The Pension Schemes Bill was introduced to Parliament last year, following the Government’s 2018 White Paper on Protecting Defined Benefit Pension Schemes. As many reading this article will be aware, the Bill contains several significant changes to the pensions landscape, including a number of new criminal offences.

After a period in which the Bill’s progression has been delayed by a General Election and now the COVID-19 pandemic, the report stage of the Bill will begin in the House of Lords on 30 June; another opportunity for line-by-line examination of its provisions. A number of those provisions merit further scrutiny given their significance, but one provision in particular is the cause of much industry concern.

Section 107 of the Bill sets out two new criminal offences relating primarily to Defined Benefit (DB) schemes. To summarise them briefly, the offences will criminalise actions (or inactions) that result in the avoidance of an employer debt (i.e. a debt payable under Section 75 of the Pensions Act 1995), or that materially affect the likelihood of accrued scheme benefits being received by members.

Concern about these offences (and the second in particular) was such that in late 2019, a Joint Industry Forum of pensions industry bodies, including the PMI, wrote to the Department of Work and Pensions (DWP) including a number of examples to illustrate the potential scope of the proposed legislation. Six months on from that letter, the results of our survey reveal these industry concerns have not fallen away.

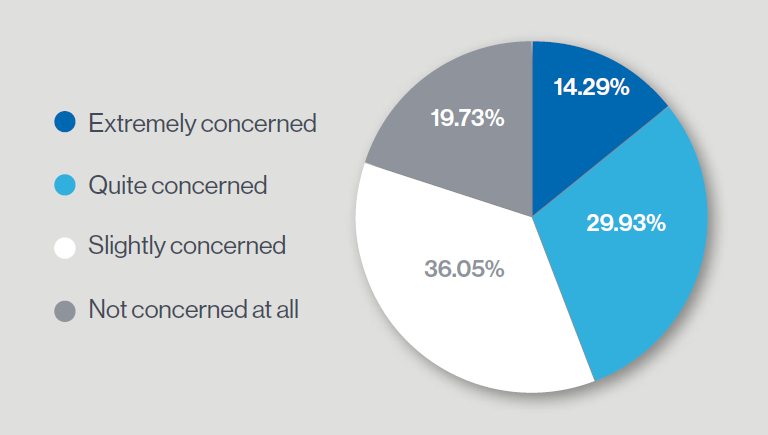

When we asked our members in a recent survey whether they were concerned about section 107, circa 80% of respondents said they were concerned. As can be seen from the chart below, almost 50% of respondents categorised themselves as at least “quite” concerned, while close to 15% described themselves as “extremely” concerned.

Clause 107 of the Pension Schemes Bill is intended to make it a criminal offence to ‘recklessly endanger’ a DB pension scheme. How concerned are you that Clause 107 of the Pension Schemes Bill will criminalise normal DB scheme management and consultancy services?

To explain the concern around these offences, we need to look a little more closely at how the offences are worded, and at the second offence in particular. For that second offence, the Bill says that a person will commit the offence if they do something that “affects in a material way the likelihood of accrued scheme benefits being received”. To be guilty of the offence, the person must have known (or ought to have known) that what they were doing would have that effect, and they must not have had a reasonable excuse.

The first point of concern is the wide number of people that could be caught by the offence. Both this offence and the first offence are expressed as applying to any person. This means they could be committed by anybody involved in activities that affect a pension scheme (company directors, scheme trustees, investment managers, professional advisers, etc.), not least because those who knowingly assist in the act are also caught by the offences. This is a significant departure from the Government’s White Paper, which suggested these offences would apply only to company directors and connected parties, and it is easy to see why this has led to industry concern.

A further concern is that the second offence could criminalise a wide variety of very ordinary activities. For example, if a sponsoring employer of a scheme pays a dividend to its shareholders, it will have knowingly reduced the likelihood of scheme benefits being received, because the employer now has fewer assets. Similarly, if a scheme’s trustees were to grant an augmentation or increase to members without requesting additional employer contributions, the trustees will have knowingly reduced the likelihood of scheme benefits being received, because this would leave fewer assets in the scheme.

While it could be argued that in these examples, depending on the size of the dividend or augmentation, there would not have been a ‘material’ effect on the likelihood of benefits being received, there is currently no guidance on what ‘material’ means in this context. If ‘material’ means anything that is not immaterial, then a very significant range of activities could be caught by the offence, as it is often difficult to say – given the highstakes nature of pensions – that acts are truly ‘immaterial’ to the likelihood of paying benefits.

This means that directors, trustees, or any of the many other people that could be caught by these provisions could face criminal prosecution for their involvement in what would otherwise be very ordinary decisions. While the Bill does provide a ‘reasonable excuse’ defence, there is currently no guidance on what might constitute a ‘reasonable excuse’ and this uncertainty is another clear point of concern. As drafted, the Bill is likely to cause hesitancy and fear in decision-making where decisions relate to pension schemes, and could, in the worst cases, result in criminal prosecution for decisions that were made in an attempt to do the right thing.

Taken together, these concerns and the results of our survey illustrate that section 107 has the potential to profoundly affect the way decisions are taken in relation to pension schemes.

We support the work being done by the Pensions Regulator and others in demanding high standards of governance and conduct relating to pension schemes. However, in the case of section 107, we echo our members’ concerns that as drafted, the offences have the potential to have wider application than intended, which could have a significant, detrimental effect on the conduct of business in and around the industry.

Notes/Sources

This article was featured in Pensions Aspects magazine July/August edition.

PMI Pulse latest results now available on the PMI’s website

Last update: 21 July 2020

You may also like: