What is ESG momentum?

ESG momentum is a term used to describe how companies are changing their ESG characteristics through time. Those with positive momentum are improving their ESG practices. For example, improving governance by appointing non-executive directors to the board, improving supply chain transparency to ensure suppliers meet human rights standards, or setting carbon reduction targets.

Any such improvement in ESG characteristics is not only reflected in a company’s stock price but also its underlying financials. This leads to long-term benefits for investors.

How can it add value to my portfolio?

Most ESG minded investors invest either into ‘best of breed’ ESG stocks or via exclusionary strategies (excluding things like fossil fuel companies, tobacco, alcohol, gambling). However, this does not always lead to improved returns. For example, since 2007, Morgan Stanley Capital International (MSCI) World ESG Leaders have performed in line with MSCI World. This is because the market has already priced in these positive characteristics for companies who are ESG Leaders.

There is evidence that the market has been slower to pick up the benefits of positive ESG momentum. Over the period since 2015, the relative performance of top quintile ESG-rated companies versus bottom quintile has been positive. But performing the same analysis for ESG momentum rather than ESG rating gives even better results. Results corroborated by third-party analysis using data from both the dominant ESG data providers, MSCI ESG Research and Sustainalytics.

Timing

Positive ESG momentum often happens when there is a significant change in the board composition of a company. This can be when longstanding board members step down or begin thinking about building their legacies. At this point, the company can enhance its approach to corporate social responsibility. For example, by implementing better and enhanced talent management programs, or by reviewing current business practices and looking to improve health and safety for their employees.

There can be a significant time lag between these changes happening and the impact on a company’s financials and share price. This is because companies that start the journey to improving their ESG standards can often face scepticism from investors. Many investors prefer to invest in an ESG positive index, which is an efficient way of removing unwanted potential risks. This means there can be an opportunity to enhance returns by investing when a company focuses on improving its ESG approach before the rest of the market catches up.

Case study – Costco

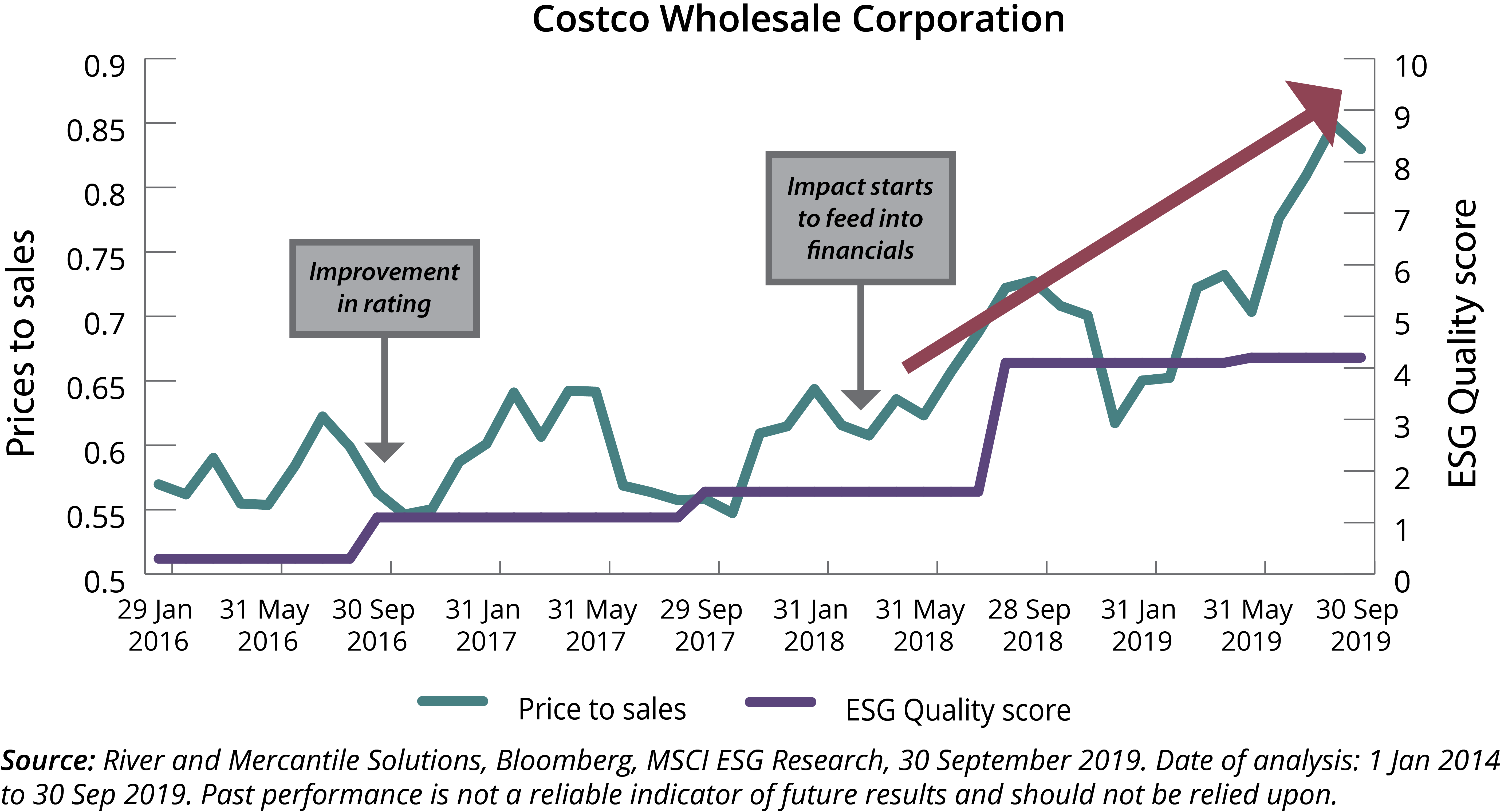

For those of you who aren’t aware, Costco Wholesale Corporation is an American multinational corporation that operates a chain of member-only warehouse centres. Their ESG rating, based on MSCI ESG data, was CCC in August 2016.

In 2016 and 2017, two of the Costco’s founders retired from the board of directors. This led to a change in the corporate governance approach. Over the following months and years, Costco’s ESG rating improved because of three key drivers:

- Improvements in quality and safety, leading to a reduction in the number and repetition of product recalls;

- Continued efforts in the organic food space; and

- Strong labour management practices - unlike its main competitor Walmart, Costco does not have a ban on unionised employees, and it pays roughly twice the federal minimum wage which is higher than its competitors.

Costco showed significant positive ESG momentum over this period and improved its ESG rating by two notches to a BB in 2019. Over the same period, Costco’s price to sales ratio increased by 25%. In contrast, over the same period, the price to sales average across the consumer staples sector was flat.

However, although Costco had been improving its ESG standard since 2017, it wasn’t until mid-2018 that this started to feed into the financials and share price. This provided a period for savvy investors to take advantage of this opportunity and capture the 60% increase in Costco’s share price.

Concluding thoughts

A lot of active ESG funds are invested in a limited set of companies with strong ESG characteristics. If we expand the investable universe to include stocks who are not yet as far along the ESG journey, but have positive ESG momentum, there are more opportunities to outperform. This can provide a different approach to a ‘best of breed’ or exclusionary strategy, and when accompanied by active ownership can help to raise companies’ ESG credentials.

ESG investing doesn’t have to mean sacrificing return; with positive ESG momentum, you can add value to your asset portfolio - all whilst supporting the companies working hard to improve their credentials. Source

Note 1

Notes/Sources

Note 1

Source: River and Mercantile Solutions, Bloomberg, MSCI ESG Research, 30 September 2019. Date of analysis: 1 Jan 2014 to 30 Sep 2019. Past performance is not a reliable indicator of future results and should not be relied upon.

This article was featured in Pensions Aspects magazine May 2020 edition.

Last update: 24 May 2024

You may also like: