And about time too. The case for CDC could not be stronger as UK plc, and society more widely, look to build a more resilient future in the wake of Covid-19.

“CDC provides savers with an income for life in retirement, from fixed-cost Defined Contribution (DC) savings, without having to make complex financial decisions along the way”, and can offer a better route forward for member and employer outcomes as they move on from the current crisis.

For employees, CDC delivers a target, inflation-linked income, payable for life - what the majority want in their retirement.

For employers, CDC looks no different to DC – fixed contributions, with no reliance on a sponsor or balance sheet risk.

This article gives a brief overview of what CDC is, how a typical CDC scheme might behave, and clears up some misconceptions surrounding CDC.

What is CDC?

CDC schemes offer a new way of building up pension benefits for UK employees.

Employer and employee contributions are fixed, with benefits taking the form of a target pension. Benefits are subject to conditional adjustments depending on the funding level of the scheme each year.

The key concept here is that benefits are not guaranteed – they can go up or down each year, although the terms are set so that increases are more likely than reductions. However, in extreme circumstances pensions can be cut, notably if an annual valuation reveals assets are insufficient to cover existing benefits at face value.

The benefits of CDC arise from a scheme design which aims to eliminate known biases (intended or otherwise) in outcomes between different generations of savers. In particular:

- All contributions are pooled together, in a single fund, with members collectively sharing investment and longevity risk

- CDC schemes are funded on a central (or best) estimate basis, with no deliberate margins for prudence.

Market movements and outcomes – in either direction – are shared, or smoothed over time, across the membership. This means that market timing and proximity to retirement – key drivers of outcomes and a source of risk in DC – have much less of a bearing on outcomes in CDC.

Multiple sets of research show that members of a CDC scheme can, on average, expect higher target pensions compared to conventional DC with an annuity providing the lifetime income. The time horizon of a typical CDC scheme will be longer than the lifespan of a conventional DC member, allowing a less conservative investment strategy.

Key to the success of CDC is clear and regular communication to members on the nature of benefits being built up: target benefits, with conditional adjustments. Members should be in no doubt that their benefits are not guaranteed, nor are they guaranteed to increase.

How does CDC work in practice?

The market falls of up to 25% seen early in the COVID-19 crisis provide a useful case study to help understand how a typical CDC scheme might have operated.

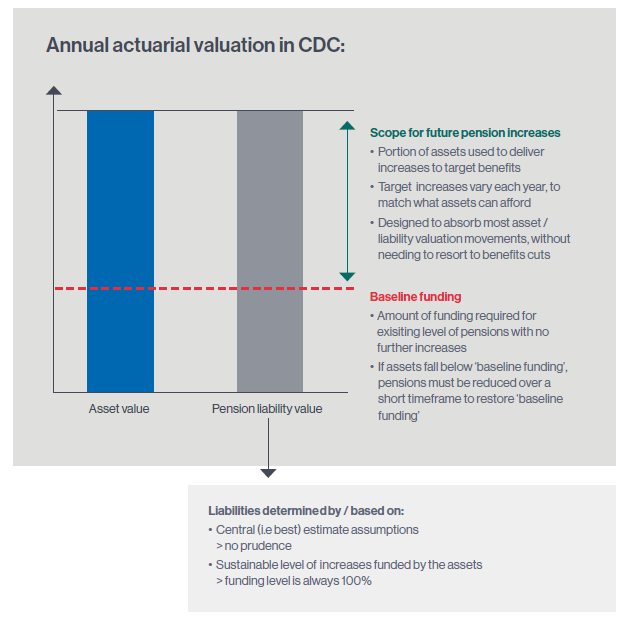

Chart 1: CDC valuations

The requirement of a CDC scheme at each annual valuation is to be fully funded. Each year a typical scheme will adjust the value of its liabilities by varying – up or down – its target level of annual benefit adjustment (or, target pension increase), to match its asset value.

Increases will only be targeted and awarded if there is sufficient scope to do so. In this example, let’s say that a 3% increase this year and expected 3% per annum increases in the future will balance the books.

No additional contributions are sought from the employer if assets fall, because liabilities are adjusted (in either direction) to match assets each year.

Clear communications will help realign members’ expectations on the benefit adjustment the scheme can provide in the coming year and will be targeting in future years.

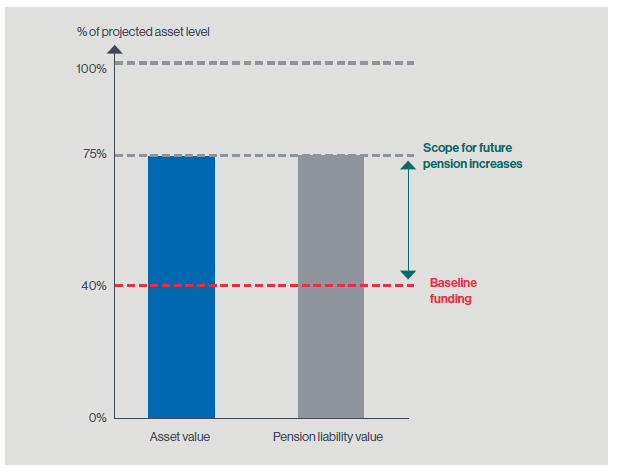

Chart 2: CDC valuation following a 25% fall in assets

Chart 2 shows that if an annual CDC valuation reveals assets have fallen by 25%, the scope for funding for future increases to target pensions will have reduced. However, where assets remain sufficient to cover baseline funding, benefits would not need to be cut.

Target pensions will still increase in the coming year, and be expected to in future years – i.e. benefit adjustments remain positive. However, these increases will be lower than previously expected.

For example, if 3% per annum increases were previously expected, this might now be 2% per annum both in the coming year and as a target in all future years.

From a member’s perspective a smaller increase to their target pension each year, compared with what they were previously expecting, helps to smooth out the impact of this market shock, and may be an easier pill to swallow than seeing their DC pot plummet 25%.

Compare this with the well-publicised risks member outcomes face in both Defined Benefit (DB) and DC schemes, which are heightened at present, and resilience in member outcomes arising from pooling risk across generations comes to the fore.

Common CDC myths

“If you paid that much into DC, you’d get a decent pension too.”

For employers wanting to offer CDC, this does not mean having to pay higher contributions than their existing DC arrangements. The benefits arise from collective sharing of investment and longevity risk, and smoothing outcomes over time.

“CDC is incompatible with pension freedoms.”

CDC is completely compatible with the pension freedoms. Any member who wishes to transfer out before retirement will be able to do so, just like DC and DB schemes. The amount they transfer will be their share of the fund in order to be equitable between those who transfer and those who do not.

“CDC can’t be good – Dutch plans had to cut benefits.”

Benefit cuts in the Netherlands (for example those in 2012, and those which we may see in 2020) are highlighted as a failure of the system. However, a fairer assessment of ‘terrible’ cuts in extreme times is that members may face a temporary reduction in their pension in comparison with typical DC savers, who face a significant cut, e.g. 25%, and have a limited time frame to repair it. The Dutch Regulator showed that for schemes that cut benefits in 2012, the average cut was around 1.9%. These cuts were largely restored in Dutch CDC plans as markets improved in the following years.

“It’s just with-profits.”

CDC does share some features of with-profits: investments are undertaken collectively without member choice or intervention, and underlying returns are smoothed over time. However, CDC differs given its features below – if these applied in the with-profits era, many issues and ‘outliers’ may have been easier to call out.

- Transparency and openness: alongside The Pensions Regulator’s oversight, all relevant financial information (including how benefit adjustment decisions are reached) are made public and subject to external scrutiny.

- Governance structure: a trustee board’s sole objective is to support members’ interests, with no potential undue commercial influences e.g. arising from the management of investments.

- Communications: it is vitally important to set members’ expectations – both at outset, and through ongoing communications – on the nature of their benefits. Terms like ‘target’ and ‘adjustment’ help to emphasise the key concepts, as should reminders that benefits can be cut in extreme circumstances.

“Won’t employers be forced to make good CDC deficits if schemes are in distress?”

No. Legislation defines CDC as Money Purchase. There is no recourse to employers for past accumulations, and CDC carries no balance sheet risk.

Notes/Sources

This article was featured in Pensions Aspects magazine September edition.

Last update: 24 May 2024