We all recognise the importance of saving into a pension scheme from an early age. We also need to apply the same thinking on risks to pension scheme investments from climate change. This is because the companies and bond issuers that pension schemes invest in, either through pooled funds or segregated mandates, must start allocating capital to address climate and transition risks at the earliest available opportunity. The later they leave it, the more challenging it will become, creating a significant risk to members’ pension pots.

Since October 2021, pension schemes over £5 billion and all master trusts must report on climate risks in line with Task Force on Climate Related Financial Disclosures (TCFD) recommendations. These rules will apply to pension schemes over £1bn in size from October 2022. However, the regulations should not be viewed as a box-ticking exercise. Climate risks have no boundaries and impact pension schemes of all sizes. Climate change is a financial risk that all schemes should be actively managing.

What actions should trustees take?

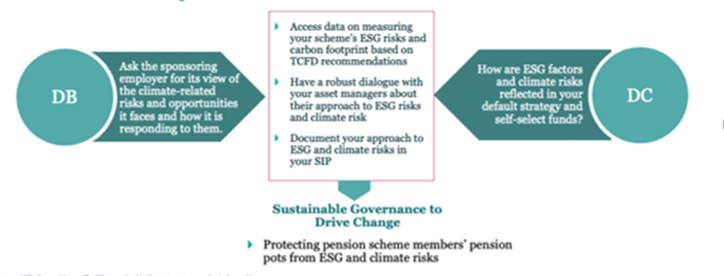

Defined Benefit and Defined Contribution schemes can be impacted by climate risks in different ways. Gaining access to good data and setting a strong governance framework lies at the heart of managing these risks.

Trustees should start by working with their asset managers and other service providers to tap into their knowledge about climate change and the risks it poses. The next step is getting access to aggregated good quality data that’s independent from those asset managers, to assess how companies and bond issuers that make up a pension scheme’s investment portfolio are impacted by climate change risks. The third key step is to set a governance framework for the scheme to monitor and manage environment, social and governance (ESG) and climate change risks – while continuing to hold asset managers to account through regular dialogue and engagement.

Key myths answered

Myth 1: My pension scheme is too small.

Climate risks impact pension schemes of all shapes and sizes. Acknowledging the scale of climate impacts, and the risks they pose to pension scheme investments, is a vital part of the process. ESG and Climate factors must be viewed as traditional risks, much in the same way investment risk is. This means ESG and Climate data should be collected across all pension scheme investments and not limited to strategies that have a specific climate or environmental objective. Climate change may have significant impact on certain companies or bond issuers and their supply chains, and some companies may find it challenging to transition to lower sources of emissions.

Myth 2: There is no consistency of data so it makes sense to wait

Pension schemes and trustees may have heard about the current challenges in obtaining consistent data, partly driven by the different methodologies used across vendors in their analysis of ESG and Climate risks across companies and bond issuers. However, this should not be a barrier to making a start on collecting and reporting on ESG and Climate risks. A good starting point is developing a data strategy, which encompasses the sources and frequency of decision-useful data, along with processes on how this data will be interpreted. In setting a strategy around climate risks, some pension schemes have already leveraged the Task Force on Climate-Related Financial Disclosures framework, which has been a good foundation for setting a their data strategy.

Myth 3: As a UK-based pension scheme, climate change will have little impact

Pension schemes invest globally – so when looking at climate risk we must think globally. Climate risks for companies in developed markets are underestimated. More frequent extreme weather events means an increasing probability of supply chain disruption. Company supply chains are often complex, and tied to developing markets, meaning climate impacts pose a risk for many companies regardless of where they’re headquartered.

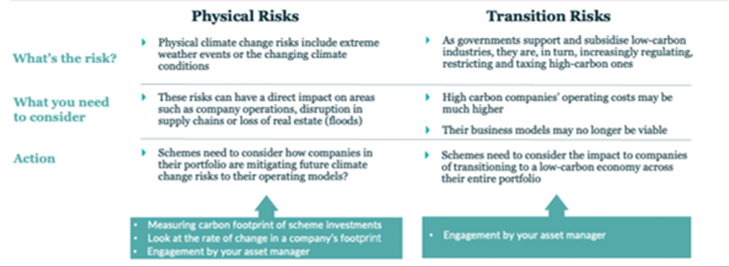

Myth 4: I can only see limited impacts on companies with extreme weather events

Climate risk to companies and bond issuers is much broader than the physical risks of extreme weather events. Governments around the world are setting targets to achieve ‘net zero’ emissions by 2050. This is when greenhouse gases going into the atmosphere are balanced by removal out of the atmosphere. Regulation is being used to achieve these challenging targets, which will drive companies and bond issuers to look at how they reduce their carbon emissions. This is referred to as transition risk – not all companies will be successful in reducing their carbon footprint, which will make it difficult for them to find sources of capital, creating a longer term impact on their value.

The solution: How can trustees take decisive action?

We have a strong belief that ‘you cannot effectively manage that which you cannot accurately measure’. Although standards and definitions around ESG and climate data are not yet a perfect science, they are key to effective stewardship and governance. This means that when setting their governance framework around ESG and climate risks, trustees need to think big but start small.

Forming a viewpoint of those risks that’s independent from the scheme’s asset managers is a crucial first step. An independent perspective is important, especially when assessing whether a scheme’s asset managers are working in line with the trustees’ stated ESG and climate change policies.

For trustees, this means acquiring data that enables them to at least start understanding the ESG and climate risks within their scheme’s investments.

A good starting point for trustees is to engage with service providers, such as custodians or consultants, to see whether ‘out of the box’ reporting solutions are available that integrate information on ESG and carbon emissions data from leading providers such as Sustainalytics or MSCI.

Measuring ESG breaches

Reports that highlight ESG risks and breaches, for example, will allow trustees to begin identifying, managing, and monitoring those risks. Trustees can set an engagement framework with their asset managers for companies or bond issuers that have the highest breaches across environmental, social or governance factors. Trustees should consider ESG reporting solutions that measure risks against established sustainability initiatives, such as United Nations (UN) Global Compact or UN Sustainable Development Goals, which adds another layer of credibility to reporting and governance.

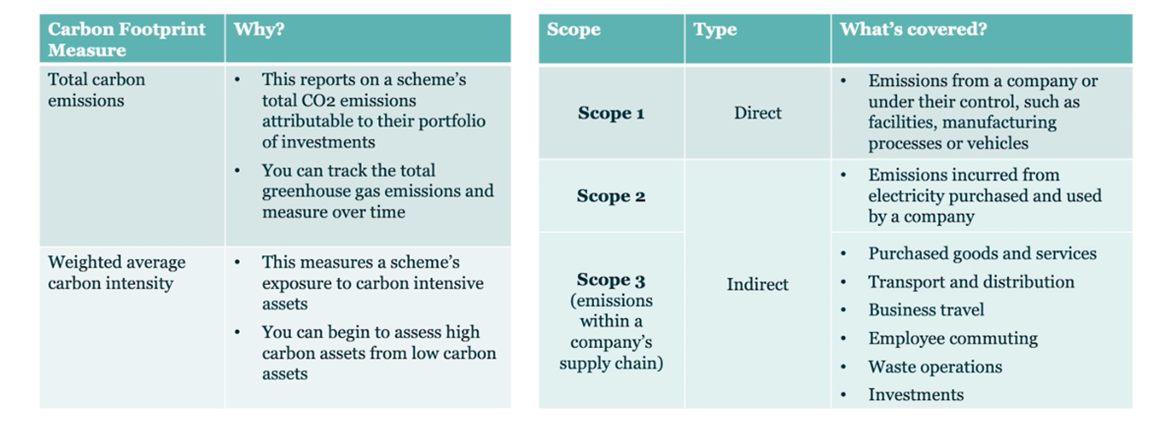

Measuring carbon emissions

Turning to climate risks, trustees need to acquire data that measures the carbon emissions generated by the companies and bond issuers held by their pension scheme through pooled funds or segregated mandates. The table below outlines the carbon emissions metrics that can be collected to measure climate risk exposure.

With all forms of data collection, the devil is in the detail. What’s important when collecting this information is the ability to ‘drill down’ and look at carbon emissions by security, industry, and geography across a pension scheme’s portfolio. Trustees can then form an engagement plan with their asset managers based around areas of their scheme’s portfolio that have the highest exposure to carbon emissions – in other words, climate risks. This information can also help inform voting policy, which plays a key role in stewardship.

Carbon emission information also helps trustees build a baseline of their scheme’s carbon emissions footprint, so they can begin setting effective targets that work towards net zero. It can also identify whether certain companies or bond issuers are making headway in reducing their own carbon emissions, enriching insight for further dialogue with asset managers in how they are engaging with these entities on their carbon emissions trajectories.

Call to action: Pathways to good governance

Engagement, engagement, engagement. Collecting independent data to assess ESG and climate risks can help create a stronger framework for stewardship and engagement. Trustees benefit from having greater insight, resulting in a stronger dialogue with their asset managers on how they are managing these risks. The data will also let trustees prioritise engagement with those companies or sectors with troubling ESG or carbon emissions scores. It also means they can hold their asset managers to account on how they are engaging with companies or bond issuers around these risks.

This information can also help with the key question of our time: should pension schemes disinvest or divest from higher carbon emitting companies, such as those in the oil and gas or airline sectors, or should they actively engage through their asset manager? Access to data will give trustees the confidence to independently review whether the carbon footprint trajectories of these companies is in line with published commitments, bringing more data-led insight into decision making.

Developing a consistent and consolidated viewpoint of how different asset managers are integrating ESG and Climate Risks into their investment decision making will help trustees with their governance framework. We’ve outlined a checklist of questions trustees can ask their asset managers to strengthen knowledge and understanding.

|

Question |

Why it is important |

|

How are you holding companies and bond issuers accountable for their climate commitments? |

This helps determine how frequently an asset manager is engaging on the topic of climate risk with the companies or bond issuers they invest in. |

|

How closely aligned are your voting practices with your approach to sustainability and managing climate risks? |

Voting is an important tool for asset managers to hold companies accountable for their commitments to climate change. |

|

Are you using climate scenario analysis to capture how the funds your scheme invests in will be impacted should certain climate risks materialise? |

Climate scenario and ‘pathway’ analysis should be an important part of risk management, and investment decision making. |

|

What data sources are you using to assess sustainability and climate risks – and what’s your decision-making process when data sources conflict with your own research? |

It’s important to understand how sustainability and climate considerations are embedded into an investment process and how decisions are made. |

|

Can you provide reporting within the scope of the TCFD? |

With more pension schemes now reporting on climate risks in line with the TCFD framework, this will highlight whether you need to address reporting gaps for your pension scheme. |

Next steps

We’ve outlined five goals to help trustees in setting a framework for their ESG and climate risk governance to help protect members’ pension pots:

- Develop a data strategy, which includes the data you want to capture and the frequency

- Start collecting your own ESG and carbon footprint data

- Set expectations with your asset managers in how they are engaging with companies and bond issuers on ESG and climate risks

- Monitor and analyse decisions on ESG and climate risks with your asset manager

- Keep your members up to date on how you are addressing ESG and climate risks within their scheme

Partnering with trusted sources, and creating open lines of contact with specialists, service providers and data sources, can help pension schemes and trustees unlock high quality insights and make effective data-driven decisions on ESG and climate risks.

Last update: 8 July 2022

You may also like: