In the context of investments, it is recognised that over-reliance on a particular market or asset class can expose pension schemes to untenable levels of risk. Legislation recognises that diversification can mitigate this risk and it must be considered.¹ Pension savers have different backgrounds, family structures and financial needs. Just as diversification ensures that the risks of different investment classes are effectively managed, the pension industry must diversify at the governance level - to ensure that the objectives of pension schemes and the needs of all savers are appropriately accounted for.

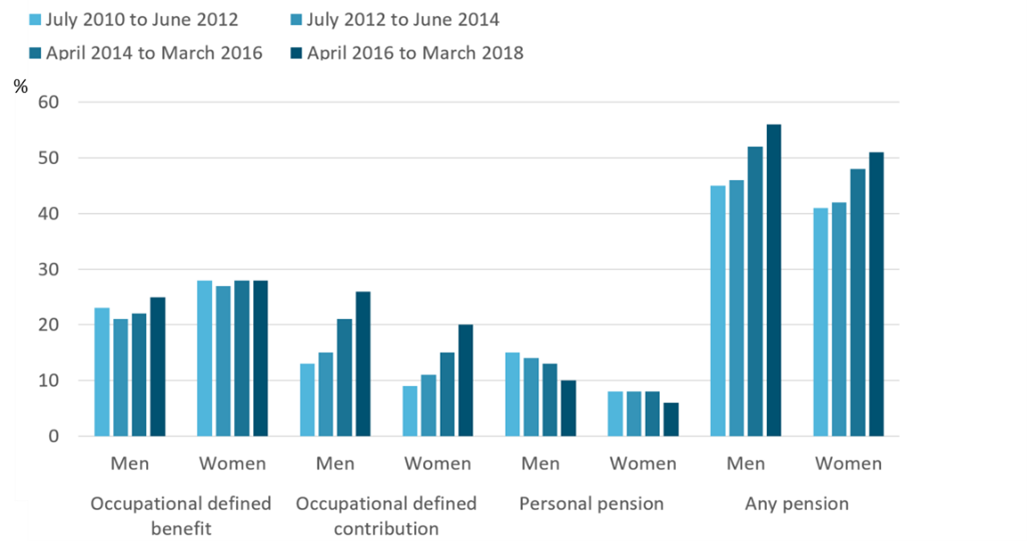

According to Aon’s publication ‘Practical Inclusion and Diversity for Trustees’ the average trustee is a university educated, 54-year-old male with ten years of experience. Only one in five trustees are female². Although as of March 2018 a lower percentage of women were saving into pensions compared to men³, the difference is not sufficient to support an argument that the national male to female ratio of trustees reflects the national male to female ratio of scheme members (although this may be true for individual pension schemes). Women are clearly under-represented. If women do not see themselves represented, they may have less confidence that their interests will be considered, and engage less with the pension scheme or forgo it altogether. On a large scale this could adversely affect the gap between the pension savings of men and women - and the median pension savings held by men are already substantially higher than those of women⁴. Aon’s ‘Practical Inclusion and Diversity for Trustees’ publication goes on to state that ‘credible statistics regarding BAME (Black, Asian, Minority Ethnic) or more specifically just black trustees is scarce, but it is fair to assume that representation [at trustee level] is very low’⁵. Now: Pensions also identified that ‘only 42% of BAME groups, 53% of carers and 50% of disabled people are currently saving into a private pension’, and that these groups (along with single mothers, female divorcees, the self-employed and those with multiple jobs) have pension savings that are 15% or less of the UK average⁶. Clearly the distribution of those with the lowest pension savings intersects different races, gender identities, medical wellbeing, and family compositions - and the same concerns about a lack of representation will apply as they do for women. Diversifying the bodies that run or review the performances of pension schemes will demonstrate that all members are advocated for, as there will be an adequate presence during decision-making processes. This should help foster a sense of belonging for all members, improving overall engagement.

The fact that the average trustee is on the cusp of normal minimum pension age also presents a separate issue, as a 2017 study by Portafina found that on average individuals hope to retire by the age of 57⁷. A large number of trustees may be retiring in the near future, taking with them a wealth of professional experience. It is therefore critical that the industry does more to engage the next generation of pension professionals so that there will be adequate available talent to support pension schemes when existing trustees move on. The most direct example of work being done to tackle this issue is the Young Pension Trustee network, which aims to help younger professionals progress into trustee roles⁸. NextGen is an example of a network that has been established to foster positive networking and innovative thinking to support the pensions industry more generally into the future⁹. O:Pen is another network which was recently formed to ‘create an inclusive and welcoming environment [...] and support positive change for LGBTQ+ pensions professionals in the workplace’¹⁰, along with LGBT Great which has similar objectives for the investment and savings industry as a whole¹¹. The Pensions Regulator has a Diversity and Inclusion Committee which publishes annual progress against stated objectives on its website¹². Many companies and organisations also operate their own inclusion networks or committees. The very existence of these inclusion networks and committees helps to demonstrate progressivism and draws those of underrepresented backgrounds to the pensions industry, bringing with them their varied life experiences and educational achievements. The Pensions and Lifetime Savings Association (PLSA) found that companies that operate inclusive practices are better at attracting talent and offsetting behavioural biases and are more likely to outperform companies that are not as inclusive¹³. It will therefore be the governance bodies that engage with the messaging of inclusion networks (or operate their own) that are able to access the unlocked talent for the betterment of the scheme members that they support.

The professional knowledge and experience of those who sit on trustee boards may differ depending on the nature of the sponsoring employer that the scheme represents. For example, the trustee board overseeing the pension scheme of an investment bank or a financial advisory firm might place a heavy emphasis on recruiting trustees with a background in high-level investment management. This might be because the trustees wish to operate day-to-day investment management instead of delegating it, their scheme has a particularly detailed investment strategy, or the trustee board may just want to demonstrate that they have expertise in investments which is at least comparable to the membership itself. Although these are legitimate aims, schemes must take care to ensure that the trustees are still capable of managing all areas of pension scheme governance and take the needs and knowledge levels of all staff into consideration. For example, a trustee board which is heavily composed of successful investment professionals might be less able to identify issues (or less likely to take adequate action on issues) that may disproportionately affect more junior employees such as:

- There could be Non-Eligible Jobholders that earn more than £10,000 but are under the age of 22 and will not be automatically enrolled into the company pension scheme. A younger trustee (perhaps a member-nominated trustee) might have more experience of this situation and be more likely to suggest changes, particularly as they and their peers are more likely to only have Defined Contribution pension benefits where starting to save early can drastically improve retirement prospects.

- There could be lower-paid employees who do not want to meet the scheme’s contribution rate and who are considering opting out of the pension scheme. An employer-nominated trustee who has worked closely with members in these roles or has first-hand experience of processing member opt-out requests may be more aware of how pension contributions are affecting the monthly finances of members. This could, for instance, lead to a consultation resulting in a reduction to the employee contribution rate, or an enhancement to employer core or matching contributions. Membership of the scheme would therefore become more affordable or more valuable to employees depending on the approach taken (subject to the minimum requirements under Automatic Enrolment being met).

- The scheme’s communications could be highly accurate but written in a way that is not clear to the generality of members. A trustee with a background in human resources, public relations or marketing may be more capable of engaging with those that are producing scheme communications and draw from their own experiences to make constructive suggestions and improvements.

It is inevitable that some trustee boards will be stronger than others in certain areas, and the detrimental impact of gaps in knowledge can be mitigated by obtaining professional advice. However, the Trustee Knowledge and Understanding requirements mean that trustees need to be able to understand and challenge the advice that they are given, so a baseline level of knowledge is still required. A trustee board should aim to have trustees with a diverse range of professional backgrounds so that the board can compensate as a whole for the perceived weaknesses of any individual trustee. Care must be taken when seeking to appoint a trustee to ensure that all relevant procedures are followed, particularly where the trustee will be a member-nominated trustee. However, the announcement of the trustee vacancy might emphasise any particular skills or experiences that a desired candidate will have, taking into account the needs of the scheme at that time. This could help ensure that applications are received from people who will add the most value to the governance of the scheme, even if the board is not as fully involved with the appointment process.

Even though considerable efforts can and should be made to make the composition of a trustee board or IGC more representative of the pension scheme it oversees, it will not be possible to mirror every view of every scheme member. Trustees need to take a proportionate approach to act in the interests of their scheme as a whole, while taking care not to disregard the sincerely held beliefs of minority groups. Pension savers who are practicing Muslims may find that there are limited investment options available to them that are consistent with Islamic principles. Specialised investment funds such as the FTSE Global Equity Shariah Index Series¹⁴ are available, but if they are not provided these members could move from the scheme, or put their pension savings into investments which are less appropriate for their duration to retirement. This could be a source of considerable dissatisfaction and financial detriment for affected members. There are also other common areas of investment which may be unpopular with a large range of scheme members - such as investments in environmentally damaging activities (such as fossil fuels) or those which may be considered socially irresponsible (such as tobacco, alcohol, and weapons manufacturing). Investments which aim to avoid or strongly limit their exposure to these markets are often referred to as ‘Sustainable’ or ‘Responsible’ funds, and trustees should already be considering how their views on environmental, social and corporate governance (ESG) influence their investment strategies. Master Trusts are already required to set out how scheme members can make their views known, but this can and should be a practice welcomed by any trustee board or IGC. Offering scheme members an easy way to leave feedback can help governance bodies align their priorities. For example, a trustee board may be relatively unconcerned about ESG integration, but if it becomes clear that members feel more should be done the board may wish to reconsider their position. As a minimum a feedback facility could inform the direction of discussions with service providers, and the outcome of these discussions can be shared with the membership. Even though the composition of the governance body would not be any more representative of the various scheme demographics, the actions that are taken may be more considerate of them. This could be used as an interim measure until decisions are implemented which strengthen and diversify the composition of the governance body. The feedback facility could alternatively be fully entrenched as an ongoing measure in recognition of the fact that the group running or reviewing the operation of the pension scheme will never become entirely homogeneous with the minds of the membership, and there will always be a risk that some members are represented less well than others.

The pensions industry is taking positive steps to commit to diversity and inclusion, and if this is done effectively governance bodies will benefit from larger pools of talent and see higher levels of member engagement. Recognising a skill surplus or deficit in aspects of governance will identify areas for improvement, enabling governance bodies to diversify themselves and more effectively manage the different challenges that pension schemes face. Although it is still unlikely that any scheme’s membership will be perfectly represented, fostering a commitment to open communication will allow for a diversity of views and concerns to be raised, which will prompt a broader range of discussion compared to those schemes who do not engage with their members in this way.

Notes/Sources

¹Pensions Act 1995, Section 36 https://www.legislation.gov.uk/ukpga/1995/26/section/36/enacted - Accessed 14 March 2021

²Practical Inclusion and Diversity for Trustees, Page 6 (Aon) https://www.aon.com/unitedkingdom/retirement-investment/trustee-effectiveness/practical-diversity-inclusion-guide-for-trustees.jsp - Accessed 14 March 2021

³Pension Wealth in Great Britain: April 2016 to March 2018 (Office for National Statistics) https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/incomeandwealth/bulletins/pensionwealthingreatbritain/april2016tomarch2018 - Accessed 14 March 2021

⁵Practical Inclusion and Diversity for Trustees, Page 6 (Aon) https://www.aon.com/unitedkingdom/retirement-investment/trustee-effectiveness/practical-diversity-inclusion-guide-for-trustees.jsp - Accessed 14 March 2021

⁶Millions of people are currently locked out of workplace pensions in the UK, missing out on £1.2 billion of pension contributions (Now: Pensions) https://www.nowpensions.com/press-release/now-pensions-reveal-most-under-pensioned-groups/ - Accessed 14 March 2021

⁷Professional Paraplanner’s Website, Dream Retirement Age is 57 (Professional Paraplanner) https://professionalparaplanner.co.uk/dream-retirement-number-is-57/ - Accessed 14 March 2021

⁸Young Pension Trustee’s Website, (Young Pension Trustee) About https://www.youngpensiontrustee.com/copy-of-about-1 - Accessed 14 March

⁹2021 NextGen website https://www.nextgennow.co.uk/ (NextGen) - Accessed 14 March 2021

¹⁰O:Pen’s Website, Our Vision (O:Pen) https://openpensions.network/our-vision - Accessed 14 March

¹¹2021 LGBT Great’s Website, About Us (LGBT Great) https://www.lgbtgreat.com/about-us - Accessed 14 March 2021

¹²The Pensions Regulator’s Website, Diversity and Inclusion (The Pensions Regulator) https://www.thepensionsregulator.gov.uk/en/document-library/corporate-information/diversity-and-inclusion - Accessed 14 March 2021

¹³Diversity and Inclusion Made Simple (PLSA) https://www.plsa.co.uk/Portals/0/Documents/Made-Simple-Guides/2020/Diversity-and-Inclusion-Made-Simple.pdf - Accessed 14 March 2021

¹⁴FTSE Global Equity Shariah Index Series (FTSE Russell) https://www.ftserussell.com/products/indices/global-shariah - Accessed 14 March 2021

Last update: 6 May 2021