I can understand where this question comes from – both pensions dashboards and open banking concern digital access to finances. And there will be some similarities in how you govern the digital ecosystem, and the consumer protections and liabilities that we will build in.

But the short answer is that pensions dashboards and open banking have less in common than it first seems. When you dig down a little, you start to see how different the two really are in terms of their audience, purpose and functionality.

Separate systems for separate purposes

The concept of a pensions dashboard sounds simple. However, in practice, connecting UK pension holders with the 43,000+ pension providers and schemes, all of which use different systems, is extremely complex.

Pensions dashboards aim to reunite people with lost pension pots and allow individuals to understand and manage their pensions more effectively. It is a non-commercial imperative, which has the user rather than the market at its heart.

Open banking came about when the EU and the Competition and Markets Authority compelled nine major banks to open up their data to new digital suppliers. It was a commercial initiative to drive innovation and create a more diverse, open market, which would also benefit consumers.

Audience, reach and relationships

Pensions dashboards have an enormous potential audience. Every UK adult with at least one pension that is not currently in payment will be able to view their pension information via a dashboard.

Within the Pensions Dashboards Programme, we’re creating the digital ecosystem, plus the design and technical standards that will make dashboards work, rather than a dashboard itself. The Money and Pensions Service is creating a front-end dashboard, and we expect other organisations, such as banks, fintechs or pension providers to create their own pensions dashboards too.

Open banking benefited from the existing relationships individuals had with their original bank. There was a ready-made audience, complete with passwords, codes or access to online systems, already set up. But dashboard users will not necessarily have a pre-existing relationship with their chosen dashboard provider.

To resolve this, we are designing a robust system for identity verification into the pensions dashboards ecosystem. It needs to provide sufficient assurance to pension providers that users really are who they say they are, to ensure that providers share information with the right individual(s). Equally, users need to feel confident that no one can access their pension information, without their explicit permission to do so.

Differences in data flow

Perhaps of even greater significance is the difference in how data moves between the parties involved in open banking and pensions dashboards.

Open banking took information that was already held by major banks and it flowed out from those organisations to alternative providers and then onward to users.

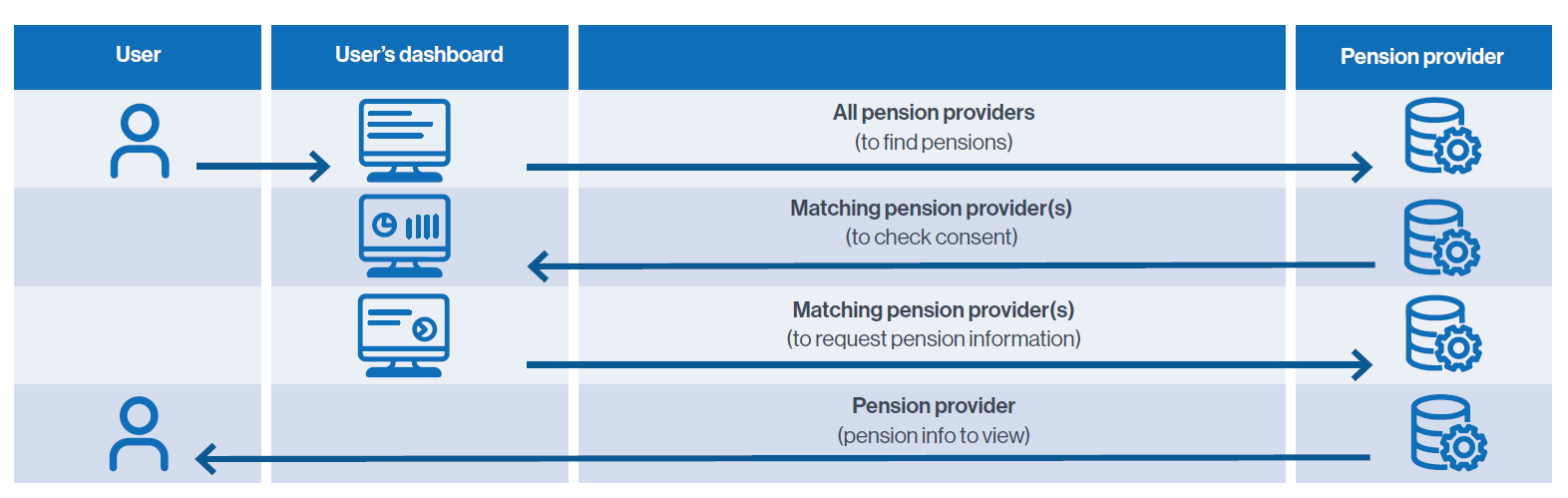

With pensions dashboards, the data flow is initially in the opposite direction. Users will input some basic information to their chosen dashboard, which will go via the pensions dashboards ecosystem to multiple pension providers and schemes, to unlock matching pensions. Then pension providers will return their pensions information for users to view via dashboards.

Even at a very high level you can see that the way data moves through each system is completely different. As a result we need a completely different set of data, design and technical standards. You can’t just lift and shift from open banking to the pension dashboard ecosystem.

Lessons to take from open banking

Despite the clear differences between the two programmes of work, there are things that we can learn from open banking, not least that answering user needs must be at the heart of what we are developing.

We are working on an initial version of pensions dashboards. We know that this will iterate and improve as open banking did, as we work together with the industry and our stakeholders to define solutions to some of the challenging issues around estimated retirement income, or including costs on dashboards, for example.

Collaboration is central to our success. As is clear from open banking’s example, industry must be on board with activity, to ensure that it acts within the spirit of any regulation. This is one reason why we place so much emphasis on engaging with the pensions industry throughout the development of dashboards.

Moving towards open pensions

Ultimately, open banking is closer to the concept of open pensions than pension dashboards. Open pensions could provide opportunities for individuals to transfer to new digital pension products in the future.

While the Pensions Dashboards Programme is not the place to lead on this, I believe that pensions dashboards could be an important stepping stone towards open pensions. Creating or reinforcing the relationship between individuals and their pensions by helping people to know what they’ve got, gives them greater understanding and control over their retirement planning. It’s a great place to start.

Notes/Sources

This article was featured in Pensions Aspects magazine May 2021 edition.

Last update: 6 May 2021