ESG investing has matured today, forcing a shift in focus from ‘why’ ESG factors should be integrated into investment processes to ‘how’. Integrating ESG investment principles into portfolios is improving as data becomes more standardised and transparent.

Cash flow matching is a key tool to help pension schemes meet increasing income needs. A cash flow matching portfolio is designed to explicitly match a scheme’s future pension payments, primarily by holding credit assets to maturity, with coupon and principal repayments to match cash outflows. Therefore, these portfolios are concerned with delivering predictable and reliable income, hence the likelihood of the issuer defaulting on payments is crucial. Cash flow matching portfolios typically focus on higher-quality credit assets with a higher probability of delivering payments as expected. Whilst investment return isn’t the primary focus of cash flow matching strategies, the yield available on securities in the market can constrain the level of matching. An effective solution is, therefore, able to capture as much yield as possible whilst preserving capital value.

Embedding ESG in credit risk

Companies with stronger governance and better control of ESG risks are more likely to meet their debts. Credit strategies aiming to hold the bond until it matures will therefore place greater emphasis on the manager’s initial credit and ESG assessment. This is prevalent in longer-horizon portfolios where the manager could hold the bonds for over 20 years. For example, an energy company’s ability to service its long-term debt is unlikely to be affected by short-term revenue fluctuations. But a lack of a green energy transition plan could put the company’s earnings at risk over 20 years, raising its likelihood to default on its debt. Limiting exposure to high-risk ESG companies should be an important factor in trustees’ approach to investing, to match their cash flow needs.

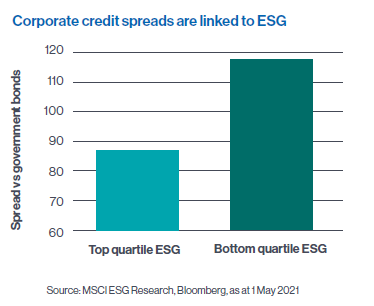

The challenge, of course, is that investors typically get paid less to hold higher ESG rated bonds. The chart below shows investment grade bonds, segmented by their ESG-ratings, with credit spreads for top-quartile bonds averaging about 25% lower than those with poorer ratings. So a cashflow matching manager should demonstrate to you how they are integrating ESG, but also their process for maximising value.

Case study: ESG assessment of cash flow matching manager

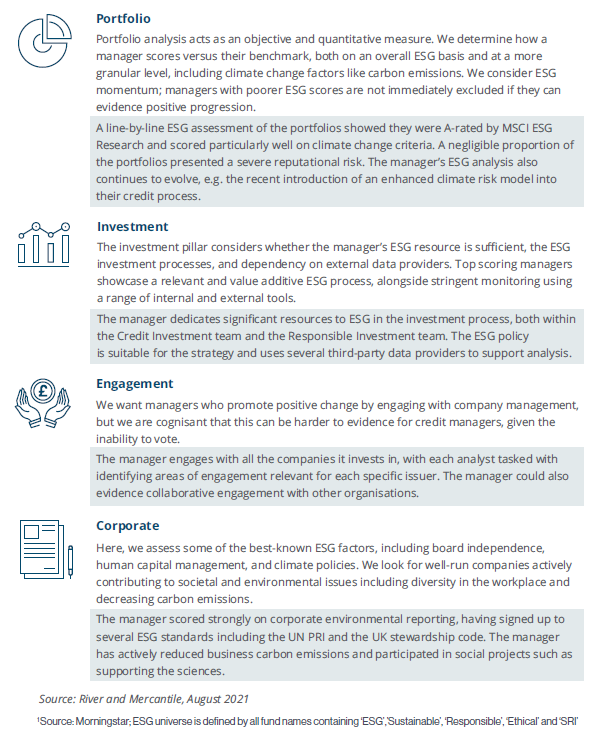

Credit funds only represent a quarter of the ESG product universe and, within that, a fraction represents cash flow matching strategies1. With the lack of off-the-shelf cash flow matching solutions, River and Mercantile seeded a new solution that could accommodate the needs of all our clients. We considered not only the managers’ performance but also the risks and processes in place to deliver sustainable returns whilst integrating ESG. This case study outlines how we applied our ESG framework when evaluating one such cash flow matching manager.

ESG assessment of cashflow matching manager

Notes/Sources

This article was featured in Pensions Aspects magazine September edition.

Last update: 15 September 2021

You may also like: