The Member as an Employee

An employer needs to have sufficient financial and human capital if it is to effectively support employees and ongoing business. Marsh & McLennan concluded that businesses who score highly on ESG implementation tend to experience higher levels of employee satisfaction³. The London School of Economics and Political Science found that employee satisfaction has a positive impact on productivity and profitability⁴. It therefore follows that sound ESG implementation can improve a company’s balance sheet. This conclusion is supported by a University of Oxford study which also indicates ESG and sustainability policies can positively affect profitability⁵.

If an employer becomes more profitable it will have more available capital. This capital may be used to maintain the business and in turn the ongoing employment of staff (who therefore remain part of an occupational pension scheme). Funds could also be used to improve the employee benefits package, offering higher salaries or benefits in kind. This may help an employer attract or retain existing talent, which may maintain or further augment profitability levels. If employees attain or maintain higher levels of disposable income they will be more able to manage their personal finances. Employees may be disincentivised from opting out of their pension scheme if they have sufficient income net of pension contributions to manage their expenditure. Member outcomes are therefore improved as more employees are able to make provision for their retirement.

The Member as a Pension Scheme Beneficiary

Pension funds exist to provide retirement income, and Trustees have to ensure that their pension scheme will meet the saving needs of the membership. The impact of ESG will differ depending on whether the pension scheme has a Defined Contribution (‘DC’) or Defined Benefit (‘DB’) structure.

Benefits - Defined Contribution Schemes:

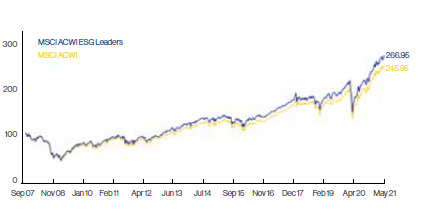

Some pension schemes have been prepared to make a significant commitment to ESG principles. LifeSight (the DC Master Trust administered by Willis Towers Watson) made ESG principles a core part of its default investment strategy in 2018⁶. Adopting ESG investment principles is a way to help ensure that savings needs are met, and they do not need to be seen as a measure which is taken for the benefit of legislative compliance and at the detriment of the pension savers. Adrian Woodcock of Willis Owen found that the return in ESG funds exceeded the return in non ESG counterparts in the three and five year period to 31 March 2021 “with a five-year return of 94.49% for the MSCI ACWI ESG leaders index versus the MSCI ACWI index return of 93.75%”⁷.

MSCI ACWI ESG Leaders Index (USD)⁸

Each investment fund will perform differently depending on the weighting of investments across different asset classes, market sectors and geographies - and past results do not guarantee future returns. It remains clear that ESG-tailored funds can outperform their non-ESG counterparts, which may in part relate to the increased profit levels that ESG-aligned companies can experience (as outlined earlier in this essay). This increased return would help to provide a higher fund value on retirement. This may facilitate a more generous lifetime annuity, a greater lump sum, or a higher fund value to be accessed using a drawdown arrangement.

Benefits - Defined Benefit Schemes:

Funding is a critical issue for trustees of DB pension schemes, as underfunding will restrict the ability of the scheme to pay the benefits due to the membership now and in the future. The Pensions Regulator (‘TPR’) indicated that DB pension schemes (excluding those which are in the process of being wound up) were underfunded by £203.353 billion as of 31 March 2020⁹.

Trustees and sponsoring employers are keen to reduce funding deficits, and this must be done in a way which is agreeable to both parties. One common approach is Liability Driven Investment (‘LDI’). Under a LDI solution, some of the scheme’s assets are invested in bonds or financial instruments (such as interest rate and inflation swaps) which match the same sensitivity to interest rates and inflation as the scheme’s liabilities. This means that if the value of the scheme’s liabilities increases the matched assets will compensate by increasing at the same rate. LDI solutions will commonly have a return-seeking component which aims to outperform the matched portfolio. If the assets increase at a greater rate than the scheme’s liabilities the extent of any funding deficit will reduce. The return seeking portfolio may invest in a range of different asset classes, and ESG funds may be considered.

As outlined previously ESG funds can outperform their non-ESG equivalents, and their use in a return-seeking component of an LDI strategy could generate higher excess returns and reduce a pension scheme’s deficit more quickly. This would increase the security of scheme benefits and reduce the corresponding risk that the scheme in question fails and is transferred to the Pension Protection Fund (‘PPF’). The PPF’s compensation caps mean that, depending on the extent to which a pension scheme is underfunded on wind-up, members could lose up to 10% of their benefits on a transfer to the PPF¹⁰ .

Even though some ESG funds will underperform their non-ESG equivalents in the short term, pension schemes usually have a very long investment horizon. This means that ESG funds may remain a suitable investment option. TPR’s DB Investment Guidance states that “consideration of ESG factors allows [trustees] to evaluate the short and long term financial risks and opportunities of [scheme] investments by looking at the current practices of the firms in which [trustees] invest”. For example, a pension scheme may invest in a fund which holds significant positions in oil, gas, or coal. The fund may be projected to perform well in the short term but if negative views of the non-renewable energy industry develop (for example, in the event of an industrial accident), past gains in the underlying investments could be eroded. With 80% of the public expressing concern about climate change¹¹ trustees may change their ESG policy to invest in funds which are less sensitive to adverse environmental developments (such as those investing in renewable energies). In the longer term these funds may generate more reliable returns which will help the scheme reach its funding targets.

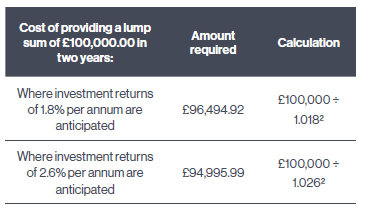

When a pension scheme reaches a higher funding level the need to generate excess returns will reduce, as there is little practical reason to accrue and maintain a significant surplus. As a result a pension scheme may be able to move some of its return-seeking ESG assets into the lower-risk matching portfolio to lock in the accrued gains. As the expected return on the scheme’s investments will lower the scheme’s discount rate will decrease. This may result in scheme members receiving higher transfer values as the actuarial present value of the member’s benefits will be higher. With all other factors remaining constant, the lower the expected investment return the higher the amount that is needed now to pay the member’s benefits into the future. This is illustrated in the table below.

The above example does not take into account the other assumptions (such as mortality) which will form part of an actuarial calculation basis, which may change from time to time to reflect changing financial and demographic conditions. On the understanding that ESG aligned funds can achieve returns which are at least equal to non-ESG funds, the principle remains that they can be used to help a scheme reach and secure a higher funding level. The benefits of transferring defined benefit pensions remain contested which is reflected in the rigorous regulations surrounding pensions transfer advice. However, if a financial advisor is able to conclude that a transfer value offers sufficient value for money taking into account the transferor’s circumstances, a measure which increases transfer values may provide greater value for money and result in improved member outcomes upon the transfer’s completion.

Potential Risks and Limitations One issue which burdens ESG concerns what it actually means in practice. One scheme may consider that reducing environmental impact is achieved by simply avoiding investment in non-renewable energies, whereas another may feel that investing in renewable energies is also required. To one scheme improving social impact may emphasise avoiding investments in countries with alleged human rights abuses. Another scheme may curate their social impact by focusing on prohibiting investments in unhealthy products such as tobacco and alcohol. Additionally, considering the governance aspects of investment could be focused on the composition of a company’s Board of Directors, or it could relate to the political lobbying and donations that the Board carries out. Inevitably each potential investment will be stronger in some areas than in others, each with inherent risks which may adversely impact the scheme’s investment experience and which must be managed and hedged accordingly.

The potential merits of schemes offering DC members the chance to invest in ESG aligned funds have been discussed in the context of investment returns. However, it is arguable that this does not account for the overarching member experience of a DC scheme member.

Fund managers derive their revenue from charges on the assets under management, and in most DC schemes the member will be responsible for meeting at least some of the costs. This might be through a conventional annual management charge or a fixed transactional fee. The additional due diligence required in forming and maintaining an ESG-aligned investment fund may result in higher fund charges. The higher charge may be warranted to the extent that the ESG fund provides positive returns, but if the performance of the ESG fund is less than or merely comparable to a non-ESG equivalent with a lower charge the additional cost may reduce any additional financial benefit.

DC schemes that are used for the purpose of automatic enrolment are required to have a default investment strategy which uses ‘lifestyling’. This means that the invested funds will move into conventionally ‘safer’ funds to preserve the capital or real-term value of a member’s fund at retirement. Some DC schemes have incorporated ESG principles into their default investment strategy which means that members do not have to do anything to access ESG-aligned funds. However, other schemes may only make ESG-aligned funds available to members who want to direct how their contributions are invested (subject to the limitations of the scheme’s investment options). In the absence of a structured decumulation strategy members may leave their investments in more volatile funds even on the approach to retirement. The member could receive higher returns but the opposite is also true, and the member could find their funds diminished with insufficient time to wait for the markets to recover. The member therefore could suffer a financial detriment.

The focus on ESG is here to stay and there are clearly ways in which both DB and DC scheme members may benefit as a result. However, it is crucial that the implementation of ESG policies is carefully considered so that any gains are realised, and members have the information and resources to make positive decisions at the most appropriate time.

Notes/Sources

¹‘ESG and climate change for pension funds A guide to trustee disclosures from 2021’, Page 6 - Sackers website https://www.sackers.com/app/uploads/2021/03/ESG-and-climate-change-forpension-funds-A-guide-to-trustee-disclosures-from-2021.pdf - Accessed 28 June 2021

²‘ESG reporting – are you ready for this year end?’, KPMG website https://home.kpmg/uk/en/blogs/home/posts/2021/01/esg-reporting-are-youready-for-this-year-end.html - Accessed 28 June 2021

³ 'ESG as a Workforce Strategy Part I’, Page 6, MMC website https://www.mmc.com/content/dam/mmc-web/insights/publications/2020/may/ESG-as-aworkforce-strategy_Part%20I.pdf - Accessed 28 June 2021

⁴ ‘Happy employees and their impact on firm performance’, London School of Economics and Political Science website https://blogs.lse.ac.uk/businessreview/2019/07/15/happy-employees-and-theirimpact-on-firm-performance/ - Accessed 28 June 2021

⁵‘From the Stockholder to the Stakeholder: How Sustainability Can Drive Financial Outperformance’, pages 33 and 42, University of Oxford https://papers.ssrn.com/sol3/papers.cfm?abstractid=2508281 - Accessed 28 June 2021

⁶‘LifeSight Adopts ESG Strategy for UK DC Master Trust’, LifeSight website https://www.lifesight.com/latest-news/news/lifesight-adopts-esg-strategy-foruk-dc-master-trust - Accessed 28 June 2021

⁷‘Sustainable and ESG now part of long-term portfolios’, Professional Paraplanner website https://professionalparaplanner.co.uk/sustainable-and-esg-now-part-oflong-term-portfolios/ -Accessed 28 June 2021

⁸‘MSCI ACWI ESG Leaders Index (USD)’, MSCI website https://www.msci.com/documents/10199/9a760a3b-4dc0-4059-b33efe67eae92460 - Accessed 28 June 2021

⁹‘Annual landscape report on defined benefit and hybrid schemes 2020’, TPR website. NB: figure derived as the aggregate of the total surplus/deficits from Tables 10 and 11. https://www.thepensionsregulator.gov.uk/en/document-library/research-and-analysis/db-pensions-landscape-2020#9bdcfaaa420442c0a64c030999afd796 - Accessed 29 June 2021

¹⁰‘What being a PPF member means’, Pension Protection Fund website https://www.ppf.co.uk/our-members/what-it-means-ppf - Accessed 29 June 2021

¹¹‘BEIS Public Attitudes Tracker (March 2021, Wave 37, UK)’, Page 12, gov.uk website https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/985092/BEIS_PAT_W37_-_Key_Findings.pdf - Accessed 29 June 2021

This article was featured in Pensions Aspects magazine September edition.

Last update: 15 September 2021

You may also like: