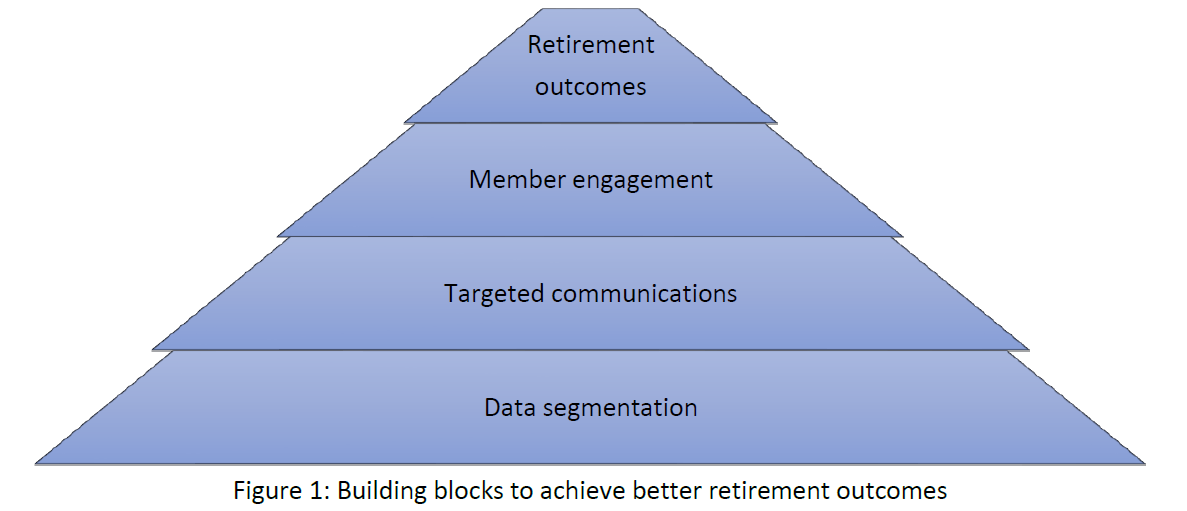

The purpose of improving member engagement, particularly in a DC scheme, is to optimise the retirement outcomes for members. Pension schemes can achieve this ambition by collating and using the data they have in insightful ways.

Pension schemes hold large amounts of personal data. The main purpose of holding this data is to administer the pensions of the members and to pay the correct benefits at the right time. Yet, member data not only supports the accuracy of a scheme’s administration services and its core financial transactions, it can also be used to improve member engagement, which can lead to better member outcomes at retirement. By taking the data a scheme holds about its membership, grouping similar data together based on chosen factors and isolating those characteristics into member communications targeted to a defined audience, a scheme can deliver more personalised messaging. This can improve member engagement, leading to better decisions by members, which can have a huge impact on retirement outcomes. The data segmentation methodology becomes even more relevant in an ever more digital age, where members expect a personalised experience like they would already receive from other financial products and services.

Before looking at how data could be used to segment a pension scheme’s membership and target member communications to improve engagement, it is important to understand why pension schemes want to improve member engagement in the first place. Evidence suggests that not all members will engage with pension scheme member communications. In fact, research shows that 24% of employees who have a pension, never actually review it1. Despite the huge impact it can have on standard of living after retirement, a lot of members think that a pension is not relevant or is perceived to be too complex to engage with until an end of career event. How wrong can some people be? With the introduction of auto-enrolment and the advent of the pension freedom and choice reforms, more and more members need to understand the value of their benefits to make informed decisions concerning their retirement arrangements. It is up to a pension scheme to drive that member engagement as it is the mechanism that can deliver better retirement outcomes for members.

For members with DC benefits, engagement is massively important. DC members carry the risk related to their benefits and they must make decisions that can significantly impact on their standard of living in retirement.2 This requirement is evidenced in the Communicating and Reporting section of the DC Code. The Pensions Regulator asks trustees to make sure that they understand their pension scheme members’ views and needs and that they communicate with them at the right time and in the right way to help them make good decisions.

Pension schemes want members to register on their provider’s online platform or explore the information on the pension scheme website. They want members to engage with the information they are provided with so that they can understand their entitlement and make choices that are based on facts, reducing the risk of individuals later feeling they made a bad decision.

Accurate and detailed data can reveal a lot about a scheme’s membership and in turn, open ways for schemes to engage with members more efficiently. In most cases, the data is already there, but pensions schemes must learn how to unlock the value of it. The membership of a pension scheme is not homogeneous. However, its membership can be split into heterogeneous groups that share certain beliefs and emotions, behaviours, and demographics.

Data segmentation is a method of data analysis, which divides the membership of a scheme into different audience types to deliver key messages that connect with a specific group. At its most basic level, this could mean dividing the data by member category. A scheme can then deliver a different message to an employed active member than it would to a pensioner member who is drawing retirement benefits from the pension scheme. A scheme could dig down deeper into the data and segment the members based on age or how far they are from retirement. Different messages are then delivered to someone just starting a career, compared to someone who is approaching retirement. Data segmentation can also allow schemes to target members even more specifically. A pension scheme could use the contributions data to target communications to members who are making contributions at the minimum level or to enable HR to deliver specific messages about pension benefits to women going on maternity leave.

Information in administration reports about the scheme’s membership may also provide insight. Schemes can go even further, using other methods of data collection to understand the members, by monitoring social media platforms and internet forums or tracking the use of digital services, through website visits and the number and type of emails or links opened by members, known as the clickthrough rate or CTR.3

The DC Code sets out several areas where understanding members is key, particularly in gauging member views to inform the design of investment strategies and the assessment of value for members. In a world of personalised advertising and digital marketing, a pension scheme member is 3 not going to be interested in engaging with information about a pension scheme that does not speak to him or her directly. This is the reason why data collection and analysis are so important. A scheme must understand its membership by analysing the data that it has collected. Then, a scheme must use that member information to tailor communication design because it is personalisation that is the key to getting members more engaged.

Some pension schemes are starting to think like marketers. Treating members like customers, they are using data to support the member experience programs and focussing on the interactions between the scheme and a member over the duration of their relationship. Schemes are recognising that the pension journey for members can span a significant portion of their lifetime and vary between generations, as life events such as changing jobs and reducing hours before retirement impact on pension benefits and options.

A scheme can use its data to offer different paths for members to engage with over their pension journey, in consideration of the knowledge, range of personal circumstances and channel preferences across the membership. Data could be used to intervene at key life events where decisions are required by members. Before entering the lifestyling phase, a member may wish to rethink his or her retirement age. At the point that a member gets married, a member may want to increase contributions. There could even be some form of intervention in response to unusual behaviour like someone investing entirEngagement can come in many different forms, but it is the outcome from that engagement that drives valued-added change. Schemes should be looking to use data to offer tailored opportunities for members to get involved in the development of the services they receive, for example, through roadshows and consultation meetings. Through regular data collection and analysis, feedback and monitoring, schemes can understand better the member experience and how the information and tools they provide are perceived and used by the members. This approach can drive the proactive delivery of service improvements and communication programmes that support members through significant events over the pension journey.ely in cash. By targeting member communications based on that understanding, members receive and digest information in a way that is relevant and meaningful to them.

In an increasingly data-driven and digital world, financial technology, or FinTech, is rapidly changing the management and delivery of pensions. Pension schemes are investigating how technology can help them achieve more intimacy with members, using financial data and analytics to understand saving and spending habits. New analytical techniques could allow for more efficient and more personalised financial retirement solutions and associated communications that are better tailored to an individual’s specific circumstances. The Pension Dashboard is just one example of this evolution, but many innovative technologies are emerging for pension scheme communication and engagement strategies. One such example is the machine learning robo-advice platform, Kandoor, which can answer financial planning questions about pensions through a chatbot.

Reliance on technology can also create new risks. There are growing concerns over data protection and data security as well as consumer protection issues relating to the suitability of the FinTech services and products offered. Less educated and less well-paid members might be excluded from technological progress because they cannot or will not engage with new methods of communication. Digital disclosure also poses certain risks in terms of disclosure standards as providers could face 4 liability risks if there is a discrepancy between the framing of the printed information and the electronic information.4

In the words of the leading management thinker in the field of quality, W. Edwards Deming, “without data, you’re just another person with an opinion.” Data is changing the world and pension scheme data is no exception. Data underpins everything for a pension scheme and in today’s modern technological world, it is the king of the proverbial digital jungle. For pension schemes to improve engagement with members and deliver better retirement outcomes, they must recognise this paradigm and evolve.

Notes/Sources

1 Close Brothers, ‘Financial Wellbeing Index 2019’, Close Brothers Asset Management, UK, 2019, p.6, (accessed 30 December 2019) [Financial Wellbeing Index 2019]

2 The Pensions Regulator, ‘Administration Guide for DC Pension Schemes’, The Pensions Regulator, UK, 2016, (accessed 30 December 2019) [TPR Administration]

3 The Pensions Regular, ‘Guide to Communicating and Reporting’, The Pensions Regulator, UK, 2019, p.4, (accessed 30 December 2019) [Guide to Communicating and reporting]

4 OECD, ‘Technology and Pensions: The potential for FinTech to transform the way pensions operate and how governments are supporting its development’, Secretary-General of the OECD, 2017, pp.5-7, (accessed 30 December 2019) [TECHNOLOGY AND PENSIONS]

The Pensions Regulator, ‘Code 13: Governance and administration of occupational trust-based schemes providing money purchase benefits’, The Pensions Regulator, UK, 2016, [TPR Code 13]

Last update: 20 December 2023