At a Society of Pension Professionals (SPP) event late last year, attendees were asked about the ultimate objective for the pension schemes they represent. Nearly two thirds of respondents suggested full buy-out with an insurance company was the main objective, demonstrating the likely significant and growing demand from UK pension schemes over the next decade for insurance buy-outs.

Interestingly, over half of respondents indicated that less than 10% of insurance transactions they were involved with were delayed or cancelled due to COVID-19 and two thirds of respondents said that COVID-19 had no impact on their appetite to de-risk. This suggests that well prepared pension schemes were still able to transact despite the COVID-19 disruption and that long-term drivers such as scheme maturity and reduced appetite for pensions risk are more important than short-term drivers such as market shocks.

So, if most pension schemes are targeting buy-out, what does this mean for pension scheme funding and how will this be affected by the Pensions Regulator’s (TPR’s) Defined Benefit (DB) funding code?

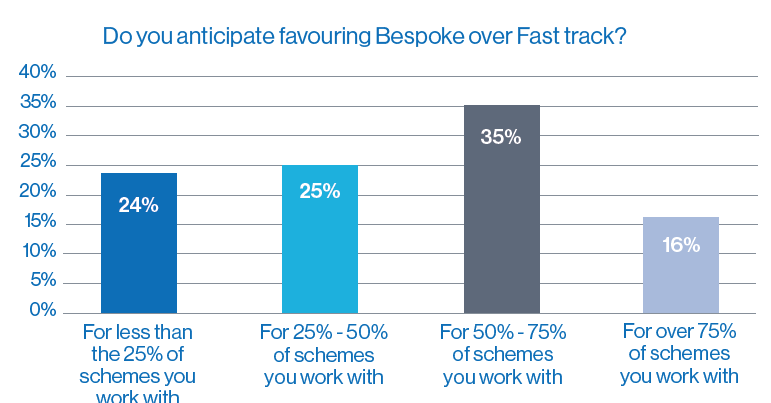

You may recall that TPR is proposing a twin track approach to demonstrating funding compliance: Fast Track and Bespoke. Under the Fast Track proposal, TPR would prescribe a minimum acceptable approach for the valuation assumptions, the timing to reach low dependency, the term of the recovery plan and the level of investment risk being taken.

For schemes that are unwilling or unable to meet the Fast Track option, there will be the Bespoke. Under the Bespoke route trustees will have more flexibility in their approach to funding. In adopting the Bespoke route trustees will be expected to provide additional evidence to explain the appropriateness of the approach and the steps they are taking to manage risk.

In a world where most schemes are targeting buy-out, you might expect that the majority of schemes would expect to meet the requirements of Fast Track, which are expected to be less onerous than buy-out. Instead, when we asked our members how many of the schemes they advise will look to go down the Bespoke rather than Fast Track route we got the results in the chart below. These suggest that only around half of schemes expect to adopt the Fast Track route, not reaching the ‘significant proportion’ anticipated by TPR.

So why might this be the case? This may result from the fact that current industry behaviour is some way away from the Fast

Track proposal. For example, while schemes may currently have an aspiration to achieve full buy-out, anecdotally less than a quarter of schemes have a formal long-term objective of any kind.

If half of all schemes went down a bespoke route, it would seem to challenge the central premise of the new Code (that it allows TPR to target its resource on a small subset of schemes). There is considerable uncertainty in the calibration of the Fast Track assumptions and, in its interim consultation response, TPR recognised industry concerns in this area. This shows TPR has a very fine balance to strike between setting Fast Track assumptions at a sufficiently prudent level (requiring only limited regulatory scrutiny) and setting them such that the significant majority of schemes elect to go down the Fast Track route. Only time will tell whether this balance is struck.

Key to delivering a pension scheme’s objective and managing risk along the way are the schemes investments. Increasingly, climate change and ESG factors are seen as key risk issues. So how are schemes dealing with these ESG factors?

Our members’ experiences suggest that the pension industry appears to be reacting to regulatory and government pressure rather than driving the ESG agenda. Schemes are required to have a policy around ESG. 63% of respondents said that although there is genuine interest in ESG no changes to portfolios have yet been made, with only 7% reporting that their clients were making material changes to their portfolio because of ESG. 25% were treating ESG as a tick box exercise.

That said, anecdotal evidence from some of our members is that changes are certainly taking place – some schemes are changing investment strategies and others are changing the governance processes around such decisions e.g. introduction of an ESG committee.

The financial benefit of ESG has been borne out in the initial phases of the COVID-19 pandemic, with studies showing that many ESG funds have outperformed their non-ESG counterparts. One in five respondents said that the pandemic had changed their clients’ approach to ESG, with 5% saying it caused a step change and 15% saying the pandemic provided impetus to changes that were underway.

Practically, monitoring scheme’s ESG exposures will be a key challenge for trustees. Respondents indicated their clients would be adopting a variety of approaches: 28% reported their clients intend to rely on manager presentations; 40% said their clients would be looking for a scheme-specific report on a regular basis with a focus on voting and engagement (with 10% looking for specific climate risk or carbon exposure monitoring); and the final 32% were undecided or did not know the approach their clients were taking.

Notes/Sources

This article was featured in Pensions Aspects magazine April 2021 edition.

Last update: 12 April 2021

You may also like: