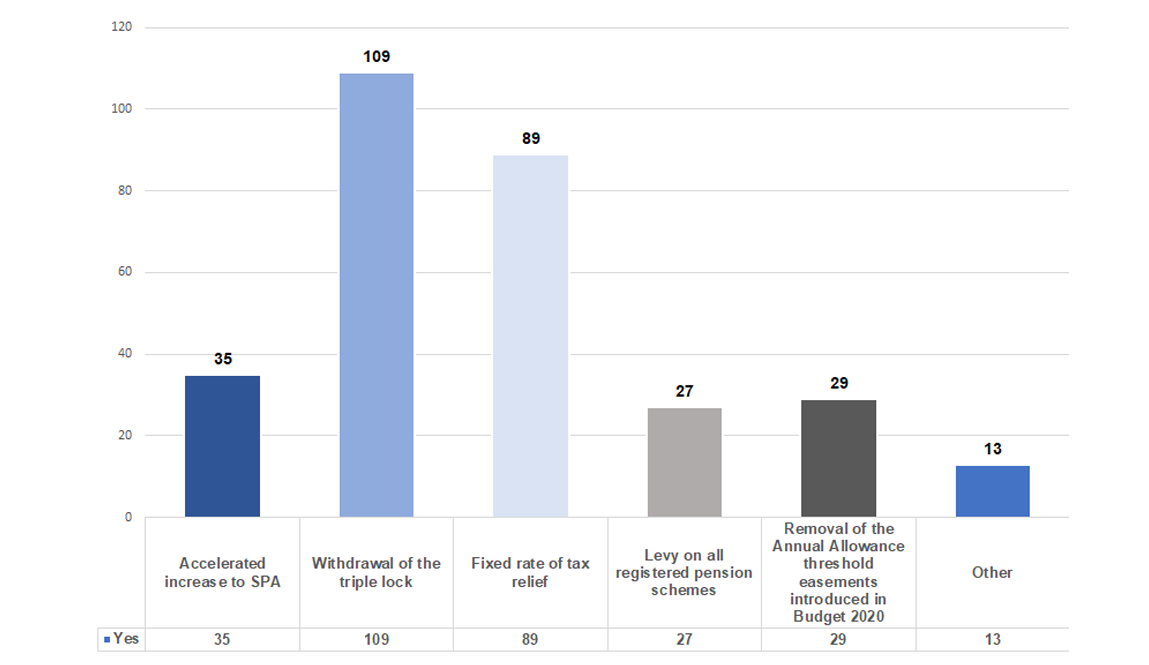

11. If after lockdown the Government were to seek fiscal savings via the pensions system, which of the following do you believe will be applied?” Select all that apply

Our fourth edition of PMI Pulse is now closed. Next poll will open in November 2020.

Last update: 29 June 2020

You may also like: