This is consistent with the direction of regulatory travel with the expected new funding code introducing a requirement for DB pension schemes to have a long-term funding target.

How DB pension schemes approach long-term funding, and the options available in this space, is what the industry has come to refer to as the ‘pensions endgame’.

Better funded DB pension schemes and attractive insurer pricing has led to a large increase in risk transactions with the combined level of pension assets being passed to insurers through buy-ins and buyouts expected to be in excess of £40bn in 2019. However insurance buyout may not be accessible for all pension schemes as:

- The cost of buyout remains prohibitive for many

- Limits on the capacity of insurers to cope with the 5,450 UK DB pension schemes.

Consequently, providers are introducing new alternative approaches. These can provide pension schemes with access to different investment and risk management strategies as well as additional security for members through access to external third party capital.

This all sounds like good news for DB pension schemes, and it mainly is. However, as the range of options grows and becomes more complex, so does the challenge in navigating between them. Key areas for trustees and sponsors to understand when approaching long-term funding and the journey to the ‘pensions endgame’ include:

- Being aware of the full range of options available and which are likely to be attractive for a specific pension scheme

- Identifying which options are in reach in terms of:

- The level of contributions that can be paid to the pension scheme

- The desired timescale to reach the endgame

- The level of investment return required to reach the target

- The level of downside risk that the sponsor’s covenant can support » Given the variety of stakeholders associated with the operation of DB schemes and the roles of providers and advisers, care is needed that all parties are appropriately advised.

Alternative governance and adviser arrangements may better serve trustees and sponsors in addressing some of these challenges. It is important that when considering different solutions, the principles of the recent Competition and Markets Authority (CMA) review should be applied i.e. look more widely than a single solution or just that being put forward by an incumbent adviser.

In summary, consider the full universe and then plan your journey.

The DB pensions universe

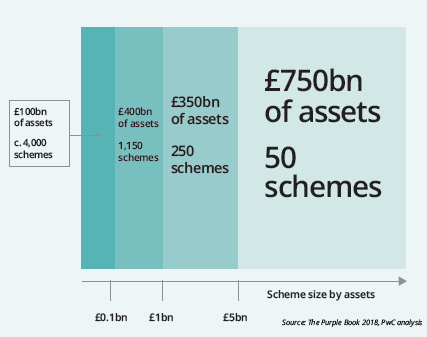

The universe of UK private sector DB pension schemes comprises of c. 5,450 schemes and c. £1.6tr of assets (based on PwC analysis and information provided in the Purple Book 2018 as published by the Pension Protection Fund).

When considering the DB pension universe it is more helpful to break down the universe by size of scheme assets (see Fig 1).

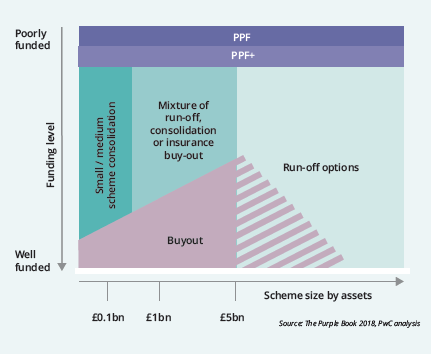

As we will come to see, the size of assets, funding level and of course the strength of the sponsoring covenant are key when it comes to assessing the ‘pensions endgame’ destinations available. We have set out below a possible breakdown of the ‘pensions endgame’ universe (see Fig 2).

FIG 1. DB PENSION UNIVERSE SPLIT BY SCHEME ASSET SIZE

The very large schemes:

Almost half of the universe’s assets are held in the very large (> £5bn) pension schemes. There aren’t that many of these in the universe, c. 50, but given their scale, bespoke solutions are available.

Many of these pension schemes may be too large for the buyout market. At the time of writing the largest risk transaction completed was for £4.7bn, although some of these very large schemes have started to consider partial buy-ins as part of their de-risking strategies.

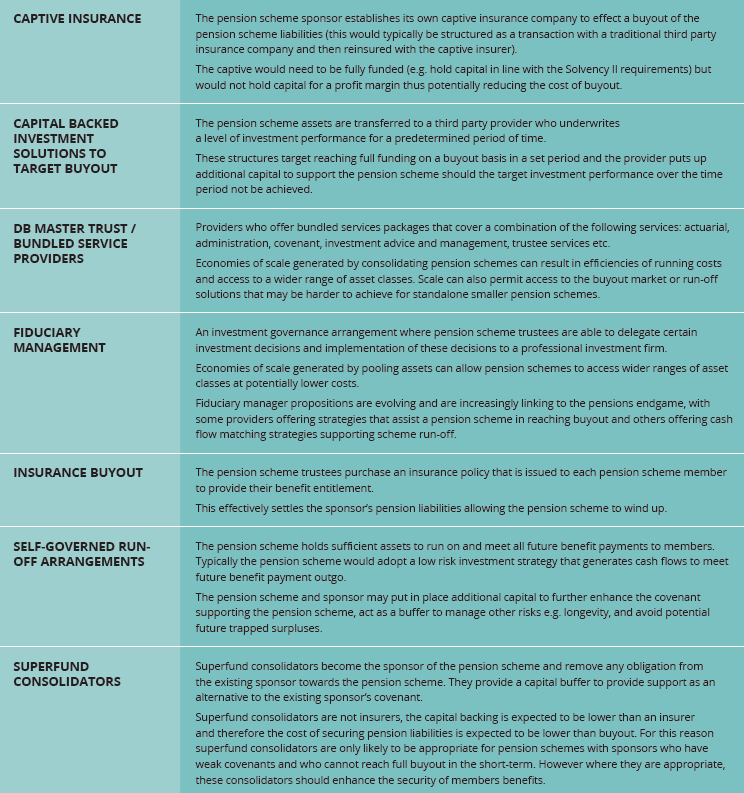

While we expect buyout transaction sizes to increase as some large schemes seek insurance, many larger schemes have the capabilities to develop ‘self-governed run-off arrangements’ (see Fig 3).

Given the size of the schemes’ assets, and that such schemes will typically benefit from a dedicated in-house pension function, or even in-house asset management function, a self governed run-off arrangement could represent a realistic and capital efficient model.

FIG 2. POSSIBLE BREAKDOWN OF ‘PENSIONS ENDGAME’ DESTINATION

These pension schemes can adopt investment strategies to future match benefit payments with cash flows and potentially hold capital buffers to protect against other risks, for example, longevity.

Run-off arrangements could potentially bring together third party capital from outside of the sponsor to enhance the supporting covenant. This is likely to sit outside of the scheme as a capital buffer to provide additional security but also allow the sponsor and/or third party capital provider to avoid trapped surpluses and benefit from a modest level of investment return.

Finally, ‘captive insurers’ (see Fig 3) could again provide a more capital efficient approach for those sponsors who are comfortable running pension scheme risk on their own balance sheet and can provide the long-term capital equivalent to that which insurers would use to back the risks.

All the above hinges on the covenant of the sponsor and willingness of management to commit part of the business to effectively support the pension scheme run-off. This might sound like a lot of effort but when the capital efficiencies compared to traditional insurance buyout are identified it may be a very compelling proposition.

The small (and very small) schemes:

What we mean by small is subjective and the challenges small schemes face increase as size reduces. With over 4,000 DB pension schemes with less than £100m of assets these are the largest group by number, but make up less than one tenth of the universe by assets.

Some specific challenges for small schemes include:

- Lack of scale makes accessing more sophisticated investment strategies challenging and expensive

- It is challenging competing for the attention of insurers, who will typically favour one larger transaction over ten smaller ones due to the cost of pricing and implementing each transaction

- A proportionately higher running costs and governance burden, compared to the size of the scheme assets.

A potentially more efficient approach for these smaller pension schemes could be some form of consolidation. Bringing together smaller pension schemes can generate economies of scale which in turn improve governance, allow access to more sophisticated investment strategies, improve cost

efficiency and bring the ‘pensions endgame’ into reach.

‘Fiduciary management’, ‘DB Master Trusts’ and ‘DB superfund consolidators’ (see Fig 3) all bring different benefits from consolidations and variants of these can effectively provide an outsourced path to insurance buyout or an outsourced pension scheme run-off arrangement.

Whether a form of consolidation is appropriate will very much depend on the specifics of an individual pension scheme, its level of funding and the strength of the sponsoring covenant.

The medium to large schemes: For those pension schemes in the middle, the range of solutions is probably the greatest.

Well funded large schemes (>£1bn) have recently been able to access insurance buyout (see Fig 3) at attractive pricing. Of the £40bn of transactions that occurred in 2019, over £25bn of transactions related to just 8 pension schemes in this category.

Consolidation solutions will be available for medium sized pension schemes and some of the larger pension schemes (>£1bn) may find run-off arrangements attractive.

Where we expect to see significant developments for the medium to large pension schemes is in relation to outsourcing the journey to the ‘pensions endgame’. A number of providers are developing ‘capital backed investment solutions’ (see Fig 3). These solutions provide bespoke investment strategies that support pension schemes on the journey to being fully funded to allow them to buyout at some future point. Providers may put up additional capital that further enhances the security of members and increases the likelihood of the pension scheme reaching the buyout destination.

PPF / PPF+ Unfortunately there will be those pension schemes where an employer is unable to meet its obligation to fund the scheme and the PPF or some form of benefit compromise (e.g. PPF+) will be the final outcome.

Some of the approaches mentioned above can be considered for pension schemes faced with PPF assessment and DB superfund consolidators and capital backed investment solutions could potentially provide an opportunity for better outcomes for members in terms of PPF+, plus a bit more. The PPF has c. £32bn of assets under management and while it has a hugely important role to play, to date its share of the ‘pensions endgame’ universe is thankfully small.

FIG 3. PENSIONS ENDGAME GLOSSARY The glossary below sets out some example structures that we see used to deliver the ‘pensions endgame’. It should be noted that innovations continue to enter the market and there is flexibility / the possibility to negotiate alternatives features to those set out below.

Last update: 4 July 2024

You may also like: