This has led trustees to consider how to hedge longevity risk. The coronavirus pandemic has led to significant uncertainty over longevity expectations and how they might affect schemes’ liabilities – but from a strategic perspective, many schemes are still considering their options. This has led to increasing interest in longevity swaps, which can be an effective and efficient way of hedging longevity risks.

Hedging longevity risk using a longevity swap can have a direct impact on a pension scheme’s investment strategy, including its overall return requirements and its collateral pool. However, it is likely to be more efficient overall than a buy-in, which can have more wide-ranging implications that make it more difficult for a scheme to achieve its goals.

How longevity swaps work

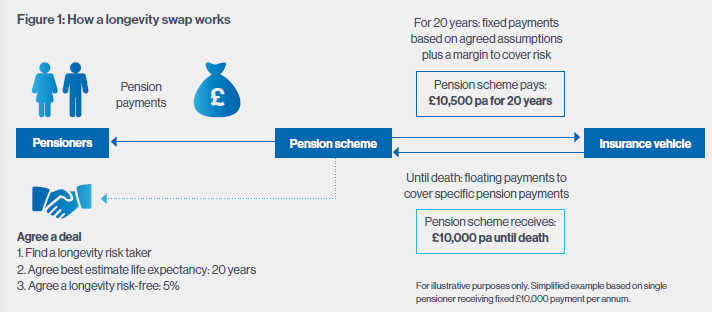

Under the terms of a longevity swap, a scheme agrees to make pre-defined monthly or quarterly payments to a reinsurer, via an insurer, in return for regular payments that cover the pensions due to a defined set of pensioners (see Figure 1).

The pre-defined payments paid by the scheme will reflect the reinsurer’s best estimate as to the pension payments that will be required, along with an additional ‘risk fee’ to reflect the risk that the pensioners’ longevity will increase.

The net effect is to transform the scheme’s obligation to pay pensions – which may vary depending on the longevity of the underlying pensioners – into an obligation to make a series of pre-defined payments. As such, the scheme is no longer exposed to the longevity of the pensioners.

Return requirements may increase

Entering a longevity swap means a scheme must generate additional returns to cover the risk fee applied to the pre-defined payments made to the reinsurer.

For example, a 4% risk fee might equate to an additional annualised return of 0.25%. In terms of a corporate bond portfolio, this would be broadly equivalent to moving from a AA-rated portfolio to a 50% AA-rated and 50% A-rated portfolio.

A scheme would need to make a judgement as to whether hedging the longevity risk more than compensates for the additional investment risk that might be taken on to achieve the additional return.

Collateral assets may not be affected as you expect

To manage counterparty risk, longevity swaps are collateralised: assets reflecting the outstanding risk fee, and the changing value of the swap, are posted by the pension scheme and the reinsurer to minimise the economic impact if either party defaults on their obligations.

For most swap instruments pension schemes typically use, such as interest rate and inflation swaps, only allowed cash or gilts are accepted as collateral. In the case of a longevity swap, however, the list of eligible assets often extends beyond cash and gilts to include high-quality corporate bonds.

This can be beneficial for the scheme as it means assets that could not otherwise be used as collateral can be used to collateralise the longevity swap, easing the burden on the cash and gilt portfolio that may be used to collateralise other swap contracts.

For example, if a longevity swap hedges £1bn of pensioner liabilities, a scheme may be required to pledge £50m of assets as collateral on day one. If the eligible assets were limited to cash and gilts, this would materially reduce the pool of assets available to collateralise other swap contracts, increasing the amount of leverage associated with those contracts. By posting high quality corporate bonds as fee collateral, however, the pool of cash and gilts is left unchanged.

What about a buy-in?

Schemes might opt to address longevity risk via a pensioner buy-in, under which a portion of the scheme’s assets are passed to an insurer, who in return promises to meet the pensions due to a defined group of pensioners.

A buy-in immunises against all the risks associated with a group of scheme members. However, buy-ins can consume a disproportionate amount of scheme assets versus the amount of risk they remove, which in turn places additional strain on residual scheme assets, potentially creating significant future risks for a scheme.

By allocating assets to the buy-in, and retaining assets to back its lowrisk LDI portfolio (to hedge the non-pensioner liability-related risks), the residual assets must be invested in high-return/high-risk assets to achieve a full buy-out within the set timeframe.

By comparison, a longevity swap removes the same amount of longevity risk as a pensioner buy-in, but it has the advantage of leaving all of schemes assets available for investment. This means the scheme can dedicate all its assets towards the goal of reaching its endgame, unlike a buy-in under which a portion of the assets have been passed to the insurer.

Longevity swaps: an effective and efficient option for hedging longevity risk

Pension schemes are maturing, and their priorities are shifting: managing their liability risks effectively and efficiently are key if they are to achieve their target within a sustainable timeframe. Taking into account their potential implications for a pension scheme’s investment strategy, longevity swaps can play an important role in hedging a key liability risk, ultimately supporting a pension scheme’s journey to its ultimate objective.

Investment in any strategy involves a risk of loss which may partly be due to exchange rate fluctuations.

Notes/Sources

This document is a financial promotion and is not investment advice. Unless otherwise attributed the views and opinions expressed are those of Insight Investment at the time of publication and are subject to change. This document may not be used for the purposes of an offer or solicitation to anyone in any jurisdiction in which such offer or solicitation is not authorised or to any person to whom it is unlawful to make such offer or solicitation. Insight does not provide tax or legal advice to its clients and all investors are strongly urged to seek professional advice regarding any potential strategy or investment. Issued by Insight Investment Management (Global) Limited. Registered office 160 Queen Victoria Street, London EC4V 4LA. Registered in England and Wales. Registered number 00827982. Authorised and regulated by the Financial Conduct Authority. FCA Firm reference number 119308 IC2225.

This article was featured in Pensions Aspects magazine July/August edition.

Last update: 13 September 2022

You may also like: