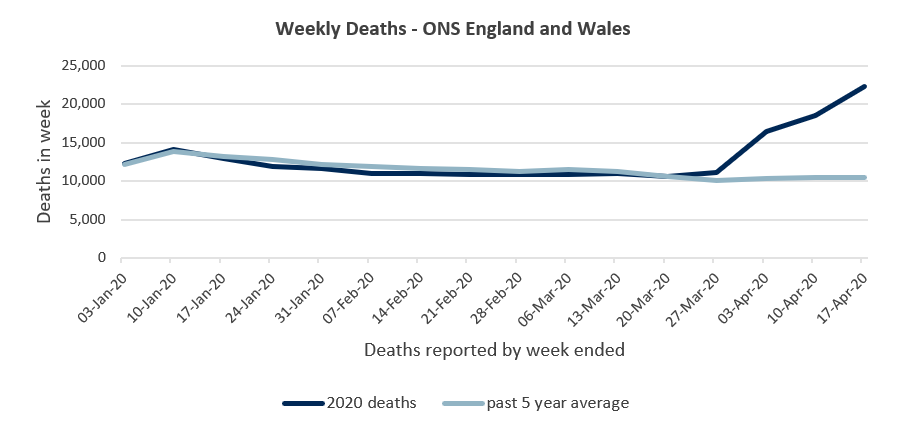

I am reminded by the occasional siren, now audible in my town, of the intensive work being done in our hospitals, evidenced by the mounting death count. This is captured by the ONS, as follows:

The recent impact of COVID-19 is clear, with 74% of excess deaths attributed to COVID-19 in the week ended 17 April.

There are reporting delays, in some instances caused by cross checking cause of death. It will therefore be some time before the data is available to form a credible view of the impact on schemes. These numbers also highlight the need to ensure procedures for dealing with members are up-to-date, not only for the lockdown and social distancing, but also to deal with affected dependants in an appropriately sensitive manner.

The impact is being acutely felt in the real economy, with sponsors connected to the most affected sectors of industry, such as retail and hospitality, finding cashflow has all but evaporated.

Many have made requests to defer contribution payments and other costs, consistent with the much needed advice issued by the Pensions Regulator. Care is needed to the proper treatment of amounts due, perhaps falling as debts with implications for covenant agreements struck with sponsors. Scheme rules need to be checked for the staff that may have been furloughed or made redundant to ensure the correct company and member contributions are deducted, and benefits paid, not forgetting the cash needed for the latter.

Financial markets have reacted dramatically, for example, the S&P 500 lost a third of its value over the month to 22 March. A rush to the US dollar was followed by prompt central bank intervention, the most notable being the support given by the Fed in the US that has dwarfed that of the 2008 crisis, including the purchase of corporate bonds to help support ‘fallen angels’, including some US Oil companies. This has helped these markets recover some of the losses, but is the full impact of the rise in unemployment yet to be felt?

I look back from the passing clouds, and turn my thoughts to my upcoming video call; to the immediate IT and data security hurdles, and how the remote world is adapting. We certainly live in interesting times.

Notes/Sources

This article was featured in Pensions Aspects magazine June 2020 edition.

Last update: 19 January 2021

You may also like: