There is a conviction that we will need to do things differently in the future, as COVID-19 has disrupted life as we know it – including economies and financial markets – in unprecedented ways.

For investors, the global scale of the pandemic and the responses from corporations shine the light firmly on the ‘s’ of environmental, social and governance (ESG) factors. But in fact. all three dimensions have come to the fore.

ESG: a performance driver Our proprietary research demonstrates that investment strategies which integrate ESG factors have historically outperformed across all asset classes:

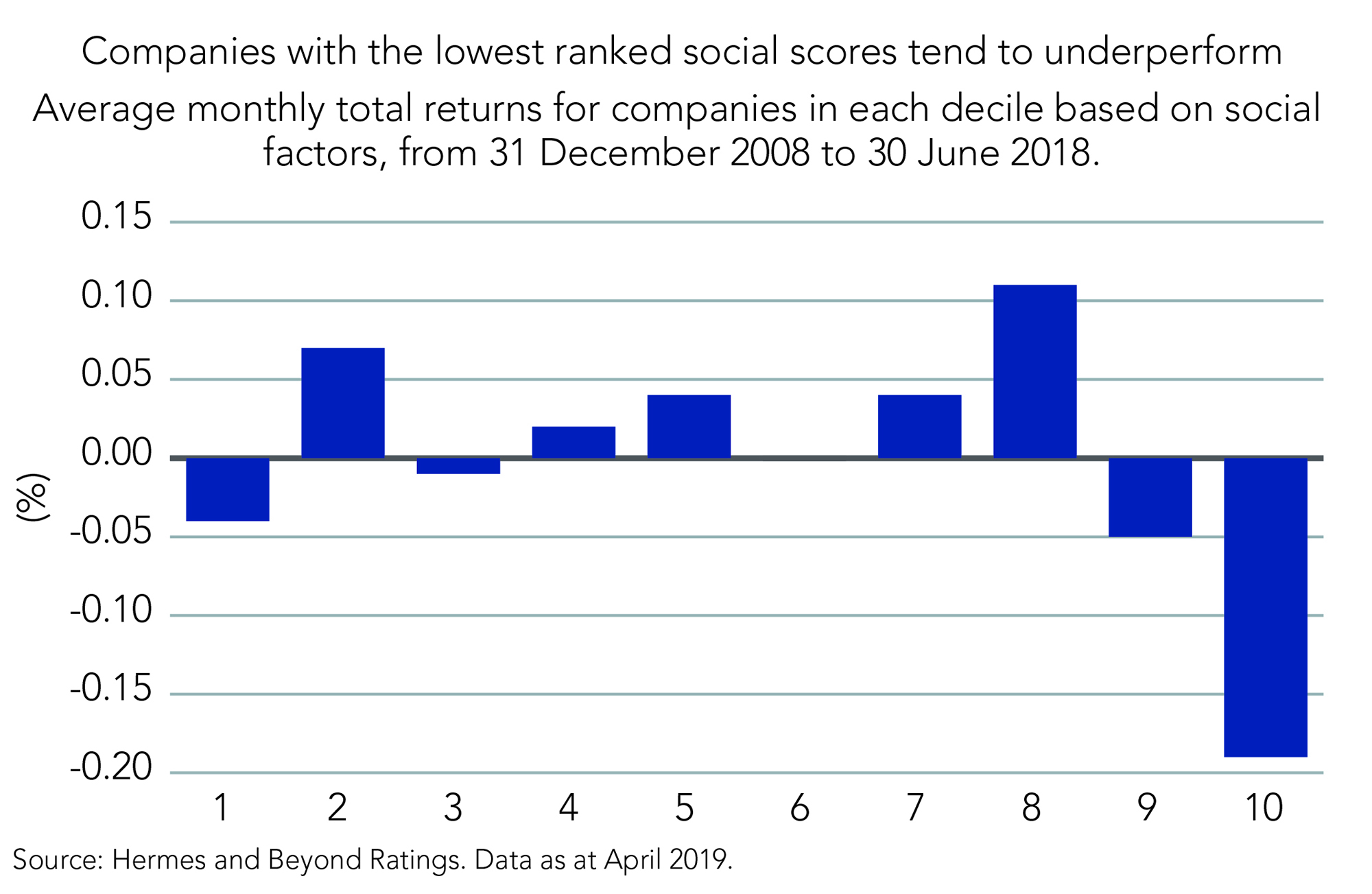

Equity: research by our Global Equities team reveals that companies with poor or worsening social practices consistently underperformed compared to their peers by 15bps each month since the beginning of 2009.

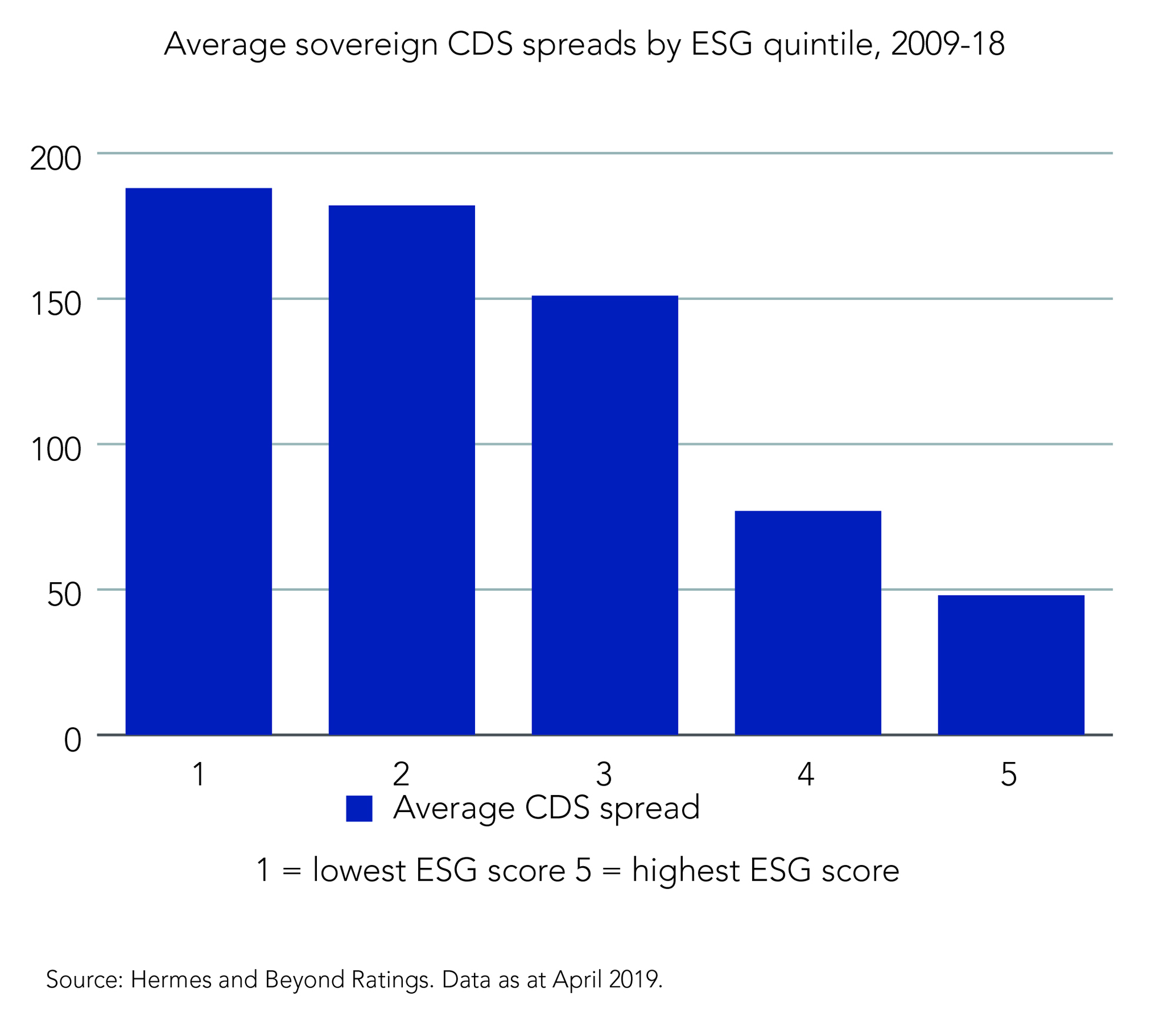

Credit: a study by Beyond Ratings and our Credit and Responsibility teams indicates that countries with the highest ESG scores (quintile five) have the lowest average credit-default swap (CDS) spreads, while those with the lowest ESG scores (quintile one) have the highest average CDS spreads. The difference in average spread between these quintiles in terms of basis points is 140bps.

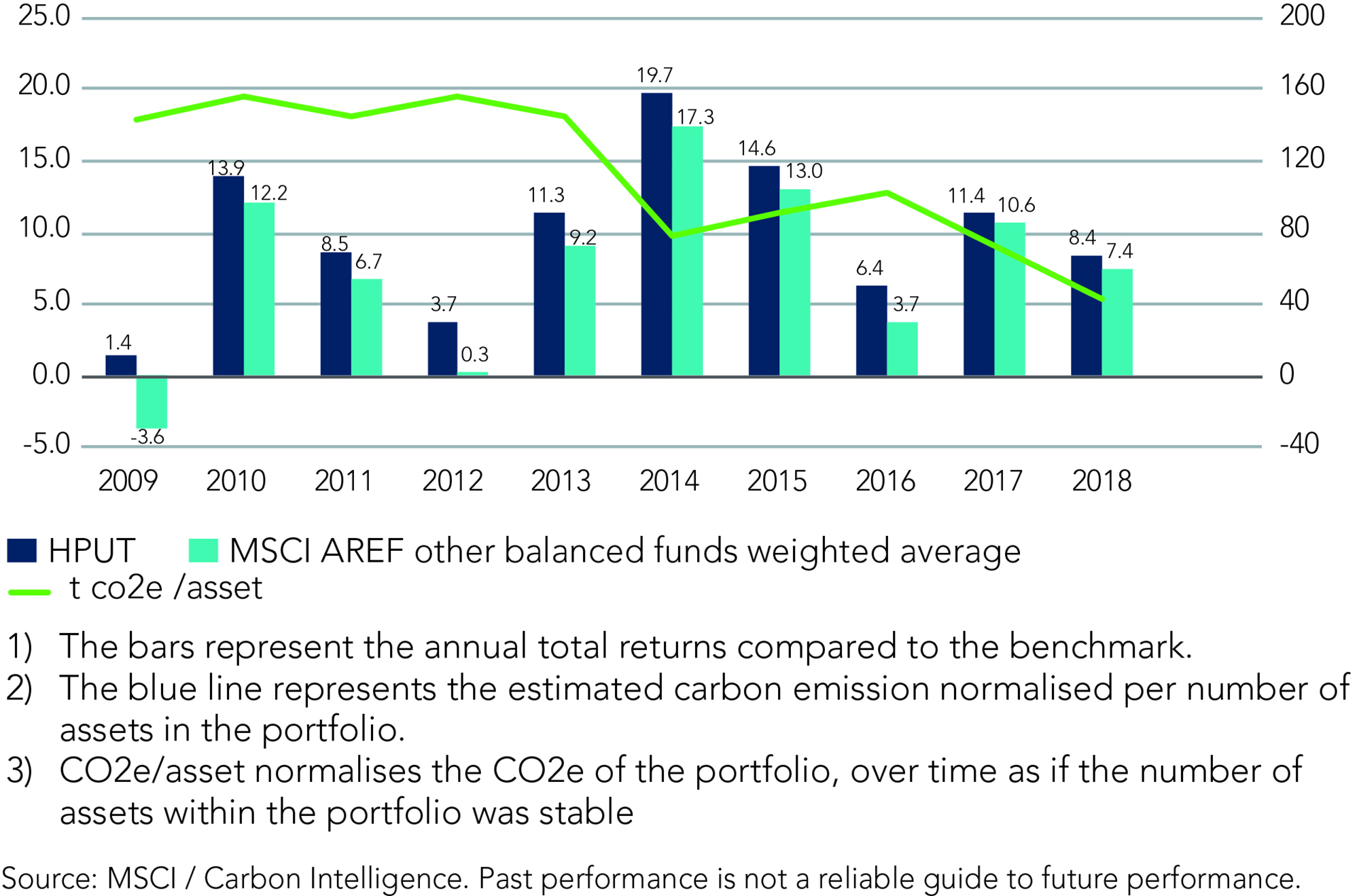

Property: our Real Estate team has delivered internal responsibility targets whilst continuing to outperform. Over the last two years, the team’s assets have delivered consistent energy and carbon emission reductions. In 2018, 33% of the buildings in its property strategies switched to verifiable zero carbon green sources energy.

Note 1

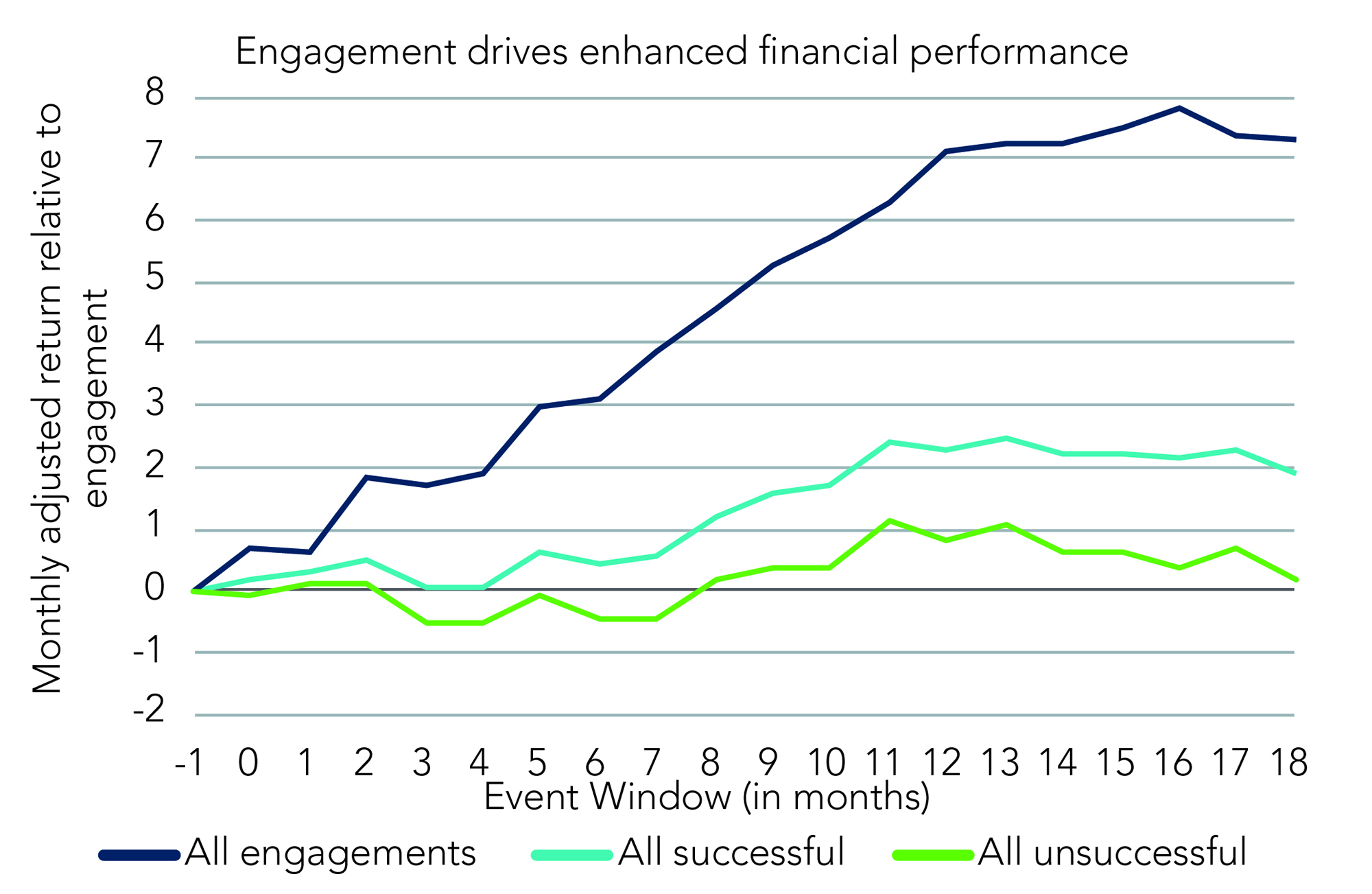

Further still, we know too that stewardship and engagement are key pillars of optimising outcomes for all stakeholders:

Note 2

Active stewards of capital have a critical fiduciary role, regardless of whether they are shareholders or bondholders. Engagement enables us to build a 360⁰ view of the companies in which we invest,

and it’s why asset managers and asset owners should be willing to support, encourage, exhort, pressurise and, if necessary, require invested entities to take the necessary steps to ensure that wealth is created sustainably.

An ESG premium?

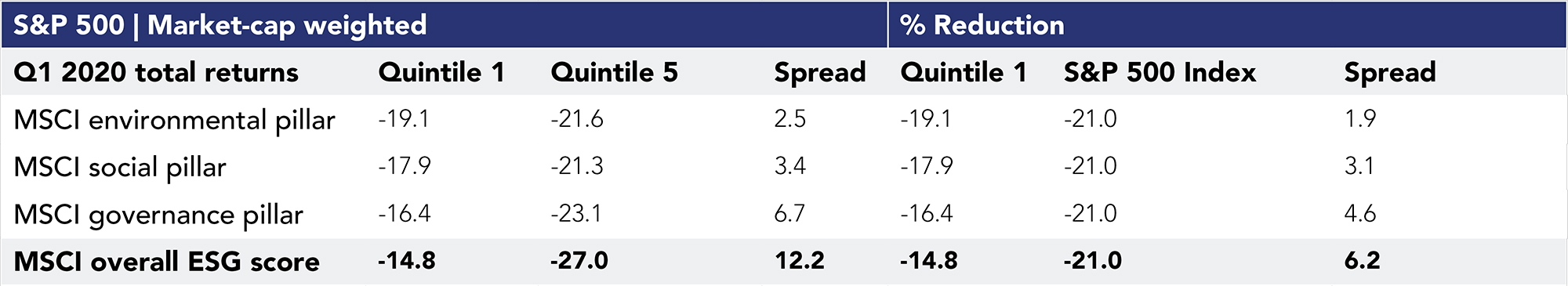

The market has spoken According to MSCI and Sustainalytics data, ESG factor performance has been positive relative to the broad market (here proxied by the S&P500 index) in the year to date. Companies with the highest ESG scores (quintile 1) are consistently outperforming laggards (quintile 5) across all pillars on a market cap-weighted basis.

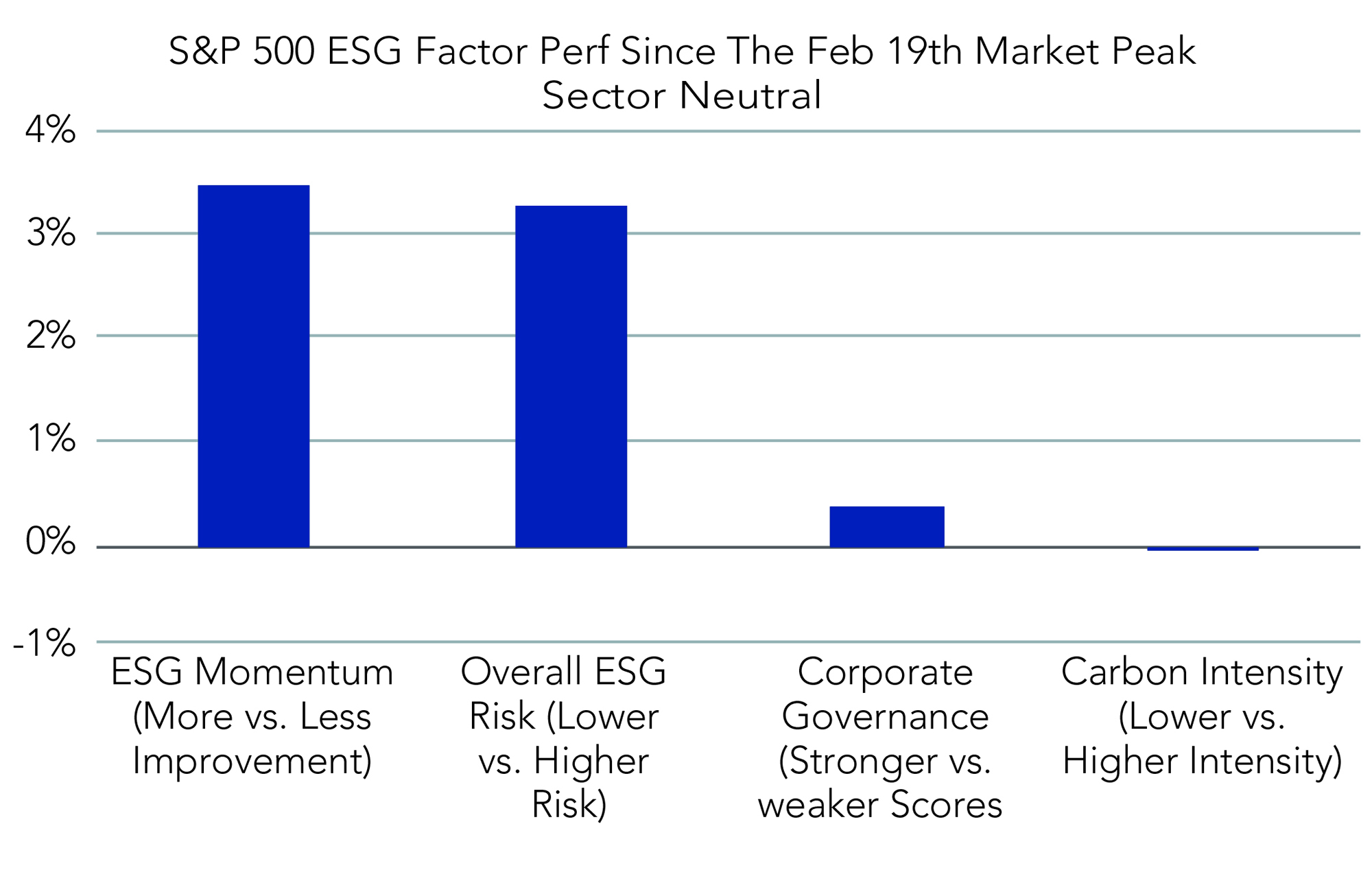

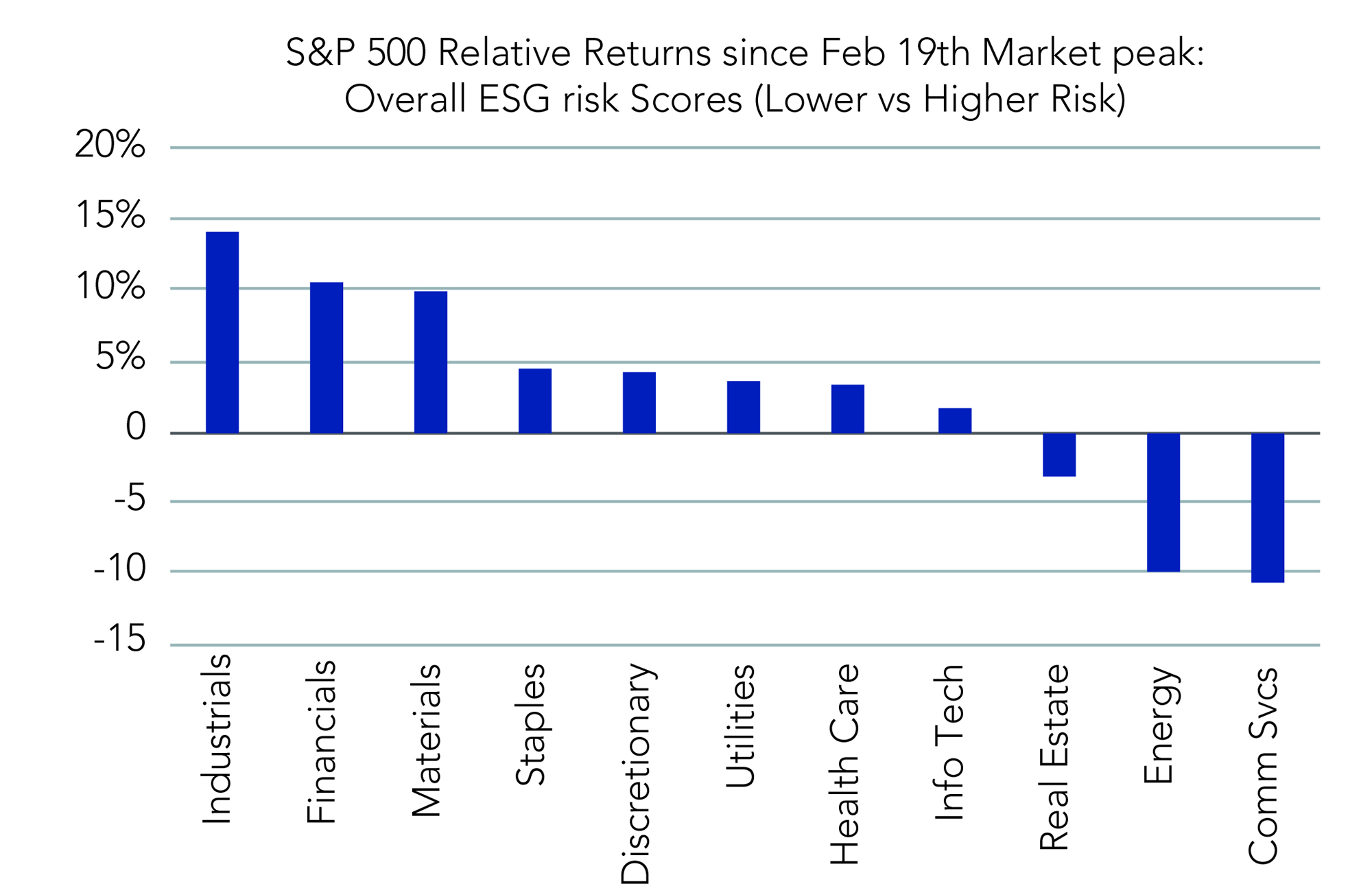

Looking at a shorter window still, from the market peak on 19 February, the results from Sustainalytics are broadly similar:

Note 3

Importantly, this is not a sector-specific phenomenon, with broad representation of ESG leaders outperforming in 8 out of 11 GICS sectors.

Despite the stock market turmoil, shares of companies focused on climate change or ESG issues have outperformed as the virus has spread. HSBC analysed 613 shares of global public companies valued at over $500 million where climate solutions generate at least 10% of revenues, plus the 140 stocks with the highest ESG scores and values above the global average1.

This analysis focused on performance across two periods up to 23 March; first, from 10 December 2019, the start of the crisis; and, second, from 24 February, when the period of high volatility began. The climate-focused stocks outperformed others by 7.6% from December and by 3% since late February. The ESG shares beat others by about 7% across both periods.

Investing to earn a share in sustainable wealth creation

ESG cynics warned that sustainability strategies would get tested in a downturn and found to be wanting. Rather than being exposed as a naked emperor, the ESG investing discipline has been shown to be fully clothed – perhaps even to be wearing a suit of armour.

The purpose of investment is to deliver sustainable wealth creation over the long-term. Sustainable, because there’s no point making an investment that rises strongly in value this year, only to collapse at some point shortly thereafter.

That is the risk investors run when businesses behave in an unsustainable way – both specifically, in the event that they suffer a reputational, governance or operational failure, and systemically, if climate change, political instability or regulatory action harms their business model.

Creating wealth is not a zero-sum game of winning at someone else’s expense. It’s investing to earn a share of the new wealth that’s created that can enrich investors, employees and society over an enduring timeframe.

Notes/Sources

Note 1

- The bars represent the annual total returns compared to the benchmark. Returns are net of fees.

- The blue line represents the estimated carbon emission normalised per number of assets in the portfolio.

- CO2e/asset normalises the CO2e of the portfolio, over time as if the number of assets within the portfolio was stable Source: MSCI / Carbon Intelligence, as at April 2019

Note 2

Source: 2012 study by Elroy Dimson, Oğuzhan Karakaş, and Xi Li analyses an extensive database of corporate social responsibility engagements with US public companies over 1999–2009 addressing environmental, social, and governance concerns. Engagements are followed by a one-year abnormal return that averages +1.8%, comprising +4.4% for successful and zero for unsuccessful engagements

Note 3

Source: RBC, S&P Global, Sustainaytics, Trucost, Federated Hermes, as at April 2019.

This article was featured in Pensions Aspects magazine June 2020 edition.

Last update: 19 January 2021

You may also like: