A report1 in 2019 by The Association of Member Nominated Trustees (AMNT) severely criticised the fund management industry on its lack of transparency on voting policies. The report also identified significant gaps in fund managers’ voting policies in several key ESG issues. Lack of transparency and lack of ESG voting policies presents a significant challenge for trustees given their growing stewardship and ESG regulatory obligations. Indeed, the AMNT shared this research with the Financial Conduct Authority (FCA) as part of a formal complaint.

It therefore stands to reason that fiduciary managers can be expected to engage with fund managers on their ESG policies and behaviours as part of their fiduciary duty. Engaging with fund managers can generally be done in one of two ways: first, by way of voting engagement, where shareholders use their position to vote for or against certain actions; and secondly, by direct engagement, working directly with the fund manager to deliver better ESG outcomes for all stakeholders.

Whilst normal corporate governance voting standards and practices don’t necessarily apply to pooled investment vehicles or funds, it is possible to take a similar approach to voting policy as with directly held assets. For example, a specific area cited in reviews has been the make-up of boards in terms of gender and racial diversity, along with the proportion of

independent directors that represent investors’ interests. It is possible to vote against the appointment of fund directors if this is a concern. Likewise, if there are ongoing reservations about the actions of a board during the year, it is possible to withhold support for the annual report and accounts.

Similar to voting activity, direct engagement with fund managers can take many forms but I believe that, to be powerful, it needs to be ongoing. This means that it starts with the initial fund selection process and continues via regular fund reviews. These reviews must consider not just the fund performance and investment process, but operational factors and the actions and policies of the wider investment firm.

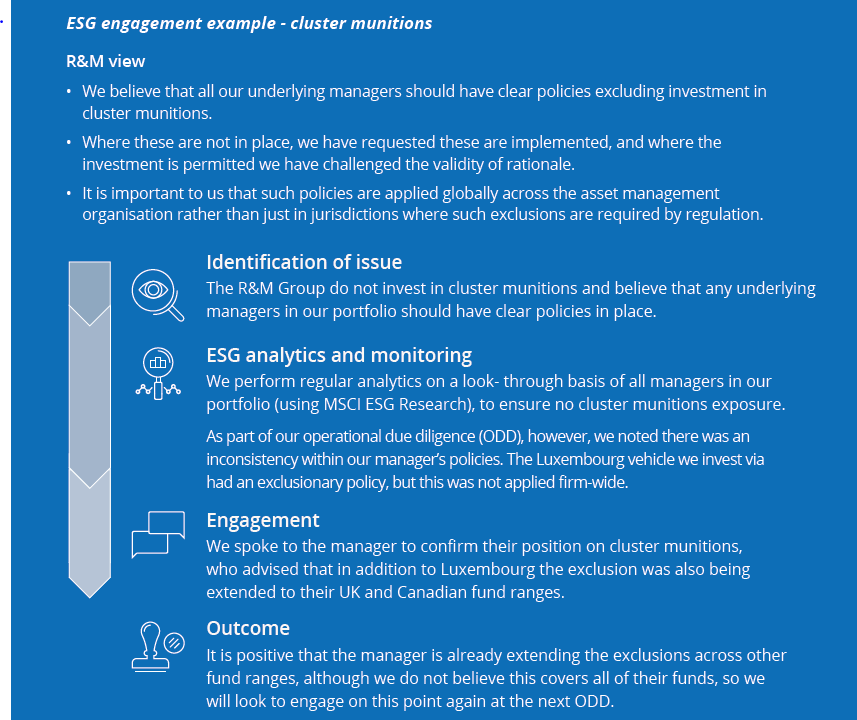

We have illustrated below how we at R&M successfully engaged with a global fund manager who was not consistently applying their policy on investing in cluster munitions across different investment jurisdictions.

As ESG policy and reporting from fund managers is rightly coming under continued scrutiny from regulators, it impacts on trustees. By ensuring that their fiduciary manager is engaging with and holding managed funds accountable, trustees should be able to feel comfortable that much of their own fiduciary and regulatory obligations are in order.

Notes/Sources

- Source: AMNT (Association of Member Nominated Trustees) review into fund managers’ voting policies and practices, May 2019

This article was featured in Pensions Aspects magazine March 2021 edition.

Last update: 11 March 2022

You may also like: