One outcome of pension schemes’ changing circumstances is that a new approach to considering the funding challenge may be more appropriate for some schemes – moving on from simply considering the funding level, to considering their specific future obligations to identify a clear cashflow-focused target outcome.

Ultimately, identifying such a target and investing in light of it could help pension schemes maximise the certainty of pension schemes achieving their target goals.

CHALLENGES FACING PENSION SCHEMES TODAY

Pension schemes are maturing: only 13% of schemes are open to new members, with a further 43% closed to new members but not to future accrual.1 As schemes approach their endgame, the time they have to achieve their objectives is shortening.

Increasing cashflow negativity: many schemes are paying out more than they receive from investments or contributions, forcing them to balance short-term cashflow obligations with long-term growth objectives.

Regulatory focus on de-risking: The Pensions Regulator (TPR) has proposed that by the time they are significantly mature, schemes must have low dependency on the sponsor and be invested with high resilience to risk.

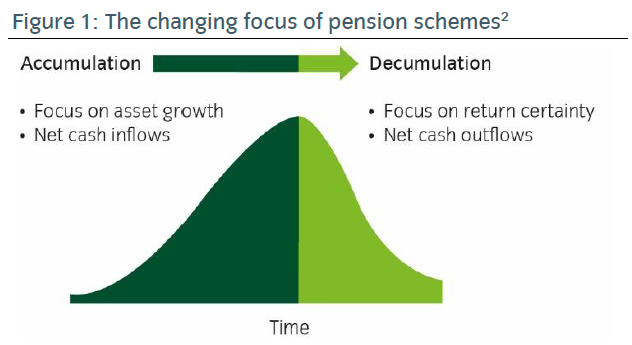

These challenges are leading pension schemes to consider their investment objective in a new way – rather than accumulation, they are considering decumulation (see Figure 1). This naturally leads to a focus on maximising the certainty of achieving their targeted cashflow outcome.

The movement from accumulation to decumulation has clear implications for a pension scheme’s investment strategy.

Shorter timeframe

A pension scheme’s funding level is a useful summary of its financial health but does not paint the whole picture. As schemes mature, they have less time to close out any funding shortfalls, increasing the required returns from their shrinking asset pool.

Maturing schemes also have less time to make up for any adverse asset returns so need to balance higher expected returns with greater investment certainty.

Forced selling

As schemes become cashflow negative, they may be forced to sell assets in order to meet liability payments. This can incur significant costs, especially if they sell at an inopportune time, such as immediately after a sharp market correction.

In addition, this would leave fewer assets to benefit from any rebound in values, leading to a lower value of assets than if the cycle of negative and positive returns was reversed. Therefore, investors need to be more aware of the path of future returns, not just overall returns.

A NEW WAY TO VIEW THE FUNDING CHALLENGE

Along with new challenges, the evolution of UK defined benefit pension schemes’ circumstances suggests a new approach to the funding challenge.

Two decades ago, pension schemes moved away from focusing only on asset growth to also consider liabilities. In other words, pension schemes recognised that funding levels are an outcome of the ratio of assets to liabilities, meaning that managing liability volatility is crucial to funding level stability.

The emergence of liability-driven investment (LDI) strategies led to better risk management and created a suitable funding level risk-management framework in an environment where many schemes remained open to new members.

However, now that schemes are maturing, facing cashflow negativity, and being encouraged to de-risk, a new way to view the funding challenge – rather than focusing solely on the funding level – may be more appropriate.

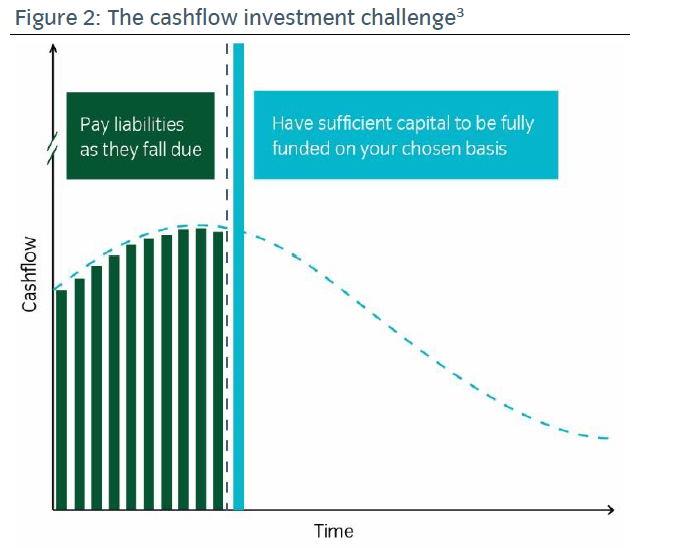

Most defined benefit pension schemes today now have defined a target outcome, be it buy-out or self-sufficiency, within a certain timeframe. This results in a clearly definable cashflow funding challenge for pension schemes, which has two features (see Figure 2):

1. Pay the liabilities as they fall due on the journey towards the target time horizon.

2. Have enough capital to achieve their objective (self sufficiency or buy-out) by a target time horizon.

This specification of the problem gives a clear and calculable ‘cashflow’, or ’pounds and pence’, view of the funding challenge. Adopting this forward-looking view of the funding challenge can provide a more relevant view of the sources of investment and funding risk.

A NEW APPROACH TO PENSION SCHEME INVESTMENT STRATEGY

Traditionally, pension schemes have focused on asset allocation: based on risk and return assumptions for different asset classes, they have built portfolios most likely to achieve their return objectives, alongside an allocation to liability-hedging assets as part of an LDI strategy.

However, it may be more appropriate to think about asset ‘roles’ rather than asset classes. With the investment challenge clearly defined, for schemes targeting a high degree of certainty of success, there are three unavoidable roles that assets will need to play:

- Lock down the outcome: protect against the risk that the ‘gap’ between the value of their assets to their targeted cashflow outcome could widen.

This will likely mean hedging liability risks e.g. interest rates, inflation and longevity. But rather than hedging them relative to measures such as technical provisions, it may be more appropriate for pension schemes to hedge these risks relative to the funding basis of their ultimate goal.

- Pay liabilities as they fall due: pension schemes will need to fulfil their cashflow obligations over the target time-horizon while progressing towards their ultimate goal. This will require trustees to consider how to meet their cashflow requirements, while minimising the risk of being forced to sell assets at an inopportune time.

Constructing a portfolio of assets that generate contractually defined cashflows that reflect a pension scheme’s required cashflows – either through income or maturing assets – can help pension schemes strike this balance. High quality contractual assets, such as investment grade bonds, can help schemes generate a more certain return stream, avoid forced-selling risk, and reduce dependency on the path of investment returns.

Flexibility to deal with unexpected cashflows is also necessary. One approach would be to use cashflows generated by scheme investments to top up a collateral pool, which is then used to fulfil both expected and unexpected cashflow obligations.

- Grow: to the extent that pension schemes are currently underfunded relative to their long-term objective, they will need to grow the assets through a combination of contributions and investment returns. Where investment returns are required, schemes will be encouraged to generate these returns with the greatest certainty possible.

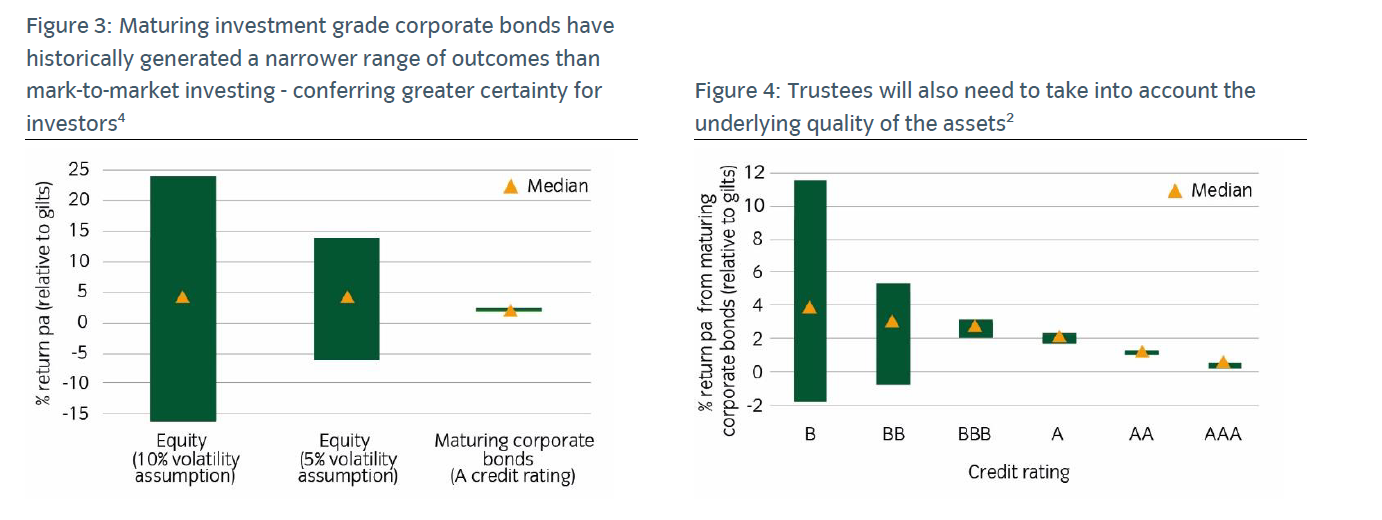

In order to reduce funding level volatility, many schemes have already made a significant shift away from traditional growth-type assets in favour of bonds, which have historically generated much fewer variable returns (see Figure 3).

It is also appropriate for trustees to consider the underlying quality of their assets when managing the investment risk. Better quality assets have generated much more certain returns historically (see Figure 4).

Some assets can play multiple roles in a portfolio. Also, optimising one asset role in isolation can have a detrimental impact on the ability to achieve one or more goals, leading to a suboptimal end outcome. Therefore, it is important to highlight the need to consider all these roles in an integrated manner to maximise the certainty of achieving the desired end outcome.

TRANSPARENT MONITORING AND BUILDING RESILIENCE

Once a clear cashflow target has been set, it is important to monitor progress by considering future cashflow requirements and measuring the projected outcome relative to that targeted outcome.

To the extent that schemes are able to meet their target using high quality maturing assets, it would no longer need to ‘hope’ that future return expectations materialise, as projections could be largely based on what has been contractually secured in the actual portfolio. This can incorporate prudent assumptions for risks, including forced-selling risk and default risk, to measure a scheme’s progress and inform strategic decisions over time.

In addition, schemes also need to build resilience into the strategy to offset the impact of developments such as changes in market conditions or unexpected cashflow obligations. Schemes will need to identify all potential risks and either demonstrate that they can be tolerated (under a prudently assumed level) or put in place processes to take corrective action if they were to occur.

Ultimately, the benefit of an approach that builds in such ongoing management can change the mindset from hoping a negative event does not occur, to reassurance that even if such an event does occur, there is a mechanism in place to mitigate its impact – and potentially turn it into a positive opportunity for the scheme.

CONCLUSION

Pension schemes are facing different challenges today, and so a different approach is appropriate. Compared to more traditional approaches, it appears that an integrated strategy that aims to hedge liability risks, manage liquidity requirements, and generate growth from contractual assets so that competing priorities can be balanced more efficiently, will be able to help pension schemes maximise the certainty of achieving their endgame.

HOW DOES THIS RELATE TO THE REGULATOR’S NEW PROPOSED FUNDING CODE FOR DB SCHEMES?

TPR issues a code of practice to help trustees and employers comply with regulations on DB pension scheme funding. In 2020, TPR conducted the first of two consultations on a revised code, which set out the proposed regulatory approach.

From an investment perspective, the consultation proposed a greater focus on the long-term objective (LTO), greater requirements for a scheme’s investments, and a greater focus on demonstrating compliance and objective risk-taking.

These would have several implications for pension schemes’ investment strategies.

- Greater focus on the LTO: the requirement to set an LTO results in a clearly defined investment challenge – schemes must pay liabilities over time and have sufficient capital to achieve their LTO by a target time horizon.

- Greater requirements for scheme investments: a scheme’s investment strategy and asset allocation should be broadly aligned with the scheme’s funding strategy; exhibit sufficient security and quality; and satisfy liquidity requirements based on expected cashflows, with a ‘reasonable allowance’ for unexpected cashflows.

- Greater focus on demonstrating compliance and objective risk-taking: trustees will need to demonstrate, both at the outset and through regular monitoring, that their funding and investment strategies are appropriate for achieving the LTO.

These implications are directly addressed by the integrated approach we have outlined. While the revised code may not incorporate all the proposals, it appears that the regulator has identified the issues facing defined benefit pension schemes – suggesting a new investment approach may be appropriate.

Notes/Sources

1 Source: The DB landscape: Defined benefit pensions 2019, The Pensions Regulator, January 2020.

2 For illustrative purposes only.

3 For illustrative purposes only.

4 Source: Insight Investment. These charts illustrate the annualised range of outcomes over rolling 10-year horizons from 1970 to 2007, excluding extremes (top 2.5% and bottom 2.5%). Maturing corporate bonds show the prevailing credit spreads (source: UBS GBP AAA, AA, A, BBB, BB and B credit curves over the UK nominal gilt curve at the 10 year point as at 31 March 2020), less a default loss adjustment based on the relevant credit rating. The range of default loss adjustments are based on historic data (source: Moody’s issuer studies covering actual occurrence of default over 10 year horizons from 1970 to 2007) where a number of issuers are tracked over a 10-year time period from multiple historical periods to obtain a probability of defaulting for each issuer rating (loss given default is assumed to be 100%; i.e. no recovery in the event of a default). Growth assets have been modelled using a normal distribution with an expected return of gilts+4% and the relevant volatility assumption.

Last update: 1 August 2024