The typical trend in this market is that larger schemes used segregated LDI and smaller schemes (and even medium-sized schemes) use pooled funds. The focus of growth is expected to continue to shift towards pooled funds as more small schemes enter the market. However, pooled funds come with compromise and offer less flexibility and efficiency than segregated LDI. We believe all schemes, irrespective of size, should be able to access the best ideas and innovations without constraint.

With an average segregated LDI mandate size of £1.3bn², it is clear that this solution is favoured by larger schemes. This infers that when size isn’t an issue this is the better option. But why is that the case and what benefits does segregated LDI bring? And if segregated LDI is so great, then why is pooled LDI more prominent? The answer is simple, in that the latter is easier for managers to implement as everyone gets put into the same pooled funds irrespective of scheme specifics. We all know that every scheme is different and so a pooled approach is not necessarily in a scheme’s best interests and what’s more, segregated LDI shouldn’t cost the scheme any more. Therefore, I wanted to set out here all of the aspects of segregated LDI that pooled fund investors may be missing out on.

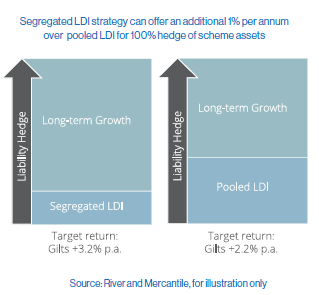

The major benefit that pooled LDI investors miss out on is the flexibility and efficiency benefits offered by a segregated approach. This efficiency can translate into material benefits for the pension scheme. Very crudely, a segregated mandate can mean more assets invested in growth assets as fewer assets are locked up in LDI. As a result, the growth assets are not reliant on heroic expected return assumptions to compensate.

The ability to use segregated LDI can allow a scheme to target up to 1% extra in return while maintaining the same hedge level. This counters the perception that schemes are forced to accept a trade-off between higher levels of return or higher levels of risk management. This a) brings forward the expected time horizon to being fully funded and b) reduces long term sponsor reliance, which are material benefits.

This flexibility to generate more return is further enhanced by utilising additional tools offered by the segregated approach. These tools include synthetic equity, currency hedging and swaptions to name but a few. Synthetic equity mandates, which allow equity-like returns with downside protection, can be efficiently implemented under the same arrangement. Having the flexibility to access these additional tools offered fantastic opportunities over the last year, allowing schemes to capture the bounce in equity markets with the knowledge they would be protected if markets fell.

Added to this are benefits around liquidity management. With pooled LDI, the investment manager operates within pre-specified operational risk levels. This means that the manager may request the scheme invests additional cash at short notice if interest rates rise significantly; indeed this happened in late March 2020 and again in February 2021. This puts a further strain on schemes’ liquidity demands and may require schemes to divest from other assets at inopportune times. As segregated LDI is bespoke to each scheme, the investment manager is not constrained by the same ‘one size fits all’ operational limits, reducing the impact of an unexpected drain on scheme liquidity.

The final point that is increasingly relevant for maturing pension schemes is accuracy and flexibility around the design of the liability hedge. Although important, it is secondary to the points above. Given the size of the risk that interest rates and inflation pose to pension schemes, using pooled LDI to crudely hedge the risk can still leave schemes exposed to more volatility than they might like. Having the ability to allow for inflation more accurately, for example, is particularly relevant given the recent Retail Prices Index (RPI) consultation. Segregated LDI can be used to implement tailored RPI hedging where the assumed gap between Consumer Price Index (CPI) and RPI has a material impact on the liabilities.

It is important to deliver a best in class solution, no matter your size, as at the end of the day, it is key to improving your members’ outcomes.

Don’t be forced to use pooled LDI just because it is easier for your provider to deliver.

Notes/Sources

- Source: XPS LDI Survey 2019

- Source: XPS LDI Survey 2018

This article was featured in Pensions Aspects magazine April 2021 edition.

Last update: 24 May 2024

You may also like: