1. What is a net zero economy and why do we need it?

Achieving a net zero economy means drastically reducing emissions by 2050, with the goal of limiting temperature increases to 1.5°C above pre-industrial levels. In order to have a 50% probability of meeting that goal, the world must achieve net zero carbon dioxide emissions by 2050 and net zero emissions of all other greenhouse gases by approximately 2070. Limiting global warming to 1.5°C is the higher aim of the Paris Agreement and is necessary in order to mitigate the most severe long-term economic consequences of climate change.

Reaching net zero requires a complete transformation of the global economy. To get there, we need to replace fossil fuels as the economy’s primary energy source, which provide 84% of the world’s energy, with low-carbon sources such as wind and solar.¹

2. What is “temperature alignment?” How do you measure it?

“Temperature alignment” reflects how closely aligned a business, government, or portfolio is to a 2050 net zero economy. Temperature alignment is a forward-looking measurement. In other words, it is measured by looking at emissions today as well as the potential of the emitter to reduce their emissions.

In order to measure temperature alignment, one approach is to look at the role a company plays in the economy today and use all available information to assess its expected emissions trajectory out to 2050. We then measure what the world would look like in 2050 if the global economy moved at that same speed to reduce emissions.

For example, an oil company today – one that lacks a solid transition plan to net zero – might have a temperature alignment of more than 5ºC. If all companies in the global economy had a similar commitment, we would expect a global temperature rise of more than 5ºC. By contrast, an oil company with a solid transition plan might be measured at 2ºC or below, for the same reasons.

This approach helps us provide an alignment measurement for companies of varying sizes. For example, a very small coal mining company or a very large oil producer would both have high temperature alignments. That’s because if the whole energy sector resembled either of those companies in 2050, we would see a significant rise in global temperature

3. Why does net zero matter for investors?

Climate risk is investment risk. Companies face two key risks – physical risk and transition risk. As policymakers, regulators, and consumers accelerate the transition to a net zero economy, companies that are not prepared for this transition – i.e., companies that will remain dependent on producing or consuming fossil fuels for too long – risk being left behind by their consumers and shareholders.

But the transition to net zero also presents a significant investment opportunity. We believe companies that are best prepared for the transition will provide better long-term returns, as they will be better able to function in an economy that looks vastly different from today’s. We believe that markets are not fully pricing in climate considerations into the value of securities. Investors who factor in transition risks and opportunities will likely benefit from an accelerating reallocation of capital to sustainable companies.

4. What can investors do today to address risks and capture opportunities as the world moves to a net zero economy?

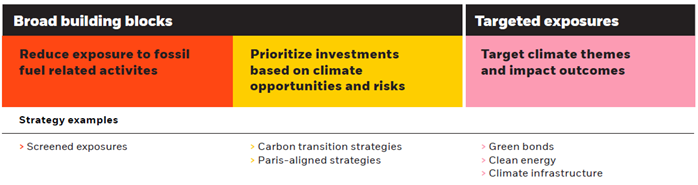

There are several considerations investors can take into account to better align their portfolios with the transition to a net zero economy, and it may take a combination of the below approaches to build an entire portfolio that is progressing toward a netzero-aligned pathway.

- Holistically address portfolios by replacing core exposures: Reduce - reduce a portfolio’s exposure to the highest carbon emitters, or companies not taking climate actions based on forward-looking commitments. BlackRock has established a “heightened scrutiny model” for companies that are insufficiently prepared for the net zero transition and have low reception to investment stewardship. Prioritize - allocate capital based on companies’ actions to transition, such as companies reducing their reliance on fossil fuels, publishing transition plans and setting science-based targets.

- Focus on a particular part of the portfolio: Target – invest in a specific sustainable economic activity, such as clean energy, or investments directly tied to projects that advance environmental purposes, such as green bonds.

- Integrate data and tools that measure temperature alignment: Overlay - use latest research and data that measures temperature alignment for issuers and investments. Investors can integrate the temperature alignment data into investment processes alongside traditional financial data.

- Use votes and engagements to change behaviour: Engage – asset managers can use investment stewardship to ensure companies are mitigating climate risks and considering the opportunities presented by the net zero transition.

For illustrative purposes only. The above list is not exhaustive but represents various ways investors can take specific climate objectives into consideration.

BlackRock’s Net Zero Commitment

BlackRock is committed to supporting the goal of net zero emissions by 2050 or sooner. We are taking a number of steps to help investors prepare their portfolios for a net zero world, including capturing opportunities created by the net zero transition. Key actions for 2021 include:

Measurement and transparency

- Publishing a temperature alignment metric for our public equity and bond funds, for any markets with sufficiently reliable data

- Publishing the proportion of our assets under management that are currently aligned to net zero, and announcing an interim target on the proportion of our assets under management that will be aligned zero in 2030, for markets with sufficiently reliable data

- Through Aladdin Climate, helping more investors manage and meet their climate objectives by tracking investment portfolios’ trajectories toward net zero, and helping to catalyze increasingly robust and standardized climate data and metrics to better serve the industry

Investment management

- Incorporating the impacts of climate change into our capital market assumptions, the cornerstone for portfolio construction at BlackRock

- Implementing a “heightened-scrutiny model” in our active portfolios as a framework for managing securities that pose significant climate risk

- Helping clients benefit from opportunities created by the energy transition, from investments in electric cars to clean energy to energy-efficient housing

- Launching investment products with explicit temperature alignment goals, including products aligned to a net zero pathway

Stewardship

- Using investment stewardship to ensure the companies our clients invest in are mitigating climate risk and considering the opportunities presented by the net zero transition

- Asking companies to disclose a business plan aligned with the goal of limiting global warming to well below 2ºC, consistent with achieving net zero emissions by 2050

- Increasing the role of votes on shareholder proposals in our stewardship efforts around sustainability

Key terms

ESG integration

Incorporating financially material environmental, social, and/or governance information into investment research and decision-making, based on the conviction that sustainability-integrated portfolios can provide better risk-adjusted returns to investors.

Greenhouse gas emissions (GHGs)

Gases that trap heat in the atmosphere, such as carbon dioxide, methane, and nitrous oxide. Emissions result from a variety of human activities (e.g., energy generation, transportation, industrial processes).²

Heightened-scrutiny model

List of issuers that present significant climate-related risk, with a combination of the following attributes:

- high carbon intensity today

- poorly positioned for the net zero transition

- low reception to our investment stewardship engagement

Investment stewardship

Engagement with public companies to promote corporate governance practices that are consistent with encouraging long-term value creation for shareholders. Engagement and voting provide shareholders an opportunity to express their views.

Net zero

Reducing nearly all human-caused emissions and balancing out remaining emissions with carbon removal (e.g., restoring forests, carbon capture and storage). A global net zero commitment establishes an aggregate timeline for achieving the well below 2°C target called for in the Paris Agreement. Many country and corporate net zero commitments target 2050, consistent with global targets to avoid catastrophic outcomes from climate change.

Paris Agreement

International agreement to keep the increase in global average temperature to well below 2°C above pre-industrial levels while endeavouring to limit warming to 1.5°C, the scientifically backed threshold to prevent the most destructive effects of climate change. Each country must determine, plan, and regularly report on the contribution that it undertakes to mitigate global warming.³

Physical risk

Increased risk to companies’ assets and activities caused by the direct impact of changing weather patterns and natural catastrophes.

Science-based targets

Targets adopted by companies to reduce GHG emissions are considered “science-based” if they are in line with what the latest climate science says is required to meet the goals of the Paris Agreement. The Science Based Targets initiative (SBTi) is a collaboration between CDP, World Resources Institute (WRI), the World Wide Fund for Nature (WWF), and the United Nations Global Compact (UNGC) that champions science-based target setting as a powerful way to boost companies’ competitive advantage in the transition to the low-carbon economy.⁴

Temperature alignment

Temperature alignment reflects how closely aligned a business, government, or portfolio is to a 2050 net zero economy. Temperature alignment is a forward-looking measurement. In other words, it is measured by looking at emissions today as well as the potential of the emitter to reduce their emissions.

Transition risk

Impact of the transition to a low-carbon economy on a company’s long-term profitability (i.e., decreased profits for energy companies with large fossil fuel reserves).

Notes/Sources

¹Source: Oxford University, Our World in Data, 2019

²Source: Greenhouse Gas Protocol, 2021

³Source: United Nations Framework Convention on Climate Change, 2021

⁴Source: Science Based Targets initiative, 2021

This material is intended for information purposes only, and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities, funds or strategies to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The opinions expressed are as of March 2021 and are subject to change without notice. Reliance upon information in this material is at the sole discretion of the reader. Investing involves risks.

In the UK and inside the EEA: Until 31 December 2020, issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: + 44 (0)20 7743 3000. Registered in England and Wales No. 02020394. For your protection telephone calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock. From 1 January 2021, in the event the United Kingdom and the European Union do not enter into an arrangement which permits United Kingdom firms to offer and provide financial services into the European Economic Area, the issuer of this material is: (i) BlackRock Investment Management (UK) Limited for all outside of the European Economic Area; and (ii) BlackRock (Netherlands) B.V. for in the European Economic Area, BlackRock (Netherlands) B.V. is authorised and regulated by the Netherlands Authority for the Financial Markets. Registered office Amstelplein 1, 1096 HA, Amsterdam, Tel: 020 – 549 5200, Tel: 31-20-549-5200. Trade Register No. 17068311 For your protection telephone calls are usually recorded. ©2021 BlackRock, Inc. All Rights Reserved. BLACKROCK is a trademark of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners.

Not FDIC Insured • May Lose Value • No Bank Guarantee

Prepared by BlackRock Investments, LLC, member FINRA. BSIH0321U/M-1573628

Last update: 20 May 2021

You may also like: