Significant job losses

As we emerge from post-lockdown, we are starting to see the longer term effects on businesses and job losses. Over the last few months the business headlines have made for grim reading;

It is estimated that at least 190,000 people have been made redundant in the UK as a direct result of Covid-19. However, it is anticipated that there could be many more job losses once the furlough scheme ends in October. Some estimates expect the total number of redundancies to be closer to 1 million as companies and the UK economy readjust.

The financial consequences of being unemployed can be severe, not only for the immediate future but also in later life and retirement.

Impact on retirement savings

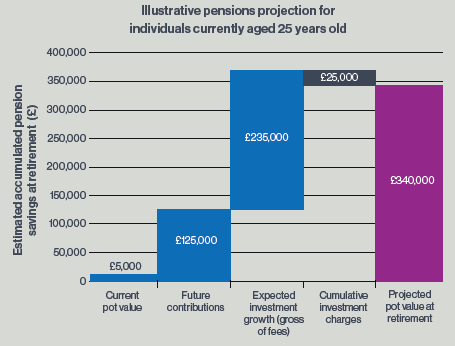

There can be significant implications for an individual’s retirement savings as a result of being unemployed for a sustained period of time. An individual being out of employment for, say, 12 months, would:

- Stop contributing into any pension plan for that period

- Miss out on 12 months’ worth of investment growth on the missed contribution payments

- Miss out on a salary increase.

The power of compounding means that the cumulative effect of these factors have a detrimental impact on younger members. However, the younger age groups would also tend to have a lower starting salary and be contributing at a lower rate compared to those closer to retirement age. In addition, younger members may expect to pay into a pension arrangement for a further 40 years (if retiring at age 65).

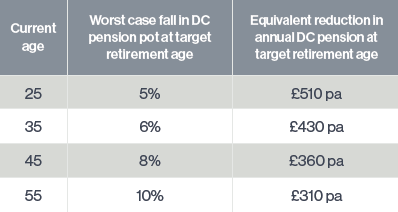

Our analysis suggests that a 25 year old who is out of employment for 12 months could be as much as 5% worse off at retirement. This could see a typical younger member worse off by as much as £510 per annum.

For those individuals who are closer to target retirement age, a period of unemployment may have a greater impact on their retirement pot, seeing as much as a 10% drop in retirement wealth if unemployed for a period of 12 months. These individuals do not have the luxury of time on their side for compounding and are also likely to be contributing a greater proportion of their salary towards their pension savings. However, this peer group are also much more likely to have alternative pension arrangements elsewhere, including Defined Benefit (DB) pensions which may be their main source of retirement savings.

The table below shows the estimated impact of being unemployed for 12 months on a range of individuals of different ages. All individuals are assumed to have a target retirement age of 65 years old for this illustration and have recently joined their employer’s Defined Contribution (DC) pension scheme.

The consequences of being unemployed can have a detrimental impact on retirement planning, such as having to:

- Retire at a later age and therefore having to continue working (and contributing) longer than planned

- Accept a lower level of financial security and wellbeing

- Reassess your investment goals and target a greater level of growth

- Change your future retirement options and nature of your benefits.

Each of these areas alone can require a significant amount of thought and pension members still find themselves the target for scam activity.

Greater vulnerability to scams

A change in employment could well be the catalyst for some individuals to review their financial situation. Those individuals could find themselves in the firing line for scam activity. Membership groups with greater levels of digital access, which would typically include younger members, will be more likely to manage their finances online and may be more vulnerable to scams.

Member profiling has also indicated that pension schemes with a higher proportion of members in poor health, who may be more susceptible to Covid-19, are also more vulnerable to scam activity. A vulnerability analysis taking into account age, health, and digital and financial awareness can help to identify these members.

All of this reinforces the importance of remaining engaged with individuals on their pension arrangements and providing them with ongoing support and up-to-date information in a way that works for them.

Member engagement is vital

Keeping members engaged, particularly once they have left employed service, is something that pension schemes often find difficult. It is important to find relevant and cost effective ways to communicate which make the best use of technology. Schemes should also consider the responsibility to protect members’ interests, which could include identifying the groups most at risk from scams. Member profiling can provide insights into the membership groups that would benefit most from targeted support and specific campaigns.

It is important that schemes create engaging communications using a ‘know, feel, do’ approach which focuses on:

- The key message you want members to ‘know’

- How do you want them to ‘feel’ about that message, and

- What do you want them to ‘do’ after reading the communication?

One important communication method is a scheme-specific member website. These can be a really powerful communication tool and information provided through the site is tailored to members’ benefit types and statuses. This can also be monitored to identify which membership demographics are accessing the information. Online navigation is simple and important scheme documentation, such as change in address forms or retirement illustrations, can be found online if member circumstances do change.

Summary

The significant impact of Covid-19 has been felt across a number of different areas. It is likely that the next, long-lasting phases of Covid-19 will be more economic in nature and in terms of pensions, it is important for employers and pension scheme trustees to:

- Determine the impact of Covid-19 on their members, particularly those that may be more acutely affected and most at risk from scams

- Consider the key variables that determine a member’s pension savings – and if changes should be considered, and

- Keep their members engaged with pension matters and provide key information and support at this crucial time.

Notes/Sources

The views and opinions expressed in this article are those of the authors and do not necessarily reflect those of XPS Pensions Group as a whole. Examples of analysis performed within this article are illustrative only and should not be viewed as regulated investment advice.

Sources used: The Guardian for total estimated job losses, as at 3 September 2020. https://www.theguardian.com/world/2020/jul/31/uk-coronavirus-joblosses- the-latest-data-on-redundancies-and-furloughs

This article was featured in Pensions Aspects magazine October edition.

Last update: 19 January 2021

You may also like: