A note was sent round the office asking people to sign up for a sponsored abseil in 6 months’ time. It was just the sort of challenge that I enjoyed. However, there was an added significance; I was 6 months pregnant with my first child. It was the perfect way to prove to myself, and others, that I was the same person when I returned to work. I signed up. To this day, I remember standing at the top of the building listening to abseiling instructions. All of a sudden, the enormity of having a child hit me. For the first time, I was aware of my responsibilities and own mortality. If someone had spoken to me at that moment about how to ensure the future security of my new baby, I would have been engaged and “bought” whatever product achieved that objective. That is the power of life moments.

The information sent by scheme/providers to members has improved enormously over the last few years; it is written in plain language; it has pictures and may even have videos. But, schemes/providers are telling the members the things that they think that are important for the member to know. They may be important for the members to know but are the members listening? Telling members things that the schemes/providers thinks the members should know is not communicating; it is broadcasting.

Communication is a two-way process where each side listens to each other. The best way to get members to listen is to listen to them. This can be done by “listening” through the data. For example, if the scheme/provider “listens” that a member has had a child (through the contribution holiday), it provides a platform to communicate to that member about matters that are relevant when someone has had a child, such as the ability to nominate to whom the death benefits are paid.

The question should not be how schemes/providers improve engagement but how they can be more engaging; improved engagement will be the result. There are three ways schemes/providers can be engaging.

- Communicate with members on the things that matter to them.

- Find out more about the members so that the scheme/provider can help them with the things that matter to them.

- Deliver value to the members by communicating on things that matter to them right now so that they share more about themselves.

These factors use data that scheme/providers have and help them improve the data that they have enabling them to deliver segmented communications that members value. This is how it can work.

What matters to members

The data managed by schemes is rich with life moments. Schemes often know when a member has moved home, got married, given birth to a child or got divorced. Yet, schemes/providers rarely use this data. Instead, scheme/providers spend money on expensive communications that count down to a retirement date that are not relevant to a high proportion of the members. The reaction of members A note was sent round the office asking people to sign up for a sponsored abseil in 6 months’ time. It was just the sort of challenge that I enjoyed. However, there was an added significance; I was 6 months pregnant with my first child. It was the perfect way to prove to myself, and others, that I was the same person when I returned to work. I signed up. To this day, I remember standing at the top of the building listening to abseiling instructions. All of a sudden, the enormity of having a child hit me. For the first time, I was aware of my responsibilities and own mortality. If someone had spoken to me at that moment about how to ensure the future security of my new baby, I would have been engaged and “bought” whatever product achieved that objective. That is the power of life moments. to this type of communication is not engagement. In fact, it can lead to the wrong or no action; some members take benefits, even if they do not need to and the rest of members will ignore it.

A more effective way of communicating is to contact members when something is happening in their lives, sometimes called “teachable moments”. Teachable moments or life moments such as moving house, getting a job or starting a family often impact the member’s financial position including their pension. For example, when a member gets divorced, he or she will request a valuation from the scheme/provider sometime resulting in money being paid in or out of the scheme. Divorce has a major impact on people’s financial position and their retirement yet schemes/providers do nothing to engage with the members at this time. Schemes/providers could provide real help by giving the member the questions that they should be asking themselves or others to better understand how to rebuild their pension to achieve their retirement objectives. Schemes/providers should actively help people at these known life moments because this is what matters to the members.

Finding out more about the members

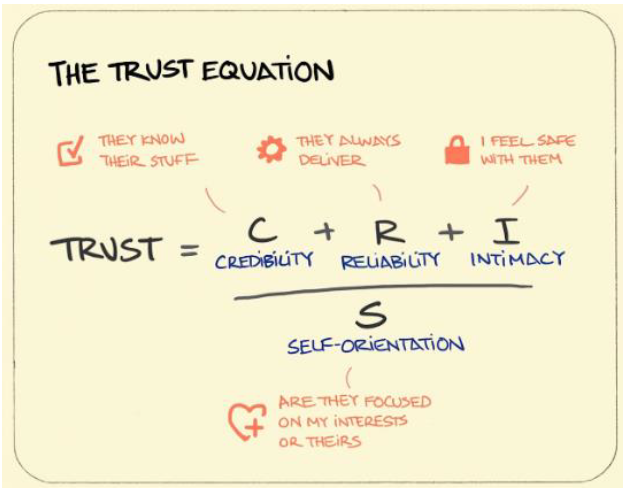

Of course, there are life moments that happen to a member, particularly a deferred member, where the scheme/provider is not aware but it could really help the scheme/provider and the member if they knew more about the impact on their pension. This would require members to share personal data with the scheme/provider. Members, in fact people, will only share personal data if they understand the context and trust the recipient. If schemes/providers are going to build up the data to better segment and target member communications, it needs to establish trust with its membership. Ask “Are you married?”, “What other pensions do you have?” to members without context or trust will, at best, fail to get the data and, at worst, upset the members. It is therefore important for schemes/providers to build the trust with the members so that they are ready to share information with the scheme. The equation of trust is:

Source: Defining Trust by Charles H Green

What does this mean in practice for a scheme/provider? The quality of the scheme’s data is at the heart of credibility, reliability and intimacy

- Credibility -. A scheme/provider should build credibility by investing some money in making the data as best it can.

- Reliability – Schemes/providers should look at the time it takes to respond to members’ questions and, most importantly, not leave members with “dead ends” – if the scheme/provider cannot help, signpost the members to organisations that may be able to help.

- Intimacy – Schemes/providers should allow members to decide what and when they share their personal data with the scheme; the more control that the members are given, the more likely they are to share. It also goes without saying that schemes/providers have been entrusted with sensitive personal data and therefore the scheme/provider should protect it.

- Self-orientation - Schemes can be selfless by offering help and guidance on areas that are not directly related to pensions but impact on their members’ overall financial wellbeing.

Having created a trusted and sharing relationship with its members, schemes/providers can find out more about its members giving the ability to target communications.

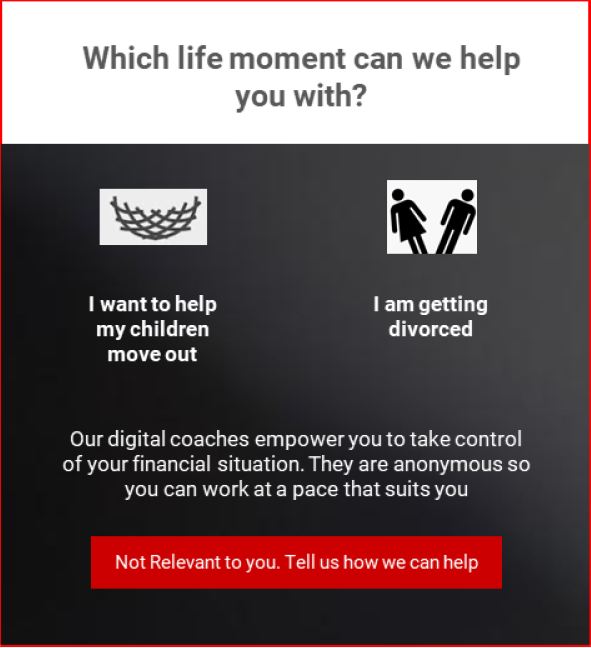

Source: Aligning Consumer & Marketing Outcomes in Pensions by Life Moments

Prompting people to think about their pensions when they are facing a life moment. These could include having a child, helping with the cost of your child’s education or moving out or getting divorced. Once a member identifies the issue that he/she is facing, the member can access knowledge, play with tools and even update their data. Much of this content has already been built by schemes. The key difference is the nudge to get members to engage.

Adding value to the member

The virtuous circle is that by using the data to provide targeted and relevant communication where the member sees the value leads to a two-way flow of information resulting in richer and more accurate data. This will enable schemes to be managed more efficiently and for members to achieve better outcomes. Here is an example of where data was used to add value to football fans.

In 2005, Celtic Football Club introduced electronic season tickets. This enabled them to know more about their fans and their habits. It sent emails to fans who continually reached the stadium within seconds of the match starting to them to gently remind them of the benefits of turning up early including a reduction in the policing costs paid by the club. Lower policing costs would enable the club to reduce the increase in ticket costs. The club set itself a golden rule that emails that were sent to more than 500 fans were probably too random to have any effect.

As well as being relevant by sending out small volumes of communication to segmented members, schemes/providers need to communicate with members again and again and again in order to add value. “Repetition is the mother of learning, the father of action, which makes it the architect of accomplishment.” (Source: Zig Ziglar). The reality is that every communication with members cost money; more communications to multiple segments, multiple times will increase costs. Electronic contact details are essential in order to communicate frequently as this type of communication can be sent at a fraction of the costs. Most employers know the personal telephone number and email address of its employees but many schemes only have the work email in the data it holds on its members. Can there be a more joined up approach on enrolment into the pension scheme between HR and the scheme’s administrator? Can the administrator be prompted to ask for the personal email address every time a member contacts them?

Budget could be saved on the boiler plate communications such as the annual benefit statement, where the open rate is never likely to be over 30% of the members and much of the information can be accessed anyway by the member online at any time. There should be a critical examination on all other communication spending; how much should be spent on further enhancements to the website that is rarely visited and videos that are not being watched? Building interesting content does not drive engagement. Schemes/providers should spend more of the budget on nudging members at their life moments; it is about prioritising context over content. Schemes/providers should apportion at least 80% of their budget on the nudge and the rest on the content rather than the other way. In fact, most schemes/providers already have built the content so by redirecting the budget to effective nudges, the existing content will be accessed more and valued.

Conclusion

The simple message to scheme/provider is “Being interested has more worth than being interesting.” (Source: Dale Carnegie).

- Engage with members on the things that matter to them, which is usually linked to their life moments rather than spending the communication budget on pushing out information on the things that the scheme/provider thinks that the member should know.

- Grow trust with members by investing in making the data as good as it can be and ensuring that the service provided to members is credible and reliable.

- Deliver relevant communication to members at their life moments where they see the value and are therefore are more willing to invest the time in sharing more information.

- Communicating with members needs to be repeated again and again and again so electronic contact details are essential. In 2005, Celtic Football Club introduced electronic season tickets. This enabled them to know more about their fans and their habits. It sent emails to fans who continually reached the stadium within seconds of the match starting to them to gently remind them of the benefits of turning up early including a reduction in the policing costs paid by the club. Lower policing costs would enable the club to reduce the increase in ticket costs. The club set itself a golden rule that emails that were sent to more than 500 fans were probably too random to have any effect.

- Communication budgets should be focussed on making the data as good as it can be and by building nudges for members rather than content.

Schemes/providers should focus on nudges at life moments to segment and target its members. Communicating at life moments is helping members on the things that matter to them and hence the member will engage. Engaging communications targeted at life moments improves engagement.

Notes/Sources

PPI Report - Consumer engagement - the role of policy through the life course - July 2017

Last update: 12 June 2020

You may also like: