RetirementMatters Training Taster Session: Managing your finances as you approach retirement

RetirementMatters Training Taster Session: Managing your finances as you approach retirement

JOIN THE DISCUSSION

How using the Tumble Dryer can impact your retirement plans?

Choosing when to retire is a complex decision at the best of times, however the recent cost of living crisis has made many who are thinking of retiring in the next couple years reassess their plans, especially as some may feel they cannot manage their pension contributions in the run up to their retirement.

Understanding your finances and how you can maximise your money through these turbulent times can help you maintain and build on your retirement plans and therefore give you confidence you will have the desired lifestyle you want in retirement. E.g. did you know that if you use your tumble dryer twice a day over the winter you could be paying £1.48 per day on this alone. By reducing the amount of electricity, you use, the extra savings could be used on other finances, such as your retirement.

As part of our “ Retirement Matters” service we at the PMI, supported by WEALTH at work, a leading financial wellbeing and retirement specialist, are running ‘Managing your finances as you approach retirement’ taster sessions which will show you ways to help your employees manage their money and still be able to save for a happy retirement. The Taster sessions which will last for 1 hour will be running on Thursday 16th July & Thursday 12th October 2023 and are open to all PMI members as well as affiliated employees and pension scheme members.

Therefore, if you are responsible for helping your company’s employees in understanding their retirement planning or if you are responsible for offering financial education within your company the “Managing your finances as you approach retirement’ taster session will provide an insight into how your employees can manage their finances leading up to and into retirement during challenging times , which in turn will enable them to make better retirement decisions.

So if you think this type of education could help your employees, then please book onto one of our Taster Sessions Changes and see how our “Retirement Matters service can support you.

-

Free

Cost -

1 hour

of CPD -

1

Speaker -

Online

BrightTALK

Event Details

THE BASICS

The Taster Session topics include:

- The increased cost of living

- Ways to review your finances, borrowing and reduce costs.

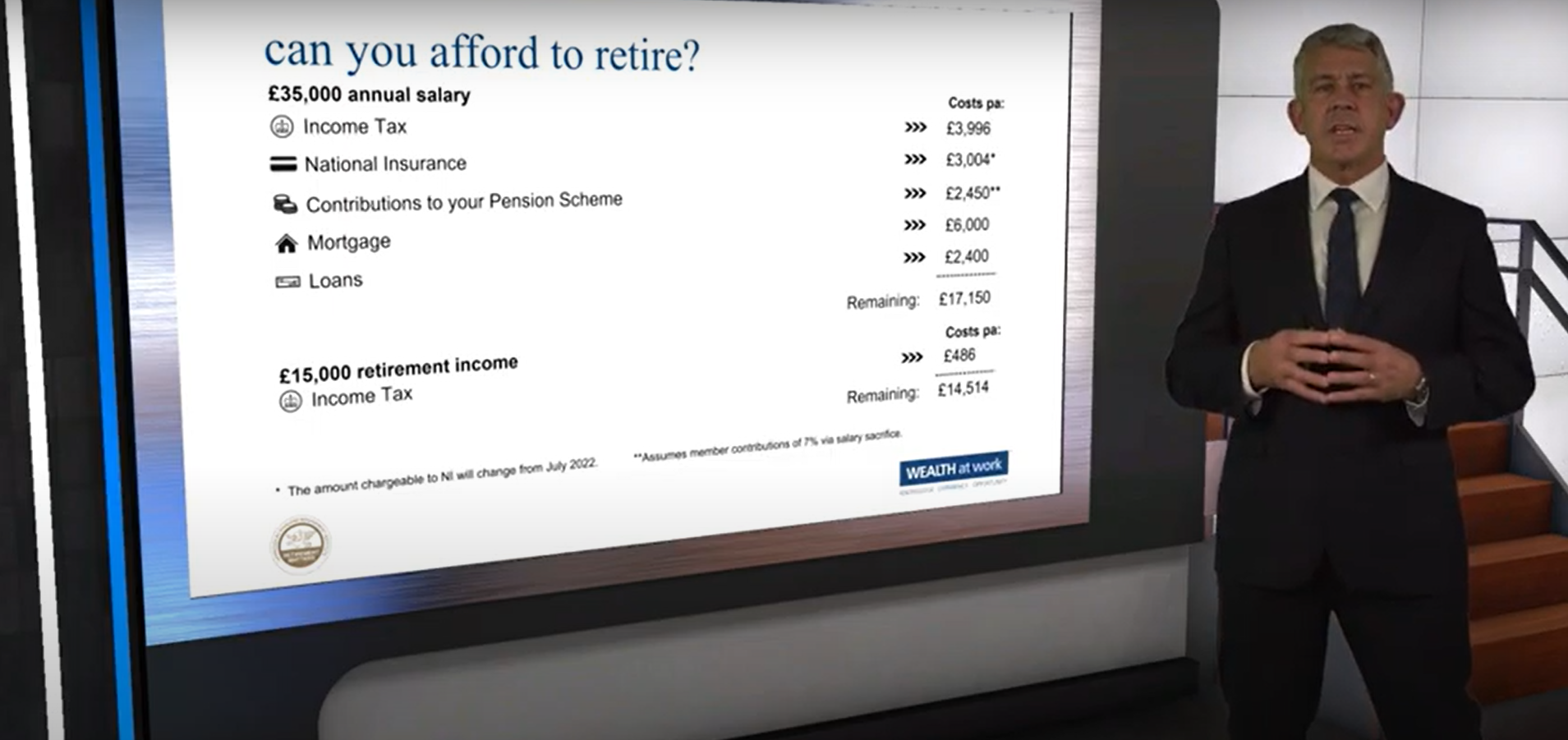

- Changes to lifestyle and costs in retirement

- Inflation in retirement

- State Pension

- Defined benefit and defined contribution pensions.

- Generating a retirement income

- Taxation

- Professionals interested in pensions

- Professionals aged over 50 and considering retirement

- HR Managers

- Employee benefits experts

- Trustees

- Scheme managers

- Scheme members

- Sponsoring employers

- Employees

- Advisers

Speaker

Hear from the experts

Can you afford to retire?

RetirementMatters financial education service

Terms and conditions

The PMI reserves the right to make modifications to the programme(s) and administrative arrangements in the event of special circumstances.

In the event of written cancellation four weeks before the event, 80% of the fee will be refunded. No fees are refundable after this date though it will be possible to substitute a delegate of the same fee category up to the day of the event.

If the seminar cannot be held for any reason, the PMI's liability will be limited to a refund of the appropriate seminar fee only. Please note that payment must be received before the event is held.