Most other places I’ve been recently use QR (Quick Response) codes to gather contact details. These look a bit like melted bar codes. Since Covid-19, they’re everywhere. Lots of cafes and restaurants use them to show you the menu.

We’re using QR codes to take people to a new phone app we’ve developed for Defined Benefits (DB) pension schemes. Open the phone camera and it grabs the QR code and brings you to the correct app store; no fiddly URL to key in. I showed it to a trustee six months ago. “Nice, but my members won’t use that” he said. Fast forward and if one of his members now wants to order a drink, they’ll probably be faced with a QR code!

There’s no doubt that pensions technology, especially in the DB world, has lagged behind other financial services. There are a number of reasons for this; some valid and some less so.

People, not members

Let’s start with “my members won’t use that”. Firstly, a member is actually a consumer of a service. All too often they are viewed in the pensions industry as an accidental by-product of a scheme valuation.

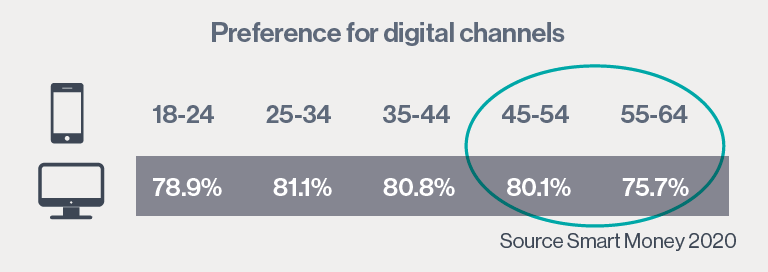

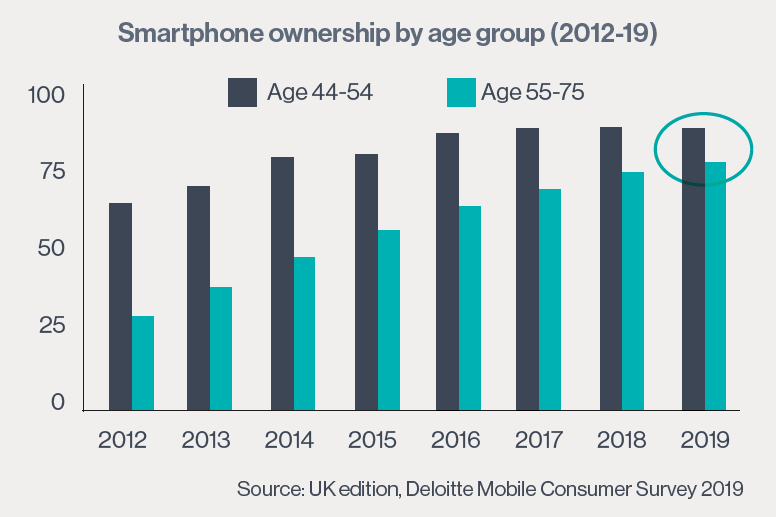

Looking at the 45-64 age group, here’s a few facts and figures on technology usage:

Smartphone ownership is around 80% and is the device most commonly used to access the internet. Research by Smart Money shows the preference for digital channels is just about as high in this age group as it is with 20-year olds.

The ONS 2019 Survey on Internet Banking found that 76% of people in the age group 44-54 bank online. This drops off by 10% in the 55-64 age range. It will be interesting to see the impact of Covid-19 on those numbers. I can only envisage an upward trend.

The 45-64 market is a lot more tech savvy and ready to adopt services than many people assume. If you make access to services easier, people will use them.

Making it easy

Recently, I undertook a comparison of leading DB software providers. They all offer a member website, but not a phone app. There was one exception, which was primarily a communication tool lacking any way to manage benefits. A well-designed website will also run on a phone, but it won’t have the same advantages as an app in terms of usability.

Let’s start with passwords and two factor authentication. I fought a fruitless battle recently trying to access a website I use infrequently. I had to remember my username, password and identify four characters from a 15-digit memorable phrase. It was like a round of Trivial Pursuit. I gave up.

A phone app can use the native security features of the device, such as facial or fingerprint recognition. For a service that’s going to be used infrequently like pensions, that’s vital for ease of access.

I mentioned QR codes earlier. Our developers have found a way to personalise them so they act as a password on first registration. Simply scan the QR code, enter your NI number and select a four-digit PIN.

The benefits of phones don’t stop with ease of access. Research shows that the first thing most people do on waking up is to check their phones. Everywhere you go, every minute of the day, you can see people on their phones. You might even be reading this article on your phone.

This confers a further advantage to phones over PCs or laptops. The phone is almost always on and generally in the member’s pocket. When communicating with members that’s significant. Research shows that people are more likely to open messages pushed to their phone than they are to open and read an email. That’s a distinct advantage in terms of being heard.

Biting the bullet

There are valid reasons why the level of service online doesn’t always meet member aspirations. While modern systems are pretty capable, there are many schemes still running on legacy platforms that can’t meet today’s requirements. That’s a problem that can be fixed by migrating, subject to the acceptance that this is not a trivial process to undertake. Guaranteed Minimum Pension (GMP) Equalisation and the Pensions Dashboard may well be additional drivers to accelerate this trend where systems can’t be upgraded.

How do you eat an elephant?

The other issue is data quality. Too many member records are incomplete or not reliable enough to expose to a member. It’s a bullet that no one really wants to bite; one that’s seen as a cost, not a benefit.

Of course, that presupposes you do the cleanse all in one go. The approach we are using is to prioritise members who download and use our app – a process of self-selection. If a member wants to engage online, we prioritise fixing their record. The app serves up a ‘working on your benefits’ message. When we are happy, we push a notification to the phone to say they are good to go.

So, to sum up, there is no doubt that the demand for DB members to access and manage their benefits online is there. Barriers may exist, but these can be overcome. Tangible benefits include improved member satisfaction and a potential reduction in administration costs of around 30% simply by letting members self-serve. Surely that’s a bullet worth biting?

Notes/Sources

This article was featured in Pensions Aspects magazine October edition.

Last update: 19 January 2021

You may also like: