I’ve climbed out from under a pile of consultation documents and responses to review the outputs from the sixth and latest Pulse survey. Taking the Pulse of our members when it comes to the direction of UK pensions policy has become an important tool in informing PMI’s response to the morass of consultations I’ve already mentioned, and in identifying underlying trends. Following our usual pattern, we started by asking the same four questions about the direction of pensions policy and confidence in the Pensions Regulator’s (TPR’s) activities and focus.

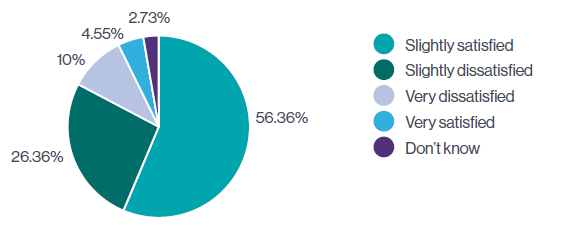

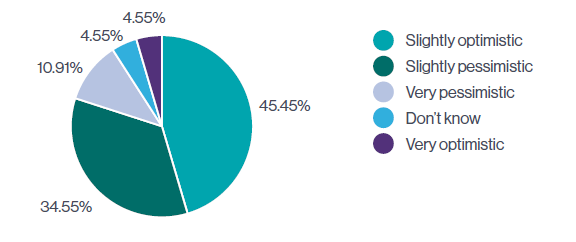

There was very little change in the results to our first two questions about satisfaction and optimism levels since our last survey. Just over half of members are satisfied with the direction of policy and feel similarly optimistic. While that means the respondents are more positive than negative, there are some areas of caution. For example, the combined Code of Practice and increased reporting requirements are a cause for concern. Members feel that latest developments will give rise to a significant increase in workloads for trustee boards and administrators. Undoubtedly, resourcing is under strain and not just for pension schemes themselves. Questions have been raised about whether the Regulator has adequate resource to produce the right guidance and whether the skills and experience are in place to focus on the new legislative requirements.

1. How satisfied have you been with the direction of pensions policy over the last six months?

2. How optimistic are you about the direction of pensions policy over the next six months?

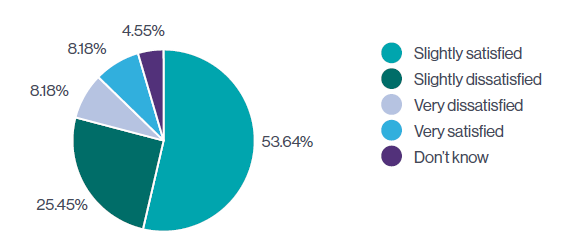

3. How satisfied have you been with the actions of the Pensions Regulator over the last six months?

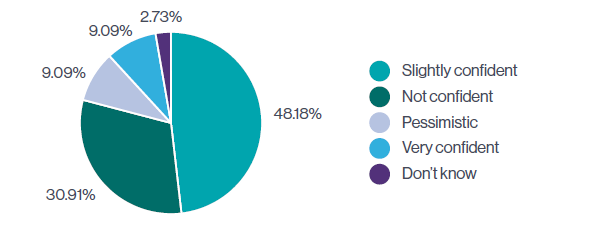

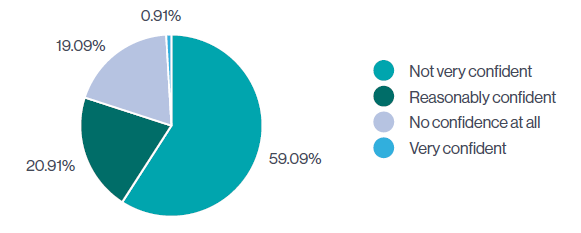

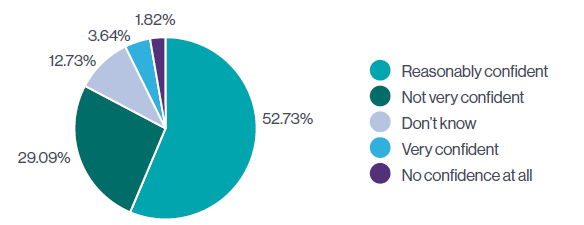

The second part of our survey covered a range of topics from the Pensions Dashboard to the new reporting requirements for the Task Force on Climate-Related Financial Disclosures (TCFD). The Dashboard programme has so far had the gestation period of two elephants, and we still appear to be no closer to the actual birth. We asked members about their confidence level on the latest timetable for delivery of the Dashboard. Over three quarters of respondents said that they were not very confident or have no confidence at all that the Dashboard would be delivered by 2023.

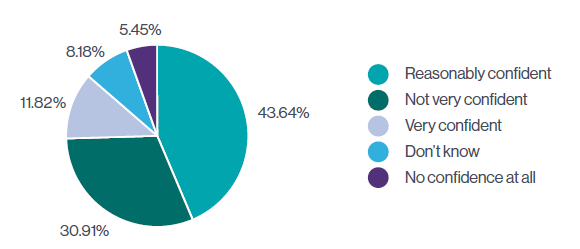

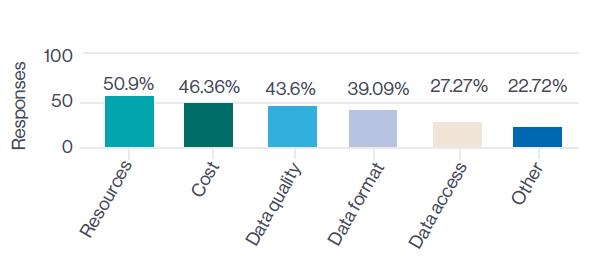

Major reservations were expressed about data formats and security. When looking at the responses, it would be fair to say that administrators are very much in the spotlight as the pensions industry recognises the ever-increasing burden falling on the same shoulders – legacy systems, incomplete and inaccurate data to fix Guaranteed Minimum Pension (GMP) equalisation and more member disclosure, whether that be in the form of extra reporting or simplified annual benefit statements. Following on, in question 8, we asked our members what the principal obstacles to delivering the Dashboard are. As you can see, resources, cost and data are understandably identified as the main areas of contention. Those mentioning other concerns listed data security and outstanding legislation to compel data sharing.

4. How confident are you that the Pensions Regulator will focus on the right areas in the next six months?

5. How confident are you that the Pensions Dashboard will be delivered by 2023?

6. How confident are you that either your own scheme, or schemes that you advise, will be able to provide data for the dashboard by 2023?

7. If you are not confident, what are the principal obstacles?

It is clear from the responses that PMI members see the vital nature of the Dashboard and its value to savers, but feel that there are significant issues still to be resolved if the latest timetable is to be achieved.

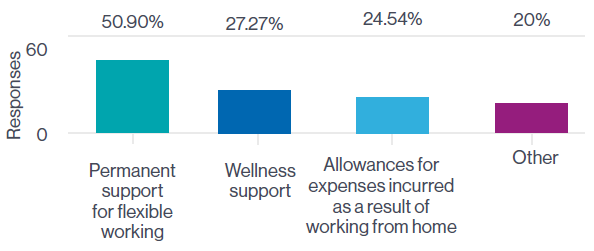

In a departure from our normal focus, being first and foremost a membership organisation, we wanted to gain some insight into the experience of our members working through the pandemic. We asked how employers could help PMI members as they come out of lockdown and return to a degree of ‘normality’. For those respondents to whom this is relevant, more than half said that permanent flexible working would be valuable, accompanied by wellness initiatives from their employers. While a return to the office will be welcome for those who do not have a living environment conducive to home working, it is clear that our members value the upside of flexible working that COVID-19 has foisted upon so many.

When it comes to TCFD reporting, just over half of the respondents were confident the asset managers would be able to provide all the necessary information. Again, some respondents highlighted those areas where managers may fall short. For example, non-UK managers running niche investment strategies and older pooled funds might struggle to supply the requisite data. Another point that the PMI raised in its own response to the TCFD reporting consultation was the need for the Financial Conduct Authority (FCA) to use equal and opposite force in mandating asset managers to provide the appropriate data. Trustees and pension schemes cannot single-handedly bear the brunt of the new reporting requirements without the help of their managers and advisers. Overall, our members would also appreciate consistency in the data templates and the form of measurement to be used. There’s now a further consultation from the Regulator on climate change guidance which is very much focused on the practicalities of reporting and I would encourage you to let the Regulator know your views.

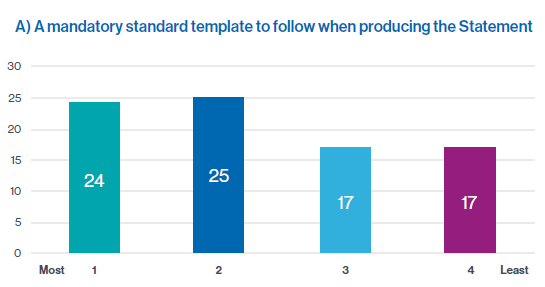

8. In what way could your employer help you as we come out of lockdown?

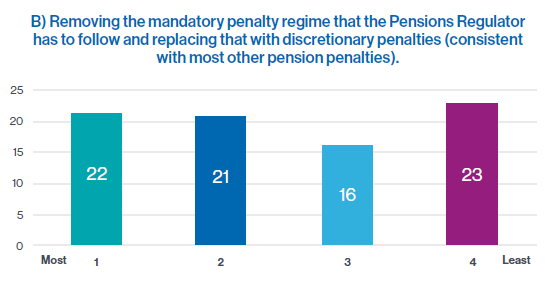

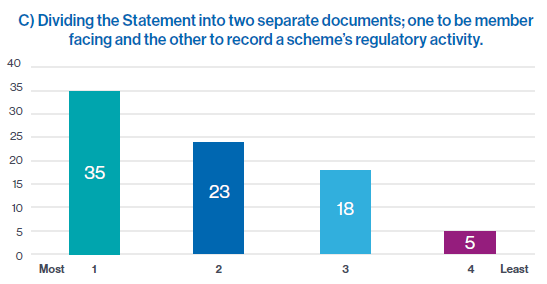

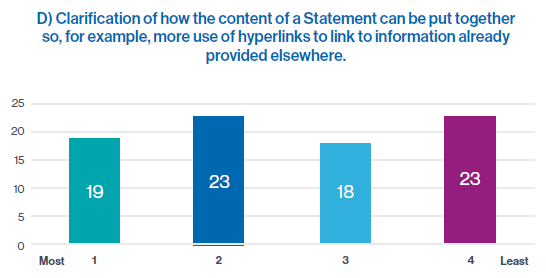

Finally, we tried to crack the good old chestnut of the Chair’s Statement for defined contribution (DC) schemes which the Department for Work and Pensions (DWP) has put up for review. I for one would like to thank the DWP for recognising that the statement simply isn’t fulfilling its intended purpose. It has become a source of both angst and anger over recent years, where otherwise well-run schemes have fallen foul of some of the more esoteric regulatory requirements and found themselves on the receiving end of financial penalties. So, what did our members think? Overall, the survey was able to glean that the majority of the respondents favoured separating the statement into two parts – one which is memberfacing and the other to record the scheme’s regulatory compliance. In addition, more than half would welcome a mandatory standard template – but that may be because they wish to avoid a potential fine! There were mixed views on whether giving the Regulator discretion on penalties would be an improvement or whether further clarification on the content of the statement would be beneficial. Perhaps it’s time back to the drawing board and think about what will best serve our scheme members rather than a regulatory box ticking exercise?

9. To what extent do you believe that asset managers will be able to provide information necessary for trustees to comply with TCFD reporting requirements?

10. The DWP’s recent Post Implementation Review on DC governance requirements focused on the Chair’s Statement for DC schemes. The review recognised that the current requirements for this are not working well and that further work is needed to address concerns raised in the review. Rank from 1 to 4 which of the ideas you think will lead to most improvement for members and governing bodies of schemes (1 being most improvement and 4 being least).

Last update: 24 May 2024

You may also like: